Information

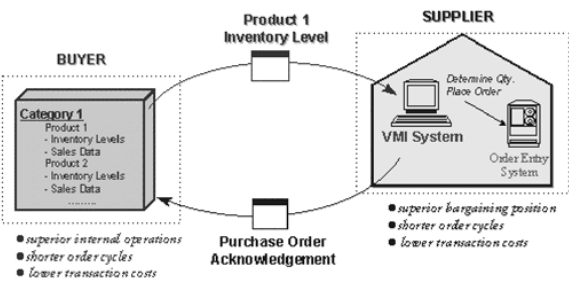

is often shared to leverage on the superior expertise, or operational economies-of-scale of one organization. This occurs when one firm owns valuable information, while the other firm possesses the ability to use this information. An example of this is vendor managed inventory (Figure 3).

Figure 3: VMI — sharing operational information

For instance, a buyer shares aggregate inventory position information with its suppliers; this enables suppliers to manage the inventory of their own products at the buyer’s site. Suppliers are better equipped to perform these duties, for the following reasons:

- They have experience managing large supply side inventories of this product.

- They have superior knowledge of production schedules, which reduces the supply-side uncertainty that a buyer normally faces, resulting in a lower average inventory for the buyer.

- They could have comparable VMI arrangements with a number of buyers (economies-of-scale).

Efficiency gains are not restricted to inventory cost reductions. In our case in when product specifications, packaging specifications or packaging quantities changed, an order sent with an outdated UPC would generate rework. When new products were introduced, there was a similar problem. Moving to VMI eliminated these difficulties. However, the buyer’s costs of ordering and order fulfillment are now borne by the supplier.

What does the supplier gain? Their internal operating efficiency gains are minimal at best. However, one benefit that may not be immediately tangible (if it exists) is that the supplier’s relative bargaining position for its transactions with the buyer may improve. Since it is has superior knowledge of how well or badly its product is doing on a regular basis, the information asymmetry it faces reduces; it may therefore be able to bargain for price schedules that are more favorable.

It is likely that the contracts underlying these sharing agreements will include value sharing agreement between the buyer and the supplier. Alternately, there could be a penalty for non-VMI suppliers. This penalty could range from a complete shut-out (‘we do business only with suppliers who manage their own inventories in our stores’ – implies a strong bargaining position on the buyer side, despite the apparent gain in power by the supplier as described in the previous paragraph) to some kind of price advantage that the buyer passes on to the supplier. Our discussion in provides insight into some these issues.

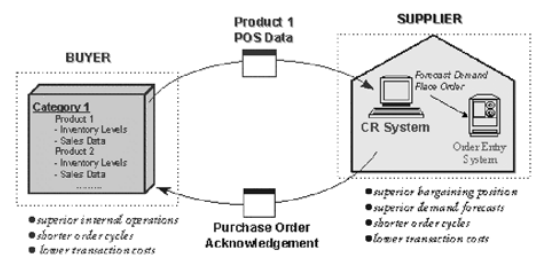

Sharing Strategic Marketing Information: It is becoming common for organizations to share brand- specific information which provides strategic benefits to one of the organizations, and also leverages on their superior expertise. This occurs when one organization owns information that it can derive little independent value from, but which another can use to generate operational benefits for the company it receives the information from, besides garnering strategic value for its own sales and marketing departments. For instance, a retailer possesses POS (point-of-sales) information on all the products it sells. This information is not of much value in isolation; however, a supplier can make superior demand forecasts by analyzing detailed transaction level information from many retailers. This form of information sharing is used in the efficient customer response, continuous replenishment and quick response systems models (Figure 4), common in the grocery and fashion retailing industry. ).

Figure 4: Continuous Replenishment — sharing strategic information

The model has been discussed for many years now – supply chain management has always striven to move towards a system where consumer purchases ‘pull’ goods through the chain, rather than suppliers ‘pushing’ them.

Since inventory positions can easily be derived from POS information, the operational information is also being shared. Hence, all the benefits that accompany VMI-type situations still exist. However, this information is of a much higher level of detail than inventory aggregates. – it can be used by the supplier’s sales and product development groups for improved demand forecasting, promotion scheduling and segment- specific forecasts. According to the director of worldwide sales forecasting at Eastman Kodak, such region specific and tactical demand forecasts are increasingly becoming a major role of sales. Reduced demand uncertainty also improves the internal inventory management of the supplier.

The benefits described above may indicate that the buyer can induce suppliers unwilling to enter into information sharing agreements by offering them access to information that is of strategic value. However, when this information is available to the supplier, the relative bargaining power of the buyer is reduced further. For instance, in the POS example above, the supplier now knows not only gross product movement figures, but also the details of what prices the buyer charges consumers, any local demand patterns and the schedule of promotions – this puts the buyer at a significant disadvantage when negotiating supply terms.

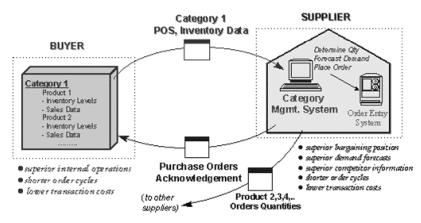

Sharing Strategic and Competitive Marketing and Sales Information: At the highest level of information sharing, it is possible for a buyer to allow a supplier to access broad market information that provides the supplier with strategic and competitive benefits This occurs when one organization possesses information that it can derive little independent value from, but from which another can derive internal strategic production benefits, as well as competitive sales and marketing benefits. The competitive benefits are with respect to intra-industry rivals – this information does not give the supplier additional competitive advantage over the buyer, but over other suppliers in its own industry. Category management is an example of this situation (Figure 5).

Figure 5: Category management — sharing strategic and competitive marketing information

The retailer endows one of the suppliers with inventory management responsibility over all the products supplied for that category, and provides them with the relevant POS information. This gives that supplier strategic benefits (from improved demand forecasts), competitive benefits (from sales and demand information about competitor’s products), and will enable superior inventory management. It also reduces the buyer’s operating costs tremendously – not only are all order management costs eliminated, but the buyer deals with only one supplier per category, and hence have a significant reduction in information technology costs.

On the face of it, the supplier also gains tremendously when provided access to this information. Not only are all the benefits of present, but the supplier can track the sales of competing products in the category, and use this information to improve the sales strategy of their own product. Since there may be a time lag between the category manager generating an order, and a competing supplier receiving it, inventory costs of competing products will tend to be higher, and hence the category manager gains a cost advantage as well. The tradeoff appears to be increased transaction costs for the supplier, who manages orders and monitors product movements of a whole category of products.

In this section, we have discussed the sources of value creation when two companies share information at different levels. We examine how this value will be shared by the two firms.

Stay Ahead with the Power of Upskilling - Invest in Yourself!

Stay Ahead with the Power of Upskilling - Invest in Yourself!