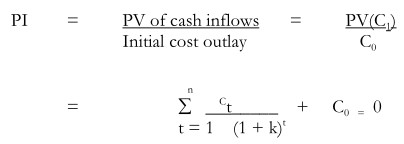

It is the ratio of the present value of cash inflows at the required rate of return, to the initial cash outflow of the investment. It may be gross or net, net being simply gross minus one. The formula to calculate benefit-cost ratio or profitability index is as under: –

Acceptance Rule

The following are the Profitability Index (PI) rules:

- Accept PI > 1

- Reject PI < 1

- May accept PI = 1

When PI is greater than on, then the project will have positive NPV. The project with positive net present value will have profitability index greater than one. Profitability index less than one means that the project’s net present value is negative

Evaluation of PI Method

Like NPV and IRR rules, PI is a conceptually sound method of appraising investment projects. It gives due consideration to the time value of money. It is a variation of the NPV method and requires the same computation as the NPV method. In PI method, since the present value of cash flows is divided by the initial cash outflow, it is a relative measure of a project’s profitability.

PI is a variation of the net present value (NPV) method, and requires the same computations as the net present value (NPV) method.

- Time value. It recognizes the time value of money.

- Value maximization. It is consistent with the shareholder value maximization principle. A project with profitability index greater than one will have positive net present value (NPV) and if accepted, it will increase shareholders wealth.

- Relative profitability. In the profitability index (PI) method, since the present value of cash inflows is divided by the initial cash outflow, it is a relative measure of a project’s profitability.