Both time rate and piece rate systems have their merits and demerits. Incentive system attempts to combine the good aspects of both systems. The main objective of incentive plan is to induce a worker to produce more to earn a higher wage. Producing more in the same period of time should result in higher pay for the worker. Because if greater number of units produced, it should also result in a lower cost per unit for fixed factory cost and also for labour cost

A good incentive plan should have the following characteristics:

- It should be simple and easy to understand;

- Operating cost of the system should be low;

- It should permit less supervision;

- The time lag between effort and reward should be minimum;

- It should be fair to the employees and employer;

- The standard set should be attainable;

- Performance above standard should be well rewarded;

- It should be flexible;

- The premium should be large enough to induce workers to work hard;

- All workers should be given equal opportunity to earn;

- It should facilitate the budgetary control and standard cost systems;

- Inspection should be good;

- Good working conditions must be available;

- The system should be introduced on a permanent basis and should not be ambiguous;

- No rate cutting should be permitted and an individual’s earnings should not be curtailed;

- There should be uniformity of reward for same amount of effort;

- Indirect workers should also be included.

Advantages of Incentive Schemes

- Less supervision is required;

- The employee morale is high because they can earn more;

- There is increased productivity;

- Increased production reduces cost;

- Labour cost can be estimated;

- It is possible to set standards for labour with accuracy;

- There is maximum utilization of resources;

- A task is done in the most economical manner which reduces labour cost.

Disadvantages of Incentive Schemes

- If rates are not uniform for same type of jobs, it causes discontent.

- Quality may deteriorate and may be sacrificed in order to increase quantity.

- It involves more calculations.

- The workers may not adhere to the safety precautions in order to increase production. Hence accidents may occur.

- The workers’ health may be affected due to over-strain.

- There may be apprehensions regarding rate cutting.

- Inefficient workers may envy the efficient ones which may cause unrest.

- Unskilled workers sometimes earn more than skilled workers if the latter have to work on time basis.

Classification of incentive schemes

Incentive schemes can be classified as follows:

- Differential piece rate

- Premium bonus schemes

- Group bonus plans

- Bonus schemes for indirect workers.

Differential Piece Rate

Efficient and inefficient workers are distinguished. More than one piece rate is determined. Standards are set for each operation or job. Efficient workers, i.e., those who attain or better the standard set are given a higher rate and inefficient ones are given a lower rate. Hence, there is encouragement to improve the performance. As the level of output increases the piece rate also increases. This ratio may be proportionate or proportionately less or more than the increase in output. Hence output is maximized.

This system is suitable where:

- The methods of working are standardized;

- The workers do the same job over a long period;

- The nature of work is repetitive;

- Output of each person can be measured;

- The standard time for each job can be determined with precision.

The advantage of this scheme is that workers are encouraged to increase their efficiency and earn higher wages. But the system is complicated and difficult to understand. It is expensive to operate. A stage may be reached when the increased labour cost will equalize the benefit arising due to reduced overhead.

Taylor’s Differential Piece Rate System

F.W. Taylor (known as the father of scientific management) originated this scheme. No minimum wage is guaranteed. The standard output is determined on the basis of time and motion studies. Wages are calculated on the basis of two widely different piece rates. Those attaining or crossing the standard get a higher piece rate and those not attaining it get a lower rate.

The lower rate is based on 83% of the day wage rate. This rate is applicable to those who don’t attain the standard. The higher rate is based on 125% of the day rate and an incentive of 50% of the day rate.

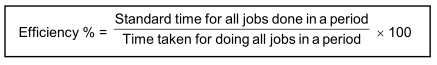

The efficiency of a worker can be determined either by comparing standard time and actual time taken or by comparing actual output and standard output.

Hence, this system penalizes the slow worker and rewards the efficient one. This principle is based on the fact that slow production increased the cost of production.

If the wage rate is =0.50 per unit

The low piece rate will be = 0.50 x 83% = 0.415 per unit

The high piece rate will be = 125% x 0.50 + 50% x 0.50

= 0.875 per unit.

