The Certified Financial Valuation Analyst course primarily focuses on the Practical Application of financial analysis, modeling, valuation, presentations, and more. This certification will evaluate a candidate as per an organization’s requirements. It analyses a candidate on different areas such as financial statements, valuation, accrual accounting, cash flow valuation, the analysis checklist, profitability analysis, value of the operation, financial statements, analysis, credit, and equity risk analysis.

Why become a Certified Financial Valuation Analyst?

Certified Financial Valuation Analyst certification is Mainly designed for professionals and graduates who wish to move forward and take a big leap in their career. This certification is also applicable for practitioners who are already working and are well suited for their career progression. In this competitive market where there is cutthroat competition in every niche, make sure that you are well skilled. This certification will instill all the skills and make you represent the best of your performance as a Financial Valuation Analyst.

Who should take this certification?

Employees or candidates who are looking for employment opportunities in the Finance or Accounting department of different Firms, and who aspire to improve their skills and make their CV’s strong this certification will be your Escort towards the desired goal.

Roles and responsibilities of a Certified Financial Valuation Analyst

Notify yourself with all the necessary details before taking a step forward for the examination. And one of the important details is to know about the tasks of a particular practitioner. Mentioned below are the duties of a Certified Financial Valuation Analyst.

- To carry out financial forecasting, reporting and operational metrics tracking

- To Analyse financial data and develop financial models for decision process

- To report on financial performance and prepare for regular leadership reviews

- To Review and analyse past results, perform variance analysis, identify trends, make recommendations for improvement.

- To Work closely with the accounting team to ensure accurate financial reporting

- To Undertake assessment of financial performance by comparing and analyzing actual results with plans and forecasts.

- To guide the cost analysis process by creating and enforcing policies and procedures

- To provide analysis of trends and forecasts and recommend actions for increase in sales and optimisation

- To Recommend actions by analyzing and interpreting data and making comparative analyses; study proposed changes in methods and materials

- To recognize and drive process improvements, including the creation of standard and ad-hoc reports, tools, and excel Dashboards

Benefits of taking Vskills Certification

Vskills being India’s largest certification provider gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and Shine.com

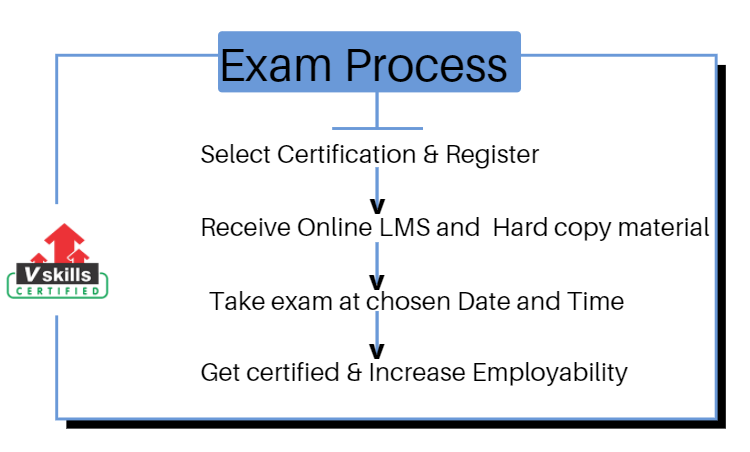

Exam Details

- Exam Duration: 60 minutes

- Vskills Exam Code: VS-1129

- Number of questions: 50

- Maximum marks: 50

- Passing marks: 25 (50%)

- Exam Mode: Online

- There is NO negative marking in this module.

Financial Valuation Career Opportunities

Financial analysis of companies, Discounted Cash Flow Analysis, Financial Modeling of companies, reviewing debt and equity securities, valuation of intellectual property, business valuations, intangible asset valuations, and option valuations are just some of the tasks that financial valuation analysts work on across multiple industries. Let us know about Financial Valuation Career Opportunities!

Course Details

The Certified Financial Valuation Analyst exam covers the following topics –

Certify and Increase Opportunity.

