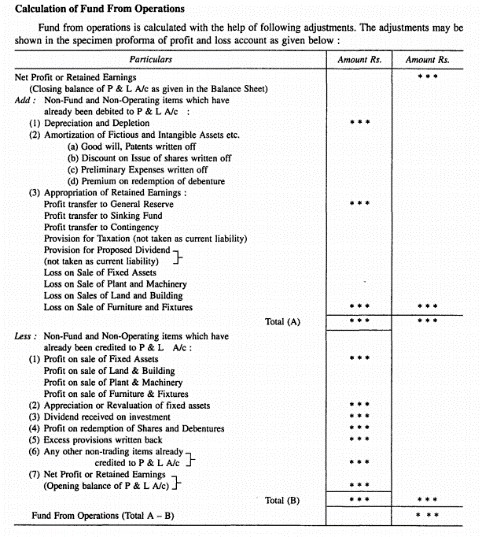

Fund from Operation is to be determined on the basis of Profit and Loss Account. The operating profit revealed by Profit and Loss Account represents the excess of sales revenue over cost of goods sold. In the true sense, it does not reflect the exact flow of funds caused by business operations. Because the revenue earned and expenses incurred are not in conformity with the flow of funds.

For example, depreciation charges on fixed assets, write up of fixed assets or fictitious assets, any appropriations etc. do not cause actual flow of funds. Because they have already been charged to such profits. Hence, fund from operation is prepared to find out exact inflow or outflow of funds from the regular operations on the basis of items which have readjusted to the current profit or loss. The balancing amount of adjusted profit and loss account is described as fund from operations.

The major source of working capital is the firm’s net profit from business operations. Since the Profit and loss account contains certain items which do not affect working capital, the profit / loss as shown in the profit and loss account, per se does not indicate the quantum of working capital provided by business operations. The Profit and Loss account contains a variety of write offs and other adjustments which do not involve any corresponding movement of funds. Therefore, while determining the amount of working capital from operations, appropriate adjustments are to be made to the profit disclosed by the Profit and Loss account.

All the expenses which have been deducted from revenue but do not involve working capital should be added back to net profit. Similarly, the items which have been added to revenue but have not contributed to the working capital or not directly caused by business operations should be deducted.

Adjustment to Profit

| Net profit as per Profit and Loss Account | |

| Add: Items which do not result in outflow of fund | |

| (i) Depreciation charged during the year | |

| (ii) Loss on sale of fixed assets / investments (non-current assets) | |

| (iii) Capital expenditure(like goodwill, preliminary expenses patents, discount on debentures or share issue expenses) | |

| (iv) Provision for income tax / proposed dividend | |

| Less: (i) Gains on sale of fixed assets / investment | |

| (ii) Dividends and interest received on investments | |

| Funds from business operations | |

Adjusted Profit and Loss A/c

| To Depreciation & Depletion charges | R | By Balance of P&L A/c B/d (of last year) |

| To Amortization of: | By Dividend received | |

| (a) Intangible assets: | By Retransfer of excess provisions | |

| – good will | By Profit on sale of fixed assets | |

| – patent rights | By Profit on sale of long-term | |

| – trade marks | By Funds from operations | |

| (b) Fictitious assets: | (Balancing figure) | |

| – deferred expenditure (if any) | ||

| To Appropriation of retained earnings: | ||

| Transfer to: | ||

| – General Reserve | ||

| – Dividend equalisation fund | ||

| – Sinking fund | ||

| – Compensation fund etc, | ||

| To Dividends paid | ||

| To Provision for taxation | ||

| To Interim dividend | ||

| To Proposed dividend | ||

| To Net profit (current year) | ||

| To Funds lost in operations | ||

| (Bal. Fig.) | ||

| Total | Total |

Proposed dividend and provision for taxation may or may not be a current liability. In case if they are treated as current liabilities, they should be shown in a schedule of changes in working capital only. However, if they are treated as non-current liabilities, then they should be considered as internal appropriation of profits made during the year and should be added back to current year’s profit while calculating funds from operations. But tax paid during the year should be considered as Application of Fund.

Depreciation

Depreciation does not affect the working capital and hence they are added back to profit. Moreover it is considered as the use of funds when the fixed asset was bought. Hence it would be double count to take depreciation again.