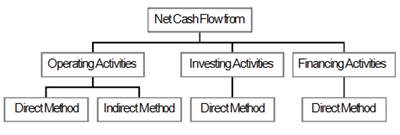

AS 3 ‘Cash Flow Statements’ requires the presentation of information on historical changes in the cash and cash equivalents of an enterprise in the relevant accounting year by means of a cash flow statement, which classifies cash flows during the period according to operating, investing and financing activities.

Operating activities

These are the principal revenue-producing activities of the enterprise and other activities that are not investing or financing activities.

Examples of cash flows from operating activities are:

- cash received in the year from customers (in respect of sale of goods or services rendered either in the year, or in an earlier year, or received in advance in respect or the sale of goods or services to be rendered in a later year);

- cash payments in the year to suppliers (for raw materials or goods for resale whether supplied in the current year, or an earlier year, or to be supplied in a later year);

- the payment of wages and salaries to employees;

- tax and other payments on behalf of employees;

- the payment of rent on property used in the business operations; royalties received in the year;

- cash receipts and cash payments of an insurance enterprise for premiums and claims, annuities and other policy benefits;

- the payment of insurance premiums;

- cash payments or refunds of income taxes that cannot be specifically identified with financing or investing activities

- cash flows arising from futures contracts, forward contracts, option contracts or swap contracts hedging a transaction that is itself classified as operating; and

- cash flows arising from the purchase and sale of securities and loans held for dealing or trading purposes.

Operating activities are those activities which determine the profit/loss result of the enterprise, hence this head helps us to determine whether the concern has sufficient cash inflow from their normal operations to support their operating cash outflow, and also the other cash outflow.

Fixed assets are to be classified as investing activities, hence any sale proceeds from such items will go to investing activities. If investments are held as stock in trade, they will be disclosed as operating activities.

Net cash flow from operating activities can be reported either as direct method or as indirect method.

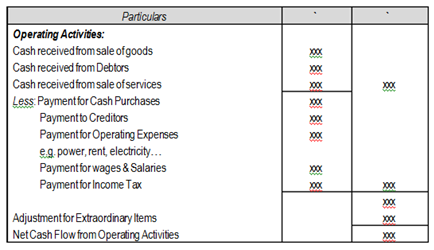

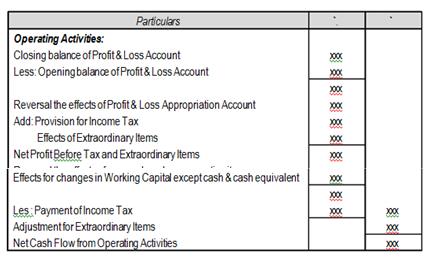

In ‘Direct method’ an individual takes the gross receipts from sales, debtors and other operating inflows subtracted by gross payments for purchases, creditors and other expenses ignoring all non- cash items like depreciation, provisions. In ‘Indirect method’ it starts from the net profit or loss figure, remove the effect of any non cash items, investing items and financing items from such profit figure i.e. all such expenses like depreciation, provisions, interest paid, loss on sale of assets etc. are added and interest received etc. are deducted. Adjustment for changes in working capital items are also made ignoring cash and cash equivalent to reach to the figure of net cash flow.

Direct method is chosen over indirect method as the direct method presents a clear picture of various sources of cash inflows and outflows which helps in estimating the future cash inflows and outflows.

Below is the format for Cash Flow Statement

Cash Flow Statement of X Ltd. for the year ended March 31, 20xx (Direct Method)

Cash Flow Statement of X Ltd. for the year ended March 31, 20xx (Indirect Method)

Investing activities

These are the acquisition and disposal of long-term assets and other investments not included in cash equivalents.

Examples of cash flows arising from investing activities include:

- cash payment to acquire fixed assets (including intangibles). These payments include those relating to capitalised research and development costs and self-constructed fixed assets;

- cash receipts from disposal of fixed assets (including intangibles);

- cash payments to acquire shares, warrants or debt instruments of other enterprises and interests in joint ventures (other than payments for those instruments considered to be cash equivalents and those held for dealing or trading purposes);

- cash receipts from disposal of shares, warrants or debt instruments of other enterprises and interests in joint ventures (other than receipts for those instruments considered to be cash equivalents and those held for dealing or trading purposes);

- cash advances and loans made to third parties (other than advances and loans made by a financial enterprise);

- cash receipts from the repayment of advances and loans made to third parties (other than advances and loans of a financial enterprise);

- cash payments for futures contracts, forward contracts, option contracts and swap contracts except when the contracts are held for dealing or trading purposes, or the payments are classified as financing activities; and

- cash receipts from futures contracts, forward contracts, option contracts and swap contracts, except when the contracts are held for dealing or trading purposes or the receipts are classified as financing activities.

Financing activities

These are activities that result in changes in the size and composition of the owners’ capital (including preference share capital in the case of a company) and borrowings of the enterprise.

Examples of cash flows arising from financing activities are:

- cash proceeds from issuing shares or other similar instruments;

- cash proceeds from issuing debentures, loans, notes, bonds, and other short or long-term borrowings; and

- cash repayments of amounts borrowed.

So all the transactions should be classified under each of these heads and presented in CFS, this kind of presentation gives a very clear idea to the users regarding the major sources of cash inflows, from where all the activities are financed by the enterprises.

Cashflow during the year is: