As a class, administrative expenses bear only a remote relationship either to the manufacturing or to the selling functions. The administrative divisions being responsible only for laying down general policies of the company, its benefits, by and large, are intangible and hence difficult to measure. Also, administrative expenses are generally period costs are constant; they are not affected by any fluctuations in the volume of production of sales activity. A careful watch over the variable administrative expenses, e.g., postage, stationery, office maintenance and upkeep, office transport, repairs, etc., is nevertheless necessary since top executives may sometimes overlook the need for exercising strict economy in expenses with which they themselves are concerned.

There are three distinct methods of accounting for administrative overheads.

- Apportioning between production and sales departments: This method recognizes only two basic functions of a manufacturing concern, i.e. manufacturing and selling and distribution Thus, administrative overheads are apportioned over production and sales departments Therefore, each of the department should be charged with the proportionate share of them When this method is adopted, administrative overheads lose their identity and get merged with production and selling and distribution overheads.

- Transfer to profit and loss account: As per this method, administrative overheads are concerned with the formulation of policies and thus are not directly concerned with either the production or the selling and distribution functions. Further administrative overheads are mainly of fixed costs. Lastly, there appears to be no equitable base to charge administration overheads to other functions or the products. In view of these arguments, the administrative overheads are charged to profit and loss account.

Treating administrative overheads as a separate addition to the cost of jobs or products

This method considers administration as a separate function like production and sales and, as such costs relating to formulating the policy, directing the organization and controlling the operations are taken as a separate charge to cost of the jobs or a product, sold along with the cost of other functions. The following bases may be adopted for such absorption:

- Works cost

- Sales value/quantity

- Gross profit on sales

- Units manufactured

- Conversion cost.

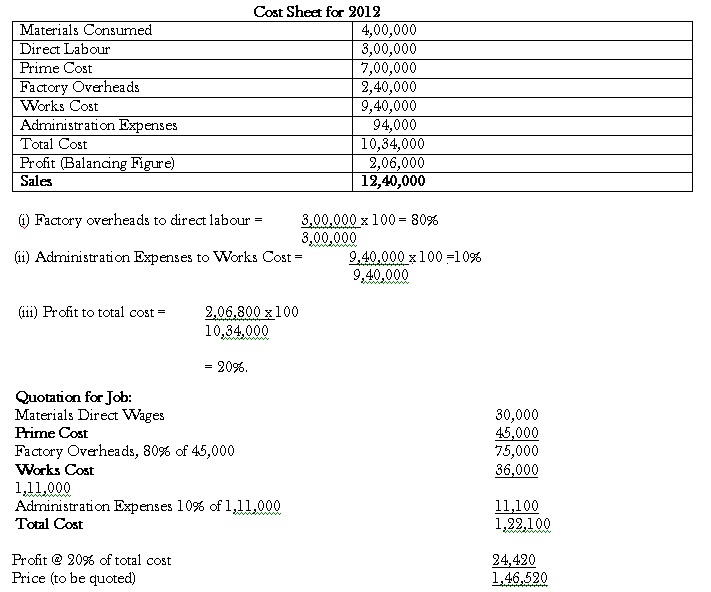

Illustration 2

The following information has been gathered for a company doing jobbing work only for 2012:

Materials Consumed 4, 00,000

Direct Labour 3, 00,000

Factory Overheads 2,40,000

Office and Administrative Expenses 94,000

Sales 12,40,800

The company has to quote for a job to be undertaken in February, 2013. It is estimated that the job will require materials costing 30,000 and direct wages for it will be 45,000. What should be the quotation?

Solution: