Integrated Accounting is a system in which the accounts are integrated and only a single set of accounts are maintained for Cost & Financial records. It avoids maintenance of Accounts under cost accounting & financial accounting. This enables a firm to eliminate separate Profit & Loss Accounts under financial accounting and cost accounting systems & only one Profit & Loss Accounts are prepared. It provides entire information for the ascertainment of cost of each unit as well as preparation of a balance sheet as per the legal requirement of the organisation. It also provides necessary information as required by the costing and finance department. There is no General Ledger Control A/c is prepared in this system.

Essential Features of Integral Accounting

The following are the essential features of an integral an accounting system:

- It records financial transitions not normally required for cost accounting be sided recording internal costing transaction prepayments and accruals are opened.

- Stores transactions are recorded in the stores control account. This account is debited with the cost of stores purchased corresponding credit being given to cash or sundry creditors depending whether the purchase is made for cash or on credit.

- Wages control account is debited with the wages paid, contra credit is taken in cash or bank account.

- Overhead expenses are debited to the overhead control account, corresponding credit being given to cash or band account or the sundry creditors.

- A transaction relating to material, labour cost overheads are posted in the stores wages and overhead control account after making suitable cost analysis and tat the end of the period transfer of the totals is made to the work in progress accounts by crediting various control accounts. The day to day cost analysis made for this purpose is known as making third etc. These entries do not mean entries in the same sense an entry of transaction in the ledger but such entries are simply a sort of cash analysis.

- All advance payments are credited and accruals debited to the respective control account by contra entries in the prepayments and accrual accounts.

- Capital asset account is debited and respective control accounts are credited in the process of cost analysis of capital expenditure.

It is also important to note that integrated accounts are like a hybrid between non-integrated and the financial system of accounting as in case of the non-integrated system, No personal or real accounts are prepared and all entries are passed through the general ledger adjustment account. In the financial accounting system, there is no base of the cost accounting. In the integrated system of accounting, personal and real accounts are prepared but there exists a base of the cost accounting system

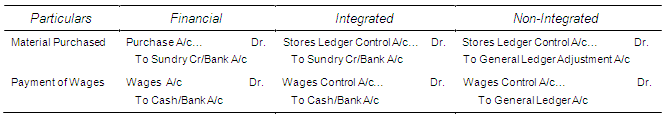

For Example, The same entry when passed through the three systems of accounting look like:

While passing entries in any system of accounting, follow the steps:

- Visualize the accounting entry in the financial system of accounting;

- Then replace the cost head, by the head in the costing system of accounting;

- In case of the non-integrated system and additional step is replacing any personal or real A/c by the General Ledger Adjustment A/c.

Illustration 1

Pass Journal Entries in the Cost Books [non-integrated systems] for the following transactions.

- Materials worth 50,000 returned to stores from job

- Gross total wages paid 96,000.

- Employer’s contribution to PF and State Insurance amount to 4000.

- Wages analysis book detailed 40,000 direct labour,

- 24,000 towards indirect factory labour

- 20, 000 towards salaries to office staff and 16,000 for salaries to selling and distribution staff.

Solution: COST JOURNAL

| Particulars | Dr. (Amount in Rs.) | Cr. (Amount in Rs.) |

| Stores Ledger Control A/c Dr To Work-in-progress Control A/c [Being material returned from stores] | 50,000 | 50,000 |

| Wages Control A/c Dr To General Ledger Adjustment A/c To Provident Funds and Employees State Insurance A/c [Being gross total wages paid] | 1,00,000 | 96,000 4,000 |

| Work-in-progress Control A/c Dr Factory Overheads Control A/c Dr Office Overheads Dr Control A/c Dr Selling Overheads Control A/c Dr To Wages Control A/c [Being wages allocated] | 40,000 24,000 20,000 16,000 | 1,00,000 |