A forecast is an assessment of probable future events. Budget is an operating and financial plan of a business enterprise. At planning stage it is necessary to prepare forecasts of probable course of action for the business in future. Budget is a sort of commitment or a target which the management seeks to attain on the basis of the forecasts made. Forecasts are made regarding sales, production cost and financial requirements of the business. A forecast denotes some degree of flexibility while a budget denotes a definite target.

The following points of distinction can be noted between forecast and budget:

| Forecast | Budget | |

| (i) | Forecast is a mere estimate of what is likely to happen. It is a statement of probable events which are likely to happen under anticipated conditions during a specified period of time. | Budget shows that policy and programmes to be followed in a future period under planned conditions. |

| (ii) | Forecasts, being statements of future events, do not connote any sense of control. | A budget is a tool of control since it represents actions which can be shaped according to will so that it can be suited to the conditions which may or may not happen. |

| (iii) | Forecasting is a preliminary step for budgeting. It ends with the forecast of likely events. | It begins when forecasting ends. Forecasts are converted into budgets. |

| (iv) | Forecasts have wider scope, since it can be made in those spheres also where budgets cannot interfere. | Budgets have limited scope. It can be made of phenomenon non capable of being expressed quantitatively. |

Objectives of Budgetary Control

The objectives of budgetary control are the following:

- To use different levels of management in a co-operative Endeavour for achievement of the objectives of the firm.

- To facilitate centralized control with delegated authority and responsibility.

- To achieve maximum profitability by planning income and expenditure through optimum use of the available resources.

- To ensure adequate working capital in other resources for efficient operation of business.

- To reduce losses and wastes to the minimum.

- To bring out clearly where effort is needed to remedy the situation.

- To see that the firm is not deflected from marching towards its long-term objectives without being overwhelmed by emergencies.

- Various activities like production, sales, purchase of materials etc. are co-ordinate with the help of budgetary control.

Preliminaries for the Adoption of a System of Budgetary Control

For the successful implementation of a system of budgetary control certain pre-requisites are to be fulfilled. They are summarized below:

- There should be an organization chart laying out in clear terms the responsibilities and duties of each level of executives and the delegation of authority to the various levels.

- The objectives, plans, and policies of the business should be defined in clear cut and unambiguous terms.

- The budget factor or the key factor(s) which will be the starting point of the preparation of the various budgets should be indicated.

- For formulation and efficient execution of the plan, a Budget Committee should be set up.

- There should be an efficient system of accounting to record and provide data in line with the budgetary control system.

- There should be a proper system of communication and reporting between the various levels of management.

- There should be a Budget Manual wherein all details regarding the plan and its procedure of operation are given as also the length of the budget period.

- The budgets should primarily be prepared by those who are responsible for performance.

- The budgets should be comprehensive, complete, continuous and realistic to attain.

- There should be an assurance from the top management executives for co-operation and acceptance of the budgetary control system.

- For the success of a budgetary control system, it is essential that there should be a sound organisation for budget preparation, budget maintenance, and budget administration. The budgetary control organisation is usually headed by a top executive who is known variously as the Budget Controller, Budget Director, or Budget Officer, who may have under him a Budget Committee constituted with the representatives of various departments like purchases, sales, production, development, administration and accounts.

- Unless the philosophy of budgeting and budgetary control is accepted by everyone in authority, the system may work only haphazardly. The full and frank and active cooperation of all is required while framing budgets. Then only they will feel committed to the achievements of targets set for them.

Functional Budgets

Budgets for a period are really classified according to the various activities in the organization. All activities are interrelated. The forecasts for individual activities are prepared and co-ordinate with those of other activities and then consolidated to show the total effect of all the activities as a whole. Approved targets for individual functions are known as “functional budgets”. The consolidation of all functional budgets is known as the “Master Budget”. This is nothing but the targeted profit and loss statement and balance sheet of the organization.

Principal functional budgets are:

- Sales Budget: The sales budget is a forecast of total sales, expressed in terms of money and quantity. The first step in the preparation of the sales budget is to forecast as accurately as possible the sales anticipated during the budget period. Sales forecasts are influenced by a variety of factors, external as well as internal. External factors include general business conditions, Government policy, etc. Internal factors consist of sales-prices, sales trend, new-products, etc. The sales-budget is based on sales forecasting which is the responsibility of the sales manager and market research staff The sales budget is regarded as the keystone of budgeting.