Merrick’s Differential Rate Scheme (Multiple Piece Rate System)

This is a modification of the Taylor’s scheme. This system smoothens the sharp differences in Taylor’s scheme by determining 3 gradual rates. It does not guarantee time rate but each one is paid according to his efficiency.

Efficiency level Piece rate

Up to 83% 110% of normal rate

83% to 100% 120% of normal rate

Above 100%

The performance below standard is not penalized.

Premium Bonus Plans

All the gains of efficient workers and all the losses of inefficient workers benefit the employer under the time rate system. Under the piece rate system, it is the workers who gain or lose.

Under the premium bonus system, the gains are shared by the employer and employees in agreed proportions. Apart from the minimum guaranteed wages, the efficient workers get bonus which depends on the time saved. The standard is determined scientifically. The various incentive schemes should be chosen keeping in mind the nature of the work, with the consent of trade unions in order to make it successful.

These plans regulate the speed of work so that the pace of work is not slow and at the same time it is not fast. Basically, there are two types of plans. Under the constant sharing plans, the proportion of sharing is constant at all levels of efficiency, but under variable sharing plans, it varies with the time saved.

Emerson’s Efficiency (or Empiric) System

Though minimum daily wages is guaranteed, efficiency is also rewarded. Standard is set based on the time and motion study.

Bonus is payable when efficiency reaches 66-2/3% and increases as the output increases.

Levels of Efficiency Piece Rate

66-2/3% Guaranteed time rate

90% Time rate + 10% as bonus

100% Time rate + 20% as bonus

Above 100% Time rate + 20% as bonus +

Additional bonus of 1% for every increase of 1% beyond 100% efficiency

The bonus is usually calculated on the efficiency achieved for all the jobs in a wage period taken together.

Slow work is avoided and work is done at a uniform rate.

But under this scheme, the incentive for efficiency beyond the standard is not appreciable.

Halsey plan

Under this plan originated by T.A. Halsey, time rate is guaranteed. Standard time and work are predetermined. The bonus is 50% of the standard time saved.

Total wages = Time taken x Hourly rate + 1/2 (Time saved) x Hourly rate.

Halsey Weir plan

The bonus under this plan is 33-1/3% of the standard time saved.

Total wages = Time taken x Hourly rate + 33-1/3% (Time saved) x Hourly rate

Rowan Plan

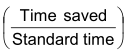

The time rate is guaranteed under the plan originated by J. Rowan. The percentage of bonus to the wages earned is that which the time saved bears to the standard time.

Total wages = Time taken x Hourly rate +  Time taken x Hourly rate

Time taken x Hourly rate

Comparison of Halsey and Rowan Plan

If the worker finishes the work in half the time fixed for it, the result under Rowan and Halsey plan will be same. If the time saved is less than 50% of the standard time, the Rowan plan is better. If time saved is greater than 50% of the standard time, the Halsey plan is better.

Bedauxe Point System

Under the scheme originated by C.E. Bedauxe, time wages is guaranteed. Earnings increase after the worker attains 100% efficiency level. Standard time and standard work is measured in terms of Bedauxe points, which are also known as B’s. ‘B’ means a standard work performed in a standard minute. In other words, one ‘B’ unit represents the amount of work which an average worker can do under normal conditions in one minute allowing for the relaxation needed. Workers get a bonus which is equal to 75% of B’s saved.

Bonus = B’s saved X (Hourly rate)/60 75 / 100

Thus, if a person gets 90 B’s and hourly rate is 1.20, then his bonus will be:

B’s saved = 90 −60 = 30 B’s

Bonus = 30 X (1.20) / 60 75 / 100

= 45 paise

If bonus is given to the extent of the value of the entire time saved, then the scheme will be called the 100% Bedauxe Scheme. But if nothing is mentioned, it is assured that it is 75% Bedauxe Scheme.

