The Certified Underwriter is one such certification course that helps you gain an advantage over other members and even increase your job opportunities. Underwriters are in charge of evaluating if a risk is worth taking. The course intends to examine the candidates in different areas in the underwriting process, fundamentals of product design, pricing products, underwriting in India, SEBI laws, and trend in claim management.

Why become an Underwriter Professional?

The Certified Underwriter course is designed for candidates and Professionals who aspire to excel in their respective areas. In this competitive market it is essential to ingrain special skills to increase employment opportunities and earning potential.

Who should take this certification?

Candidates who wish to work in the insurance or underwriting department of different companies, must take the Certified Underwriter course. This certification will improve your CV’s by highlighting your commitment towards the job, and showcasing your skills but and making you stand out in the crowd

Roles and Responsibilities of a Certified Underwriter

The following are the responsibilities of a Certified Underwriter

- Undertake data assessment on information recovered from hard money loan applications.

- Consult with loan officers following a meeting with clients

- Scrutinize real estate properties in question and make a judgment about investment

- Undertake risk evaluation on client based on past borrowing history, credit rating, and industry experience

- Undertake additional information from loan officers when appropriate

- Provide application decisions based on consultation with supervising underwriter

- Prepare reports about risk in detail and assess other data.

Career as an underwriter

Liability abounds in the insurance industry. Damages must be compensated for, and the means to do so must come from someplace. When you study how to become an insurance underwriter, you may assist protect policyholders from financial loss while also preventing insurance companies from taking on the risk of a bad credit application. To safeguard an insurance company’s financial line, it’s up to the underwriter to exercise sound judgement. Let us know about Career as an Underwriter!

Benefits of taking Vskills Certification

Vskills being India’s largest certification provider gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and On Shine.com.

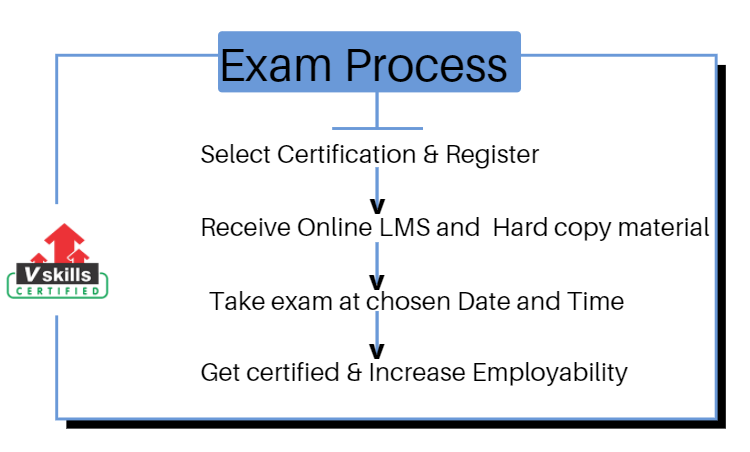

Exam Details

- Exam Duration: 60 minutes

- Vskills Exam Code: VS-1174

- Number of questions: 50

- Maximum marks: 50

- Passing marks: 25 (50%)

- Exam Mode: Online

- There is NO negative marking in this module.

Course Details

Certify and Increase Opportunity.

