Profitability ratios can be related to Sales in respect of Gross Profit Margin, Net Profit Margin and Expenses.

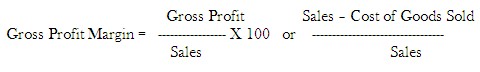

Gross Profit Margin to Sales ratio

High G/P ratio is a sign of good management and low G/P ratio is a cause of worry to unless there is improvement in managing.

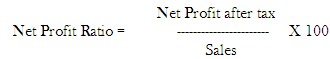

Net Profit Margin to Sales ratio

Net Profit Margin ratio is calculated as below:

Expenses Ratios

These ratios establish relationship between various expenses and sales:

Cost of Goods Sold Ratio = Cost of Goods Sold X 100 / Net Sales

Administrative Expenses Ratio

Administrative Expenses x 100/ Net Sales

Selling & Distribution Expenses Ratio

Selling & Distribution Expenses X 100 /Net Sales

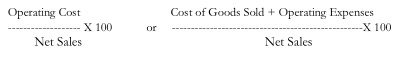

Operating Ratios

Operating Cost

Profitability in relation to Investments

These ratios relate Profit to Investments. Return On Investments (ROI) is related to three categories of Assets, Shareholders’ Equity / Funds and Capital Employed

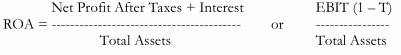

Return on Assets

Return on Capital Employed (ROCE)

Net Profit after taxes

ROCE = —————————————————

Capital Employed

(Non Current Liabilities + Owners’ Equity)

Return to Shareholders

Return on Total Shareholders’ Equity = Net Profit after Tax / Shareholders’ Funds

Shareholders’ Funds = Equity Share Capital + Preference Share Capital + Reserves & Surplus – Accumulated losses, if any)

Return on Equity Capital (ROE)

ROE = Profit after tax – Preference Dividend / Shareholders’ Equity or Net Worth

Earnings Per Share (EPS)

EPS is the amount equity holders can get on every share held

EPS = Net Profit available to equity holders (Net Profit after tax – Preference Dividend) / Number of Equity Shares

Dividend Per Share (DPS)

The earnings distributed to the shareholders as cash dividends

DPS = Earnings paid to shareholders / Number of Equity Shares

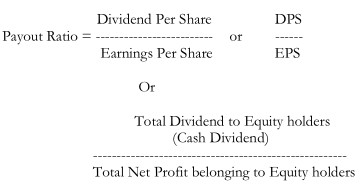

Dividend Payout Ratio

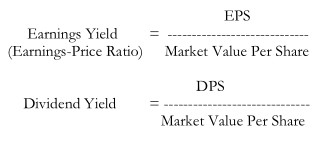

Earnings Yield and Dividend Yield

The yield is expressed in terms of the market value per share

Price-Earnings (P/E) Ratio

P/E Ratio assesses a firm/s performance as expected by the investors. It is the reciprocal of Earnings Yield or Earnings

Price Ratio P/E Ratio = Market Price Per Share / Earnings Per Share

Market to Book Value Ratio

Market Price Per Share / Book Value Per Share