The primary object of standard costing is to reveal the difference between actual cost and standard cost. A ‘variance’ in standard costing refers to the divergence of actual cost from standard cost. Variances of different cost items provide the key to cost control. They indicate whether and to what extent standards set have been achieved. This enables management to correct adverse tendencies.

After standard costs have been established, the next step is to ascertain the actual cost under each element and compare them with the standard cost. The difference between these two is termed as cost variance. Cost variance is the difference between a standard cost and the comparable actual cost incurred during a given period.

The Chartered Institute of Management Accountants London, defines variance as “the difference between planned, budgeted, or standard cost and actual cost; and similarly for revenue”.

Variance analysis can be defined as “the analysis of performance by means of variances”. It is the process of computing the amount of and isolating the cause of variances between actual costs and standard costs.

Variance analysis involves:

- Computation of individual variances, and

- Determination of the cause(s) of each variance.

Actual cost which is higher than the standard costs would be a sign of inefficiency and the difference would be termed as unfavorable or adverse. A variance that reduces profit is adverse or unfavorable. A variance that increases profit is favorable. Variances are computed under each element of cost for which standards have been established. Each variance is analyzed to ascertain the causes so that the management can exercise proper control. The cause is affixed to the variance, for example, materials price variance will show that the variance arose due to change in the price of materials. Some of the variance are controllable while others are not. The purpose of such classification is that proper emphasis can be placed on the controllable variance. This follows the principle of management by exception.

Variances occurring in a period may be compared with variances on the same account expressed as a percentage of the standard costs and compared with the percentage for the previous month. Comparison may be made between the standard and actual or between basic standard and current standard.

As already stated, the origin and causes of the variances need to be traced by analyzing the total variances into their components parts in order to determine and isolate the causes giving rise to each variance.

Equal emphasis should be laid on favorable and unfavorable variances. An unfavorable variance points out the inefficiency in use or waste of materials, labour, and resources. A favorable variance may be due to improvement in efficiency or production of substandard products or an incorrect standard. An unfavorable variance may be off-set by a favorable variance; hence the need for analysis and appropriate action.

A detailed probe into the variances, particularly the controllable variance, helps the management to ascertain:

- The amount of variance;

- Its occurrence;

- The factors responsible for it;

- The executive responsible for the variance;

- Corrective action which should be taken to obviate or reduce the variance.

- Favorable and Unfavorable Variance: If the actual cost is less than standard cost, the difference is known as a favorable variance, credit variance or positive variance denoted by (F) or Cr. – it increases the profit, on the other hand, if actual cost exceeds, standard costs, the divergence is known as an unfavorable variance, debit variance, negative variance or adverse variance denoted by (A) or Dr. – it reduces the profit.

- Controllable and Uncontrollable Variance: When the variance with respect to any cost item reflects the degree of efficiency of an individual or department, i.e., a particular individual or departmental head is responsible for the variance, the variance is known as a controllable variance. Obviously, such a variance is amenable to control by suitable action. An uncontrollable variance is one which is not amenable to control by individual or departmental action. Such a variance is caused by external factors like change in market conditions, fluctuations in demand and supply, etc. No particular individual within the organisation can be held responsible for it.

When variances are reported, attention of the management is particularly drawn towards controllable variances. If a variance has been caused by multiple factors, the part of cost variance relevant to each factor should be determined.

There are certain variances which may arise under material, labour or overhead due to change in the basic condition on which the standards are established.

- Revision Variance: This is amount by which a budget is revised but which is not incorporated in the standard cost rate as a matter of policy. The standard costs may be affected by wage rate changes after wage accords, fiscal policy etc. The standard costs are not disturbed to account for these uncontrollable factors and to avoid the amount of labour and cost involved in revision, the basic standard costs are allowed to stand. It is essential to isolate the variance arising out of non-revision in order to analyze the other variances correctly.

- Method Variance: It is the difference between the standard cost of the product manufactured or operation performed by the normal methods and the cost of operation by alternative method. Standards usually take into account the best method applicable, and any deviation will result in an unfavorable variance. Hence such deviations should be as few as possible.

Variance analysis usually proceeds after amending the standards according to the revision variance and the methods of variance.