Under 75% Bedauxe Scheme, the labour cost increases till 100% efficiency and then starts declining. Under the 100% Bedauxe Scheme, the labour cost remains constant after the 100% level is reached.

Hayne’s Scheme

Time wages are guaranteed. The standard time is set in terms of standard man minutes called ‘manits’. A manit means a standard work performed in a standard minute. Bonus is given for the time saved. The value of the time saved is shared by the worker and foreman in the ratio of 5:1 if the work is standardized and repetitive in nature. Otherwise, the ratio of sharing between worker, employer and supervisor will be 5: 4: 1.

The labour cost falls until 100% efficiency is reached. Thereafter, it falls at a decreasing rate if work is non-standardized or remains constant if the work is standardized.

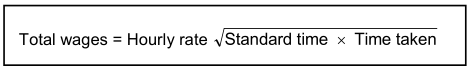

Barth’s Scheme

This scheme does not guarantee wages. Under this scheme,

Total wages is higher for less efficient people. As the efficiency increases, the earnings decrease. Hence, this plan is suitable for beginners and trainees. Since it is complicated, workers cannot understand it. Moreover, it does not encourage efficient workers.

Diemer Scheme

It is a combination of Halsey’s and Gantt’s schemes. A straight line increasing incentive is given beyond 100% efficiency.

Accelerated Premium Systems

Increments of bonus increase at a faster rate as production increases. This scheme provides a strong incentive to increase efficiency at all levels. Though labour cost per unit decreases, it may rise at a very high level of output.

The formula for calculating wages differs from one concern to another. To understand the scheme, graph of y=0.6×2 may be used, where y = wages and x = efficiency.

If X is 1 1.5 2 2.5 3

Y will be 0.6 1.35 2.4 3.75 5.4

Calculation can be expressed in percentages also.

This scheme is complicated. It is difficult for workers to understand it. This scheme should not be used where quality of output is important.

It is most suitable for foremen and supervisors. This scheme will encourage them to get higher production from their workers.

Group Bonus Plans

There are certain jobs which have to be performed collectively by a group of workers. The ultimate production depends on the efficiency of the whole group. Under group bonus plans, payment is made by results to all the workers in the group. Bonus may be shared equally or in different proportion according to the levels of skill required. These proportions may be based on time rates or some previously agreed ratios.

These plans may increase production and reduce costs per unit. It creates team spirit. But efficient and inefficient workers are rewarded alike. Efforts and rewards are not properly linked.

These plans can be used where:

- it is required to reward both direct and indirect workers;

- output depends on team work;

- it is desirous to create team spirit; and

- It is not possible to measure the output of an individual person.

The incentive can be made attractive by:

- Creating small groups;

- Forming a group where degree of skill required does not vary widely; and

- Making the group independent of any other group, machines, etc.

Advantages of group bonus plans

- There is more co-operation and team work;

- Inspection and supervision can be reduced as every worker is concerned about output;

- There is self-discipline;

- Production increases;

- Cost of production decreases and also the spoiled and defective goods;

- It simplifies payroll and cost accounting.

Disadvantages of group bonus plans

- The amount of bonus given is too insignificant.

- No distinction is made between efficient and inefficient workers.

- Time gap between effort and reward is very wide.

Bonus Scheme for Indirect Workers

Production cannot be increased by giving incentives to direct workers only. It is necessary to have the cooperation of indirect workers to attain maximum efficiency. Indirect workers are equally important and should be given incentives.

It is difficult to introduce an incentive scheme for indirect workers because standards cannot be set easily, efficiency is difficult to measure and actual output cannot be determined in relation to set standards.

Inspite of the difficulties, the purposes of establishing an incentive scheme are the following:

- To reduce costs by increasing departmental efficiency;

- To avoid discrimination among different types of workers. It is illogical to reward the efficiency of direct workers and not to reward the efficiency of indirect workers;

- To create team spirit;

- To avoid labour unrest and dissatisfaction among indirect workers;

- To reward good work;

- To increase the efficiency of providing services to direct workers;

- To reduce waste, scrap idle time;

- In certain cases, work of direct workers depends on the services provided by the indirect workers. Inefficiency of indirect workers due to lack of incentives will affect the efficiency of the direct workers.

