When the changes / flows are related only to change in cash, the statement is called Cash Flow Statement. It reports only the cash receipts and disbursements. It simply explains the change in cash position of a business enterprise during the period by reflecting the flow of cash into and out of the business.

Cash Flow Analysis is useful for short-run planning. A historical analysis of cash flows provides insight to prepare reliable cash flow projections for the immediate future & make suitable arrangements. Cash Flow statement shows inflow -sources of cash (i.e. positive cash flow) and outflow – uses of cash (i.e. negative cash flows) during the period and the difference being ‘Net Cash Flow’. This statement analyses changes in non-current accounts as well as current accounts (other than cash) to determine the flow of cash.

Statement of changes in cash position is prepared recording only inflows and outflows of cash, reflecting the net change during the period. Cash received minus cash paid during a period is the cash balance at the end of the period. If the net change in cash position has to be found out from the profit and loss account, comparative balance sheets, adjustments for the non-cash items should be made.

Effective financial control of the business requires thorough knowledge of the sources and uses of cash in the business. A business may have both a strong balance sheet and income statement but the cash needs and commitments may not match the cash inflows. The cash flow statement can be a statement of past activities or a budget of expected cash inflows and outflows. As a statement of past performance, a cash flow statement shows how and when cash was generated and used to pay for inputs, loan payments, family living and any capital purchases. A projected cash flow is essential for evaluating the borrowing needs of a business and the feasibility of repayment plans.

A cash flow statement shows a complete accounting of debt transactions including principal and interest payments as well as the proceeds from new loans. An income statement only shows interest payments. Other items included in a complete cash flow but not in an income statement include family living costs, income and expenses, and income taxes.

The flow or movement of cash may be of two types, namely, actual flow of cash and notional flow of cash. The different types of cash flows are as follows.

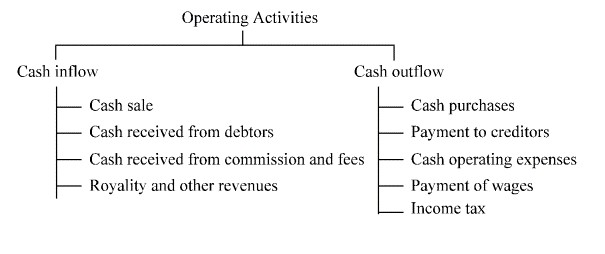

Cash Flows Related to Operating Activities:

- Cash receipts and collections from sales of goods and services

- Cash receipts from earnings on investments in securities (interest and dividends)

- Payments to suppliers

- Payments to employees

- Payments for interest

- Payments for taxes

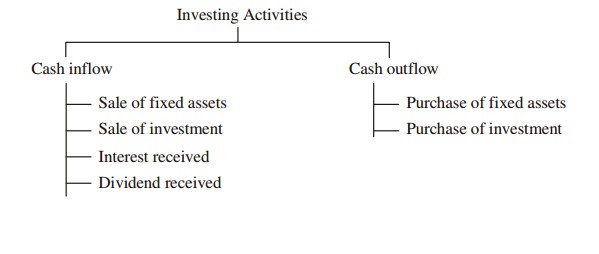

Cash Flows Related to Investing Activities:

- Cash receipts from the sale of securities of other companies

- Cash receipts from sales of productive assets

- Payments for the purchase of securities of other companies

- Payments at the time of purchase for the acquisition of productive assets

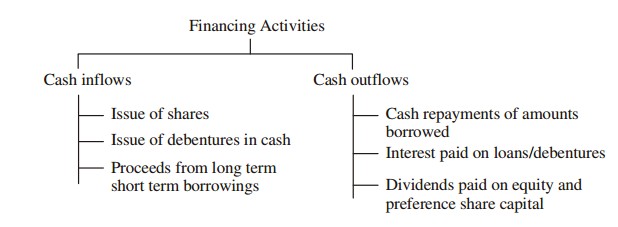

Cash Flows Related to Financing Activities:

- Proceeds from issuing capital stock or other equity securities

- Proceeds from issuing debt securities or obtaining loans (other than trade credit)

- Payments for reacquisition of capital stock or other equity securities of the entity

- Payments for the retirement of debt securities (excluding interest)

- Payments of principal on loans (other than trade payables)

- Payments of dividends