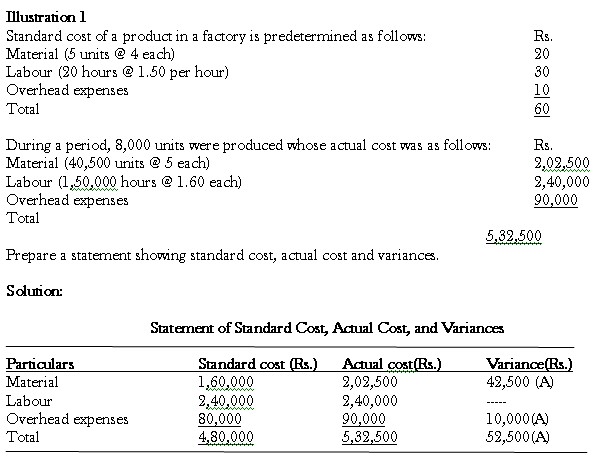

The above statement shows the variance in respect of each element of cost. Each such variance can be further analyzed. Before making such analysis it is necessary to recognize the two broad processes in cost accumulation. The cost is first incurred and then charged to production. For example, materials are purchased first (normally) and then issued for production and wages are incurred first and then charged to production on the basis of time spent on production. Thus, there are two stages in cost accumulation, namely, (i) the incurring stage, (ii) the recovery stage. The recognition of these two stages is essential because variances arise both at the incurring and recovery stages. Analysis involves identifying and quantifying the variances at both these stages.

Before we proceed to analyze the variances, the following essential points should be noted regard to the utility of the variance analysis:

- Variances should not be automatically applied for control purposes. They are just indicators of where the reason for higher cost exists. It is up to the controlling authority to judge whether the higher costs are well justified. The actual cost may be higher due to factors absolutely out of the control of the responsible authority and perhaps the responsible authority had contributed in preventing the actual cost from escalating too high. In such a situation applying controls implicit on the basis of variances disclosed will lead to demoralization of staff.

- While comparing the actual costs with the standards, the level of activity should be checked up for comparability. If standards have been evolved for a budgeted level of activity and if the actual level is different, a simple comparison of actual with budgets would be erroneous. The standards should be revised in accordance with the actual level of activity attained. But, in doing so care should be taken to distinguish between fixed costs and variable costs. The difference between the original standard and revised standard is known as “Revision Variance”.

- While working out the variance in respect of fixed costs (particularly fixed overheads), it should be kept in mind that what is charged to cost is not the actual cost but an amount based on pre-determined recovery rates multiplied by the output which may be expressed in standard hours.

Two-Way Analysis of Variances

Each variance has to be analyzed as (i) incurring variance, and (ii) recovery variance. Also, broadly, the causes leading to a variance may be either efficiency or inefficiency in the use of resources or change in the price paid for the resources. Accordingly, we have the following analysis:

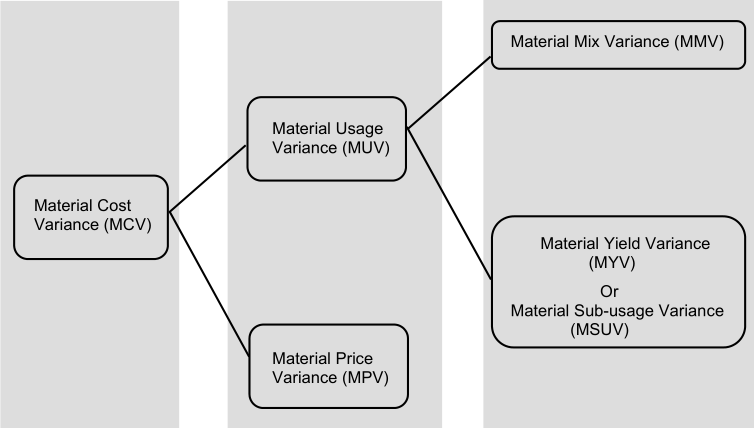

(i) Material cost variance – Material price variance

– Material usage variance

(ii) Labour cost variance – Labour rate variance

– Labour time variance

(iii) Overheads cost variance – Overhead expenditure variance

– Overhead volume variance

As each element of cost is analyzed into two broad groups It is known as “Two- way Analysis”.

Material Variance

Classification of material variances are as under: