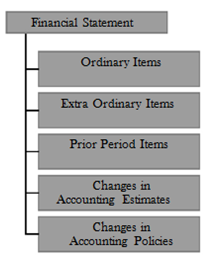

The objective of AS 5 is to recommend the classification and disclosure of items in the statement of profit and loss so that all enterprises prepare and present such a statement on a uniform basis. This betters the study of the financial statements of an enterprise over time and with the financial statements of other enterprises. Accordingly, this Standard requires the classification and disclosure of extraordinary and prior period items, and the disclosure of certain items within profit or loss from ordinary activities. It also states the accounting treatment for changes in accounting estimates and the disclosures to be made in the financial statements regarding changes in accounting policies.

Net Profit or Loss for the Period

The net profit or loss for the period comprises the following components, each of which should be disclosed on the face of the statement of profit and loss:

(a) Profit or loss from ordinary activities: Any activities which are undertaken by an enterprise as part of its business and such related activities in which the enterprise engages in furtherance of, incidental to, or arising from, these activities. For example profit on sale of merchandise, loss on sale of unsold stock at the end of the season.

(b) Extraordinary items: Income or expenses that arise from events or transactions that are clearly distinct from the ordinary activities of the enterprise and, therefore, are not expected to recur frequently or regularly. For example, profit on sale of furniture or heavy loss of goods due to fire.

Extraordinary items should be disclosed in the statement of profit and loss as a part of net profit or loss for the period. The nature and the amount of each extraordinary item should be separately disclosed in the statement of profit and loss in a manner that its impact on current profit or loss can be perceived. Whether an event or transaction is clearly distinct from the ordinary activities of the enterprise is determined by the nature of the event or transaction in relation to the business ordinarily carried on by the enterprise rather than by the frequency with which such events are expected to occur. Hence, an event or transaction may be extraordinary for one enterprise but not so for another enterprise because of the differences between their respective ordinary activities. For example, losses sustained as a result of an earthquake may qualify as an extraordinary item for many enterprises. However, claims from policyholders arising from an earthquake do not qualify as an extraordinary item for an insurance enterprise that insures against such risks.

When items of income and expense within profit or loss from ordinary activities are of such size, nature or incidence that their disclosure is relevant to explain the performance of the enterprise for the period, the nature and amount of such items should be disclosed separately.

Circumstances which may give rise to the separate disclosure of items of income and expense include:

- The write-down of inventories to net realisable value as well as the reversal of such write- downs.

- A restructuring of the activities of an enterprise and the reversal of any provisions for the costs of restructuring.

- Disposals of items of fixed assets.

- Disposals of long-term investments.

- Legislative changes having retrospective application.

- Litigation settlements.

- Other reversals of provisions.

Prior Period Items

Prior period items are income or expenses which arise in the current period as a result of errors or omissions in the preparation of the financial statements of one or more prior periods. Prior period items are generally infrequent in nature and can be distinguished from changes in accounting estimates.

Accounting estimates by their nature are approximations that may need revision as additional information becomes known. For example, income or expense recognised on the outcome of a contingency which previously could not be estimated reliably does not constitute a prior period item.

Disclosure under Following Category

For example, Mr. Dutt bought a new machine costing 10 lacs. Useful life was taken to be for 10 years. Therefore depreciation was charged at 10% on original cost each year. After 5 years when carrying amount was 5 lacs for the machine, management realizes that machine can work for another 2 years only and they decide to write off 2.5 lacs each year. This is not an example of prior period item but change in accounting estimate. In the same example management by mistake calculates the depreciation in the fifth year as 10% of 6,00,000 i.e. 60,000 instead of 1,00,000 and in the next year decides to write off 1,40,000. 1,00,000 current year’s depreciation and 40,000 as prior period item.