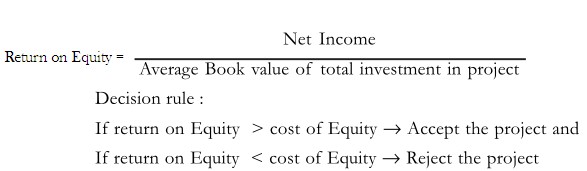

The return on Equity means return to the equity investors using the accounting net income as a means of this return. So,

- ROE indicates the rate of return on equity capital and is particularly on equity capital significant in the context of objective of maximization of share value. Equity is the sum of share capital, preferred shares, paid-in surplus, retained earnings and reserves for future contingencies.

Rate of Return Equity % = [Net income/Total equity capital] × 100

- Return on Assets (ROA) measures the ability of management to utilize the real and financial resources of the bank to generate income and is used to evaluate management.

Rate of Return Assets % = [Net income/Total assets] × 100

- The relationship between ROE and ROA is

ROE = ROA × Equity multiplier (financial leverage)

[Net income/Total equity] = [Net income/Total assets] × [Net assets/Total equity]- Return on equity is a product of ROA and equity or leverage multiplier. A high equity multiplier can increase both ROE and the growth rate of the bank as long as ROA is positive. ROA is the product of profit margin and asset utilization.

ROE = Profit margin × asset utilization × equity multiplier.

[Net income/Total equity] = [Net income/Operating income] × [Operating income/Total assets] × [Total assets/Total equity]Return on assets is also a product of profit margin and asset utilization ratio. Profit margin is determined given the operating income by the ability to control expenses; and asset utilization ratio on the effective employment of assets to generate revenues.

- Net Interest Margin (NIM) gives an insight into the bank’s financial performance because interest income and expenses absorb a major share of total operating income and expenses.

- Net interest margin % = [(Total interest income –Total interest expense)/Average earning assets] × 100