Be

Govt. Certified Underwriter

Meaning and Fundamental of Underwriting

- Underwriting Basics

- Underwriting Policy

- The Underwriting Process

- Sources of Underwriting Information

- Classes of Business

- Product Design

- Underwriting of Life Insurance

- Underwriting of General Insurance

- Mortgage Underwriting

- Life Insurance Underwriting

Underwriting & Pricing of Product

- Types of Underwriting

- Other forms of Underwriting

- General Underwriting Considerations

- Assessment & Management of Exposure

- Perils & Clause of Insurance Policies

- Rules and Regulations Under Tariff

- Operational Control

- Nature of Claim for Various Classes of Insurance

- The Underlying Reason for Classification

- The Separation of Life and Non-life

- Claim settlement & its Significance

- Dispute, Litigation & Arbitration

- The Role of Insurance Intermediaries

- Underwriting Cycle

- The COPE Model

- Underwriting Results

Underwriting in India

- Underwriting Types

- Types of underwriters

- SEBI (UNDERWRITERS) REGULATIONS 1993

- SEBI (Underwriters) (Amendment) Regulations, 1996

- SEBI (UNDERWRITERS) (AMENDMENT) REGULATIONS, 2002

- SEBI (UNDERWRITERS) (AMENDMENT) REGULATIONS, 2006

- SEBI (UNDERWRITERS) (AMENDMENT) REGULATIONS, 2011

Trends in Claim

- Introduction

- Role of IT in Claim Adjustment

- Customer Service

- Insurance Business & Claim Management in other Countries

- Automated Underwriting

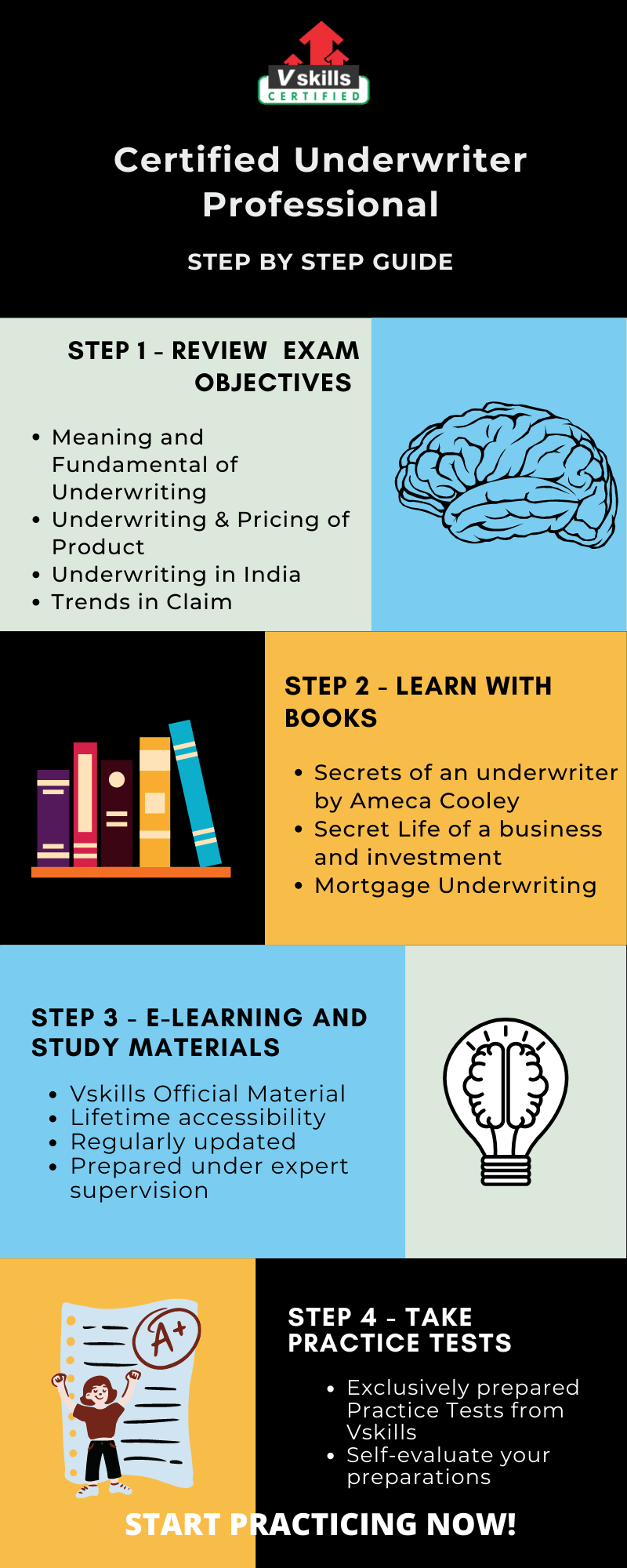

Preparation Guide for Certified Underwriter Exam

An ideal preparation guide gives us a comprehensive outline of the strategy that should be implemented before giving the exam. The following preparation guide consists of all the necessary study resources and the essential steps for your plan of action before taking the exam.

Step 1 – Review the Exam Objectives

Reviewing each and every exam objective becomes the most important part of your preparation. Devote enough time to each topic and have in-depth knowledge of the subject. Moreover, this will also result in strengthening your preparation. This certification exam covers the following topics:

- Meaning and Fundamental of Underwriting

- Underwriting & Pricing of Product

- Underwriting in India

- Trends in Claim

Refer: Certified Underwriter Brochure

Step 2 – Learning with Books

Books are meant to improvise our memory, therefore it is a traditional source of learning. Although many of us feel that it is a tedious process and a waste of time sometimes but the fact is contrary to such a mindset. Books are beneficial in the terms of making you aware of the topics in detail, hence gain command of the required skills.

The books mentioned below are the best books for the Underwriter certification exam.

- Secrets of an underwriter by Ameca Cooley. The book essentially explores topics like how to approve a loan, how it evaluates, and what are the factors in underwriting.

- Secret Life of a business and investment. The book consists of all the secrets of the underwriter experience. How to create more business and investment. It has highlighted the major topics in the book

- Mortgage Underwriting. The book explains the domain of the underwriter. It reveals all the principal of the topic and what the outcome of it.

Step 3 – E-Learning and Study Materials

E-learning resources are accessible anytime and anywhere, along with accommodating all the educational needs as well. Through E-learning, the lectures can be repeated as per your convenience. Vskills offers E-Learning Study Material for the Certified Underwriter exam. One very special advantage of Vskills learning material is its timely updates and lifetime access. In addition to supporting your e-learning, Vskills also provides study materials in hard copy for the candidates preferring offline study methods.

Refer: Certified Underwriter Sample Chapter

Step 4 – Check your Progress with Practice Tests

There is a quote which states that “the more you are accustomed to sitting for a period of time, answering test questions and pacing yourself, the more comfortable you will feel when you actually sit down to take the test”. Practice tests can help us ensure our preparation and familiarize ourselves with the concepts better. So Start practicing with free Practice Tests Now!

Job Interview Questions

Prepare for your next job Interview with Vskills Latest online Interview questions, these questions are created by experts to help you to overcome the interview fear.