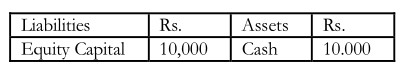

You can see with the help of a simple example, how financial leverage affects return on equity. A company needs a capital of Rs.10,000/- to operate. The shareholders of the company may bring in this money. Alternatively, a part of this money may also be brought in through debt financing. If the management raises Rs.10,000/- from shareholders, the company is not financially leverages and would have the following balance sheet.

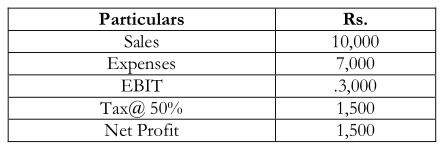

The company commences operations, which leads to the preparation of the following simplified version of its income statement

What is the return the company has earned on the owner’s investment? You will see that the return on equity is 15%. The net profit of Rs.1,500/- may be paid fully or partly to the shareholders as dividends or may be retained to finance future actives of the company. Either way the return on equity is 15%.

What happens to the owner’s rate of return if the management decides to finance a part of the required total investment of Rs.10,000/- through debt financing? The answer to this question depends upon

- The proportion of total investment which the management decides to finance through debt (Debt Equity Ratio the firm aspires to) and

- The interest rate on borrowed funds

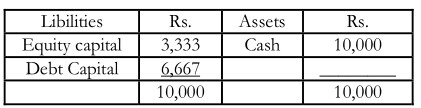

If the management has decided on a Debt Equity Ratio of 2 : 1, total borrowings will be amounting to Rs.10,000 X 2 = Rs.6,667/-. Assuming that the company is able to raise this amount at an interest of 15%, the company’s balance sheet will appear as follows:

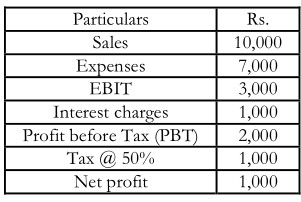

The company now has an added financial burden of payment of interest on the amount it has borrowed. The income statement will now be as follows:

The use of debt in the company’s capital structure has caused

the net profit to decline from Rs.1,500/- to Rs.1,000/-. But has the return on owner’s capital decline? Return on equity now works out to 30%, as the owners have invested only Rs.3, 333/-now which earned them Rs.1,000. What were the factors, which contributed to this additional return?

Though the company has to pay interest at 15% on the borrowed capital, the company’s operations have been able to generate more than 15%, which is being transferred to the owners. The reduction in PBT has brought about a reduction in the amount of tax paid, as interest is a tax deductible expense, to the extent of interest (1 – tax rate) i.e., Rs.500/-. The greater the tax rate, the more is the tax shield available to a company, which is financially leveraged.

As you have seen in the above example, a company may increase the return on equity by the use of debt i.e., the use of financial leverage. BY increasing the proportion of debt in the pattern of financing., by increasing the debt –equity ratio, the company should be able to increase the return on equity.