Indirect monetary incentive schemes

Profit Sharing

The workers get a share in the profit of the undertaking in a certain agreed percentage which is in addition to the normal wages of the workers. The profit percentage is predetermined and may be given in cash or in the form of shares. The percentage is often governed by the Payment of Bonus Act. If profit is given in the form of shares, it is called co-partnership.

Advantages of Profit Sharing

The advantages of profit sharing are:

- Relations between labour and management improve because labour takes interest in management.

- This method assumes that every worker contributes towards profit. It is applicable to all workers irrespective of their efficiency. There is better employer-employee relationship.

- Labour morale is boosted. Hence, there is industrial peace.

- The employees get a share of profit, capital and control of the management. This creates a sense of belonging to the company and the workers contribute to the welfare of the company. Materials and plant will be handled with care, thus minimizing loss and wastage.

- As bonus is given annually there will be low labour turnover.

- There is a direct relationship between profits and bonus. The workers try to increase bonus by increasing efficiency and production.

- There is greater co-operation and better team spirit.

- Because of this scheme, quality workers are attracted to the industry.

Disadvantages of Profit Sharing

- The workers may not be satisfied as there is uncertainty of profits inspite of the efforts taken.

- Labour unions also oppose the scheme as it may alienate the workers from unions.

- Profits depend on many factors. Many are beyond the control of the workers and are not directly related to their efforts.

- Apportionment of profit on a suitable basis is difficult.

- Once the workers are used to bonus, non-payment of bonus in a year may give rise to discontent. Fluctuations in bonus also create bad industrial relations.

- The workers may not trust the figures presented by the employer and resort to strikes.

- The efficiency of worker may not increase as they have to wait for the year end to get reward for their efforts.

- The efficiency may be adversely affected as both efficient and inefficient workers are treated alike.

- The employers object to this scheme as the workers share the profits but not the losses.

Co-partnership

Sometimes labour is given a share of the profit in the form of shares. This form of profit-sharing is called labour co-partnership. It gives the labour a permanent interest in the future of their organization. Hence, this scheme is also known as co-ownership.

Though the employees get part of the capital and profits accruing thereon, these shares may or may not carry the voting rights. The employees may freely deal with these shares or a few restrictions may be placed on them. Sometimes, employers may be given a loan to buy the company’s shares.

Advantages of Co-partnership

- Because the employees have a share in the capital, they have a greater sense of belonging and hence they evince more interest in the concern.

- It reduces labour turnover.

- As the employee’s contribution to the profit of the concern is recognized, their morale is high.

Disadvantages of Co-partnership

- Efforts and rewards are not properly related.

- The importance of incentive is reduced as date of payment is too far.

- It does not differentiate between efficient and inefficient workers.

- Misunderstanding between employee and employer may arise because employees cannot verify the shares allotted to them.

Other non-monetary incentive schemes

These are also known as psychological incentives. This benefit is given to all employees in the organization. These are provided free or employees may partially contribute towards them. These benefits are not given for any specific job done rather these is conditions and terms of employment. Examples of non-monetary incentives are:

- Health and safety benefits.

- Favorable working conditions.

- Cheap grains.

- Housing facility.

- Subsidized canteen.

- Sports and recreational facilities.

- Welfare measures.

- Free uniforms, protective clothing etc.

Because some of the incentives are obligatory under law or given as matter of convention, they cannot be called incentives even though the employer incurs extra expenses to provide them.

The merits of the scheme are:

- A good reputation is created for the undertaking and hence best labour is attracted.

- It reduces labour turnover.

- It reduces absenteeism.

- It encourages employees’ loyalty to the concern.

- It makes the employment attractive.

- It helps to build a happy, contended and satisfied staff.