Besides many planning problems, some operational problems also come in the way of effective budgetary control system. Following problems are the major ones:

- A budget is just a sophisticated guesswork, so question can be raised about its usefulness for being used as standard against which to measure the performance and to take action. Apart from control actions relating to materials and things, control actions may be directed towards personnel in the organisation. This may work against the morale of the people in the organisation especially if the budgetary control system does not operate properly.

- Budgetary control may affect organisational morale adversely in another way. There is every likelihood that department managers may adopt a defensive attitude as soon as unfavorable variances are brought to their notice. To save themselves from criticisms, they may pass on the blame on other managers. This may create many types of problems and conflicts in the organisation.

- Budgetary control system requires a lot of paper work which the technical personnel always resent. In fact, this does not fit with their areas of specialization. To the extent, the applicability of budgetary control system, particularly in its control aspect, may be limited.

Exhibit

Budgetary Control in Baroda Rayon Corporation: Baroda Rayon Corporation is located at Surat with its head office at Mumbai. It produces rayon filament yarn, polyester filament yarn, and nylon tyre cord. It has adopted a comprehensive budgetary control system. It prepares its budget on annual basis to coincide with its financial year, April to March. There is a separate Budget Control and Cost Accounts (BCCA) department which coordinates the activities of budgetary control.

Budget Preparation: The Company prepares its master budget along with budgets for major important functions like sales, production, cash, labour, etc. The budget is prepared by BCCA department in consultation with the chief executive, departmental heads. After the initial budget preparation, it is approved by budget committee and finally, it is sent for the approval of Board of Directors at its head office at Mumbai. Normally the standards of last year are used as the basis for budget preparation with suitable adjustment. For example, rates of materials are adjusted according to the prevailing rates in the market. Similarly adjustment is made in labour cost depending on the rate of dearness allowance payable to workers for the budget period. Dearness is paid on the basis of All India Cost of Living Index. Overheads are charged on percentage basis. When budgets are prepared and approved, these are communicated to respective heads of departments/sections for implementation.

Budgetary Control: For control purposes, variance analysis is made. Factors for variance between budgeted and actuals are identified. For taking further course of action, various factors have been divided into two parts: controllable and non-controllable. Controllable factors are like utilization of plant capacity, unit consumption ratios of various raw materials, utilization of auxiliary materials, labour utilization, etc. Uncontrollable factors are like price of raw materials, price of the final products, etc. Budget deviations are calculated every month and for some sections every day. Deviations due to controllable factors are communicated to respective personnel for corrective actions. In case of deviations due to uncontrollable factors, these are communicated to the chief executive who in consultation with marketing people decides about a change in product mix specially if the deviation is due to price of final products. Usually a deviation below 5 per cent is ignored.

Financial Ratio Analysis: Financial ratio analysis identifies the relationship between two financial variables in order to derive meaningful conclusion about their behavior. Metcalf and Tigard have defined financial ratio analysis as “a process of evaluating relationship between component parts of financial statements to obtain a better understanding of a firm’s position and performance. The type of relationship to be investigated depends on the objective and purpose of evaluation. In the case of measurement of overall performance, generally, four groups of ratios are considered: liquidity ratios, activity ratios, leverage ratios, and profitability ratios. A brief description of these ratios is presented here.

Liquidity Ratios: Liquidity ratios indicate the organization’s ability to pay its short term debts. These ratios are generally expressed in two forms: current ratio and quick ratio. Current ratio shows the relationship between current assets and current liabilities. This indicates the extent to which current assets are adequate to pay current liabilities. Quick ratio indicates the relationship between liquid assets (cash in hand and with bank and short-term debtors) and current liabilities. It helps in identifying the organization’s ability to pay its current liabilities without considering inventory in hand.

Activity Ratios: Activity ratios show how funds of the organisation are being used. These ratios are in the form of inventory turnover ratio, receivable turnover ratio, and assets turnover ratio. Inventory turnover ratio indicates the number of times inventory is replaced during the year and shows how effectively inventory has been managed. Receivable turnover ratio shows how promptly the organisation is able to collect dues from its debtors. Assets turnover ratio indicates how effectively assets have been used to generate sales.

Leverage Ratios: Leverage ratios indicate the relative amount of funds in the business supplied by creditors/financiers and shareholders/ owners. These ratios are in the form of debt-equity ratio, debt- total capital ratio, and interest coverage ratio. Debt-equity ratio indicates the proportion of debt in relation to equity and indicates the financial strength of the organization. Debt-total capital ratio shows the proportion of debt to total capital employed. This also indicates the financial strength. Interest coverage ratio shows the interest burden being borne by the organisation in relation to its profit.

Profitability Ratios: Profitability ratios show the ability of an organisation to earn profit in relation to its sales and/or investment. Profitability ratios are expressed in terms of profit margin as well as return on investment. Profit margin, net profit or gross profit, is expressed in the form of relationship between profit and sales and indicates the degree of profitability of the business. Return on investment is measured by relating profit to investment. Return on investment is the most comprehensive technique for controlling overall performance. Therefore, somewhat more elaborate discussion is presented.