Be

Govt. Certified Financial Valuation Analyst

1. Introduction To Investing And Valuation

1.1 Valuation

1.2 Investment Style and Fundamental

1.3 Bubble, Bubble

1.4 The Setting Investors, Firms Securities, and Capital Markets

1.5 The Professional Analyst

1.6 The Analysis of Business

1.7 Choosing a valuation Technology

2. Introduction To The Financial Statements

2.1 The Analyst’s Checklist

2.2 The Form of the Financial Statements

2.3 Measurement in the Financial Statements

3. How Financial Statements Are Used In Valuation

3.1 The Analyst’s Checklist

3.2 The Form of the Financial Statements

3.3 Measurement in the Financial Statements

4. Cash and Accrual Accounting, And Discounted Cash Flow Valuation

4.1 The Analyst’s Checklist

4.2 The Dividend Discounts Model

4.3 The Discounted Cash Flow Model

4.4 Reverse Engineering Converting a Price to a Forecast

4.5 Simple Valuation Models

4.6 The Statement of Cash Flows

4.7 Cash Flow, Earnings, and Accrual Accounting Earnings and Cash Flows

4.8 The Web Connection

4.9 Key Concepts

4.10 The Analyst’s Toolkit

4.11 Kimberly-Clark Corporation Case

5. Accrual Accounting And Valuation

5.1 The Analyst’s Checklist

5.2 The Price-to Book Ratio Concept

5.3 Prototype Valuations

5.4 A Model for Anchoring Value on

5.5 Applying the Model to Equities

5.6 Applying the Model to Projects and Strategies

5.7 Features of the Residual Earnings Model

5.8 Reverse Engineering the Model foe Active Investing

5.9 The Building Blocks of a Residual Earning

6. Accrual Accounting And Valuation

6.1 The Concept behind the Price-Earnings Ratio

6.2 A Model for Anchoring Value on Earnings

6.3 Applying the Model to Equities

6.4 Features of the Abnormal Earnings Growth Model

6.5 Reverse Engineering the Model for Active Investing

7. Business Activities and Financial Statements

7.1 The Cash Flows

7.2 All Stocks and Flows

7.3 Accounting Relations that Govern Reformulated Statements

7.4 Business Profitability

8. The Analysis Of The Statement Of Shareholder’s Equity

8.1 Reformulating the Statement of Owners’ Equity

8.2 Dirty-Surplus Accounting

8.3 Ratio Analysis

8.4 Cash Flow Form Operations

9. The Analysis Of The Balance Sheet And Income Statement

9.1 Reformulation of the Balance Sheet

9.2 Reformulation of Income Statement

9.3 Comparative Analysis of the Balance Sheet

9.4 Ratio Analysis

10. The Analysis Of The Cash Flow Statement

10.1 The Calculation of Free Cash Flow

10.2 GAAP Statement of Cash Flows and Reformulated

10.3 Introduction to Growth Analysis

10.4 The Analysis of Changes in Profitability

10.5 The Analysis of Growth in Shareholders’ Equity

10.6 Growth Sustainable Earnings and the Evaluation of P/B Ratios and P/E Ratios

11. The Analysis of Profitability

11.1 Cutting to the Core of the Operations

11.2 First-Level Breakdown

11.3 Second-Level Breakdown

11.4 Third-Level Breakdown

11.5 The Web Connection

12. The Analysis of Growth and Sustainable Earnings

12.1 What Is Growth?

12.2 Financing Risk and Return and the Valuation of Equity

12.3 Mark-to-Market Accounting

13. The Value of Operations

13.1 A Modification to Residual Earrings Forecasting Residual Operating Income

13.2 Abnormal Growth in Operating Income

13.3 The Cost of Capital and Valuation

14. Simple Forecasting and Simple Valuation

14.1 Simple Forecasts and Simple Valuations form Financial Statements

14.2 Adding Speculation to Financial Statement Information

14.3 The Applicability of Simple Valuations

14.4 Simple Valuations with Short-Term

14.5 Simple Valuation as an Analysis Tool

14.6 Value Creation and the Creation of Residual

14.7 Price-to-Book Ratios, Price-Earnings Ratios, and the Valuation

14.8 Hidden Reserves and the Creation of Earnings

14.9 Conservative and Liberal Accounting

14.10 Accounting Methods and the Forecast Horizon

15. Full-Information Forecasting, Valuation, And Business Strategy Analysis

15.1 Financial Statement Analysis

15.2 Full- Information Forecasting and Pro Forma Analysis

15.3 Value Generated in Share Transactions

15.4 Financial Statement Indicators and Red Flags

15.5 Business Strategy Analysis and Pro Forma Analysis

16. Creating Accounting Value and Economic Value

16.1 Detecting Transaction Manipulation

16.2 Justifiable Manipulation?

16.3 Disclosure Quality

16.4 Quality Scoring

17. Analysis Of The Quality Of Financial Statements

17.1 What is Accounting Quality?

17.2 Detecting Income Shifting

17.3 Inferring Expected Returns form Market Prices Adapting to the Risk Measurement

18. The Analysis Of Equity Risk And The Cost Of Capital

18.1 The Nature of Risk

18.2 Fundamental Risk

18.3 Value-At-Risk Profiling

18.4 Fundamental Betas

18.5 Price Risk

19. The Analysis Of Credit Risk

19.1 Ratio Analysis for Credit Evaluation

19.2 Forecasting and Credit Analysis

19.3 Liquidity Planning and Financial Strategy

Preparation Guide for Vskills Certified Financial Valuation Analyst

The primary motive of a study guide is to organize information and assist candidates with learning steps. It is the most helpful method to study. All the essential resources which are mentioned in the study guide helps you to follow the correct order for the examination and ensures preparation before exam.

