The risk of an investment refers to the variability of its rate of return.

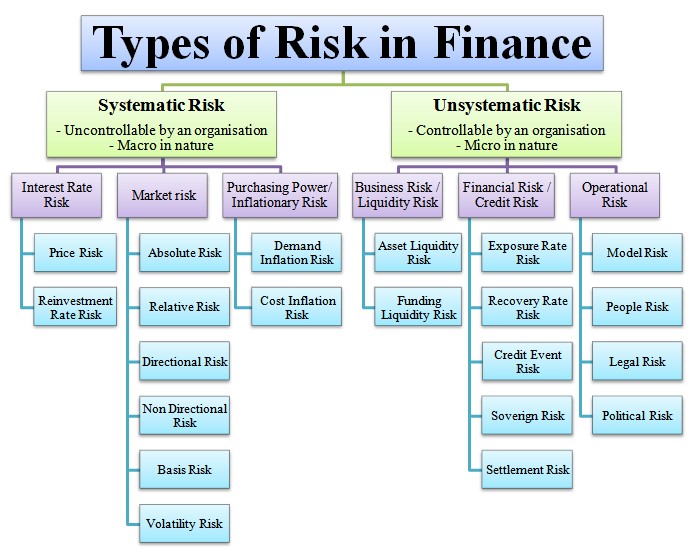

Forces contributing to variations in return – price or dividend (interest) constitute elements of risk. Some influences are external to the firm and affect large number of securities and are uncontrollable in nature. Such forces are called sources of systematic risk, whereas controllable factors internal to the firm and peculiar to industries are called sources of unsystematic risk.

It refers to that portion of total variability in return caused by factor affecting the prices of all securities. The sources of such a risk are economic, political and sociological changes. This results in prices of all common stocks to move together in the same manner. There is a limit on the amount of risk that can be reduced through diversification. There are 2 reasons for this. The first is because of the degree of correlation. The lower the degree of positive correlation, the greater is the amount of risk reduction that is possible. The second reason is the number of stocks in the portfolio. As the number of stocks increases, the diversifying effect of each additional stock diminishes.

The risk of any two stocks can be separated into two components.

Non-diversifiable risk: It is a part of the total risk that is related to the general economy or stock market as a whole and hence cannot be eliminated by diversification. This is also referred to as market risk or systematic risk.

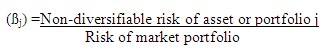

Systematic risk is measured using Beta (ß) which measures the relative risk associated with any individual portfolio as measured in relation to the risk of market portfolio. The market portfolio represents the most diversified portfolio of risky assets an investor could buy since it includes all risky assets. This relative risk can be expressed as

Systematic Risk Includes

- Market Risk: There are many causes, but is mainly due to a change in investors’ attitude toward equities in general, or toward certain types or groups of securities in particular.

- Interest rate risk: refers to the uncertainty of future market values and of the size of future income, caused by fluctuations in the general level of interest rates.

- Purchasing power risk: is the uncertainty of the purchasing power of the amounts to be received. In short, purchasing power refers to the impact of inflation or deflation of an investment.

Rising prices on goods and services are normally associated with what is referred to as inflation. Falling prices on goods and services are termed deflation.