Return on Investment

The efficiency of an organisation is judged by the amount of profit it earns in relation to the size of its investment, popularly known as ‘return on investment’ (ROI). This approach has been an important part of the control system of Du Pont Company, U.S.A, since 1919, though it was actually devised by Donaldson Brown in 1914. Since its successful operation in Du Pont, a larger number of companies have adopted it as their key measure of overall performance.

This technique does not emphasize absolute profit for judging the efficiency of an organisation as a whole or a division thereof, rather the amount of profit is related with the amount of facilities or capital invested in the organisation or the division. The goal of a business, accordingly, is not to optimize profit, but to optimize returns on capital invested for business purposes. This standard recognizes the fundamental fact that capital is a critical factor in almost any business and its scarcity puts limit on progress.

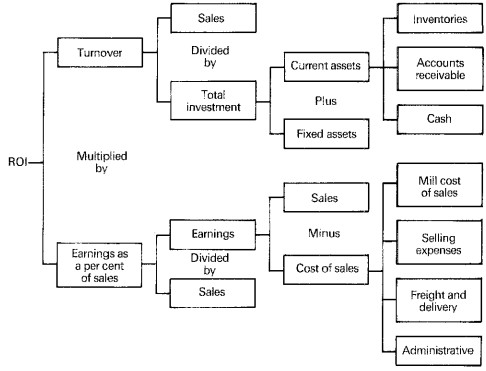

The system of control through return on investment can be seen from figure as operating in Du Point Company.

The rate of return is calculated by dividing the profit by total investment. It can be computed in respect of historical data so as to reveal the rate of return realized or it may be applied to budgeted data to give a projected rate of return. In the Du Pont system, the investment includes total fixed and current assets without reducing liabilities or reserves. The basis is that such a reduction would result in fluctuations in operating investments as liabilities or reserves fluctuate, which would distort the rate of investment and render it meaningless.

On the other hand, many business organizations adopt a different view of investment. Accordingly, the amount of the investment should be taken by deducting depreciation from the assets. The argument is simple. Depreciation reserves represent a write-off of initial investment and that funds made available through such charges are reinvested in other fixed assets or used as working capital. The argument seems to be realistic as it puts heavier burden on return on new assets, as compared to old and obsolete assets. Moreover, the amount of investment thus calculated is further reduced by the amount of current liabilities.

Advantages: The return on investment is an integral part of the productivity and efficiency accounting. It gives following advantages:

- The technique offers a sound basis for inter-organization comparison. Such comparison can be made among the different divisions, departments, or products of the same organisation. It places high values on the effective and efficient use of organisational resources. It is a mirror which reflects the entire image of the operating activity. As such, suitable action can be taken for removing inefficiency.

- It provides success to budgetary planning and control by putting restraint on the managers’ demand for higher allocation of resources for their departments even if these are not actually needed. Thus, the resource allocation in an organization is made on more rational basis.

- This system is helpful in authority decentralization. Each manager, in charge of a department or section, is responsible for earning certain rate of return, but enjoys complete freedom in running his department. Such autonomy gives additional incentive to managers for higher efficiency.

- It can be treated as a total control system in the sense that rate of return reflects the objective of the organization. If this rate is satisfactory, other control systems like budgetary, costing, ratios, reports may be taken as satisfactory.

Limitations

There are some limitations of the rate of return as a control tool:

- The use of rate of return is associated with the fixation of a standard rate of return against which the actual is compared. What should be this standard return is often questionable. Comparisons of rates of return are hardly enough because they do not tell what the optimum rate of return should be.

- Another problem comes in the way of valuation of investment. The question is at what cost the assets should be valued: at original cost, depreciated cost, or replacement cost. In an inflationary economy, the problem of price adjustment becomes more acute, whatever basis of valuation is adopted.

- The rate of return on investment sometimes hampers diversification if it has no flexibility. This is because of the fact that the rate of return is determined by the amount of risk; higher the risk, higher the desirable rate of return.

- Many times, the return on investment is followed so rigorously that expenditure such as research and development which can contribute to the profitability in the long run are curtailed to show impressive results in terms of rate of return. This practice, however, is detrimental to the organisation in the long run.

- As is the case with any system of control based on financial data, return on investment can lead to excessive emphasis on financial factors. This emphasizes that capital is the only scarce resource in the organisation leaving aside the role and availability of competent managers, good industrial relations and good public relations.

Social Performance Control: Social responsibility is a part of overall business objectives of an organization. Most of the organizations set their social objectives either explicitly or implicitly depending on organizational practices. Social performance control deals with assessing the extent to which an organization is achieving its social objectives. This requires defining the basis on which social performance should be evaluated and identifying the degree to which social performance is effective. Thus, social performance control involves two aspects:

- Approaches for measuring social performance and

- Social audit.