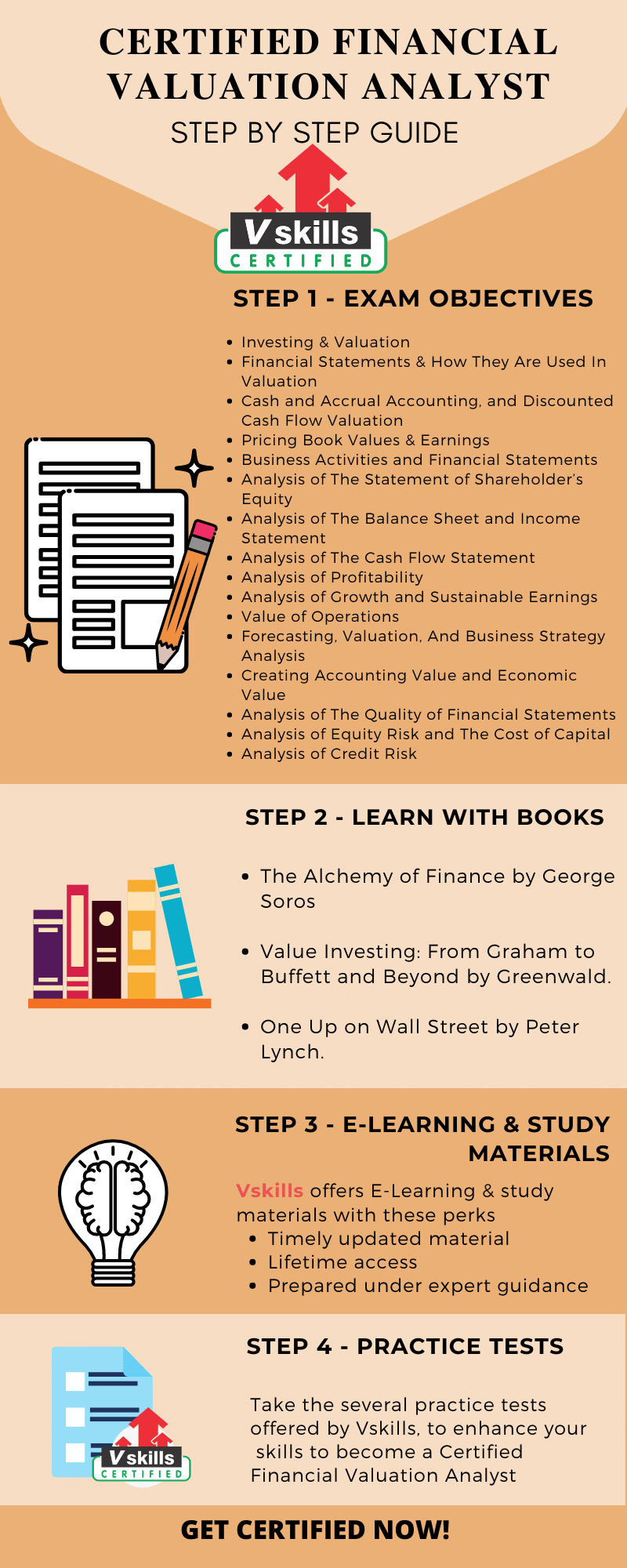

Step 1 – Review Exam Objectives

Let’s start by getting an insight on the syllabus of the certification exam, before beginning the preparation go through the syllabus so that you are aware of the topics and concepts that you are about to learn. Every expert will recommend you to go through the exam objectives before beginning the preparation for the exam as it sets an advantage for the candidate.

- Investing & Valuation

- Financial Statements & How They Are Used In Valuation

- Cash and Accrual Accounting, and Discounted Cash Flow Valuation

- Pricing Book Values & Earnings

- Business Activities and Financial Statements

- Analysis of The Statement of Shareholder’s Equity

- Analysis of The Balance Sheet and Income Statement

- Analysis of The Cash Flow Statement

- Analysis of Profitability

- Analysis of Growth and Sustainable Earnings

- Value of Operations

- Forecasting, Valuation, And Business Strategy Analysis

- Creating Accounting Value and Economic Value

- Analysis of The Quality of Financial Statements

- Analysis of Equity Risk and The Cost of Capital

- Analysis of Credit Risk

Refer: Certified Financial Valuation Analyst Brochure

Step 2 – Learning with Books

Books define the concepts and all necessary information that a individual must go through about any domain. Books are essential for any beginners of any niche as it clears all the doubts and queries regarding basic knowledge. It is one of the important resources and candidate should take help of a book to study for this certification exam. Mentioned below are top 3 books for this certification exam.

- The Alchemy of Finance by George Soros. Alchemy of finance has all the investment strategies that a writer himself has discovered during his career. It is an amazing guide for concepts like a marketplace, including specific economic and political history of recent times.

- Value Investing: From Graham to Buffett and Beyond by Greenwald. This book will provide a reader with many valuation examples and intelligent investment skills.

- One Up on Wall Street by Peter Lynch. This book is easy to follow terminology. It is a guide about the directions that you must take or while figuring out the long shots from the no shots by spending just a few minutes with a company’s financial statements.

Step 3 – E-learning and Study material

E-learning should not be just used for entertainment purposes, but for also gathering all the information that you need regarding a particular domain. E-learning has all kinds of information on different online platforms which provides you easy access to learning. Online learning increases memorizing power. One of the benefits online is that you can find study material with all the mandatory concepts which save your time and ensure that you study the necessary concepts in detail. Vskills offers you its E-Learning Study Material and its hard copy as well, to supplement your learning experience and exam preparation. Moreover, this online learning material is available for a lifetime and is updated regularly.

Refer: Certified Financial Valuation Analyst Sample Chapter

Step 4 – Check your Progress with Practice Tests

Practice makes a man perfect. This isn’t an overstatement but a fact. Practice makes your weaker section stronger and helps you assess your performance. Practice test gives you the examination experience and prepares you mentally for the real examination, and it is a big benefit of practice tests. Attempting practice tests will clear all your barriers and help you achieve your desired goal.