- Production Budget: The production budget is a forecast of the production for budget period. It is prepared in two parts, viz.., production value budget for the physical units of the products to be manufactured and the cost of manufacturing budget detailing the budgeted costs. The main steps involving in the preparation of a production budget are production planning; consideration of capacity; integration with sales forecasts, inventory-policies, management’s overall policies. The operation of a production budget results in various advantages, main being: optimum utilization of productive resources of the enterprise, production of goods according to schedule enabling the concern to adhere to delivery dates, proper scheduling of factors of production

- Production Cost Budget: It may be further classified as under:

- Materials Budget: Materials requirement budget, commonly known as materials budget, assist the purchase department in suitably planning the purchases, fixing the maximum and minimum levels of materials, components etc. The timing and amount of funds which will be needed to make purchases are also known with the help of the materials budget.

- Labour Budget: The labour content of each item of production as per the production budget is determined in terms of grades and trades of the workers required and the labour time for each job, operation and process. The rates of pay, allowances, bonus, etc., of each category are then considered and labour cost to be set for each budget centre is calculated by multiplying the wage rate with the labour hours for the number of units of products budgeted.

- Plant Utilization Budget: Plant Utilization Budget is prepared for the estimation of plant capacity to meet the budgeted production during the budgeted period. It is a forecast of plant capacities available for fulfilling production requirements as specified in the production budget. This budget is expressed in working hours or other convenient units.

Followings are the features of Plant Utilization Budget:

- It will be base for the requirement of machine for sale and production department.

- It will provide the base of reasonable depreciation so that machine can be replaced in future.

- It may be base for the new inventions in the context of plant & machinery.

- It will indicate the budgeted machine load on departments or machines.

- It reveals that overloading on some departments, so that sales volume may be increased by providing after-sales service, advertisement campaign reducing selling price.

- Overhead Budget: It may be further classified as under:

Manufacturing Overhead Budget: The following steps are required to be taken up to prepare the manufacturing overhead budget:

- Classification of expenditure into fixed, variable and semi-variable and collection thereof in accordance with a schedule of standing order numbers;

- Departmentalization of expenditure;

- Determining the level of activity for setting the overhead rates; and level of activity may be actual, budgeted level or normal capacity; and

- Establishing the variable overhead rates per unit of production or productive hour.

Selling and Distribution Budget: The selling expenses include all items of expenditure on the promotion, maintenance and distribution of finished products. This budget which is closely related to the sales budget is the forecast of the cost of selling and distribution, for the budgeted period. Selling and distribution expenses may be fixed or variable with regard to the volume of sales;

Separate budgets are usually established for fixed or variable selling and distribution expenses.

- Research and Development Budget: This depends mostly on management decisions regarding the research and development effort – the projects already in hand and the proposed projects.

- Financial Budget: It may be further classified as under

Cash Budget: Cash forecast precedes a cash budget. Cash forecast is an estimate showing the amount of cash which would be available in a future period. This budget usually of two parts giving detailed estimates of (i) cash receipts and (ii) cash disbursements. Estimates of cash-receipts are prepared on a monthly basis and depend upon estimated cash-sales, collections from debtors and anticipated receipts from other sources such as sale of assets, borrowings etc. Estimates of cash disbursements are based on estimated cash purchases, payment to creditors, employee’s remuneration, bonus, advances to suppliers, budgeted capital expenditure for expansion etc.

The main objectives of preparing cash budget are as follows:

- The probable cash position as a result of planned operation is indicated and thus the excess or shortage of cash is known. This helps in arranging short term borrowings in advance to meet the situations of shortage of cash or making investments in times of cash in excess.

- Cash can be co-ordinate in relation to total working capital, sales investment and debt.

- A sound basis for credit for current control of cash position is established.

- The effect of sudden and seasonal requirements, large stocks, delay in collection of receipts etc. on the cash position of the organisation is revealed.

A cash budget can be prepared by any of the following methods:

- Receipts and payments method

- Adjusted profit and loss account method

- Balance sheet method.

Receipts and Payments Method: In this method the cash receipts from various sources and cash payments to various agencies are estimated. Delay in cash receipts and lag in payments are taken into account for making estimates. Since this method is based on the concept of cash accounting, accruals and adjustments obviously cannot find place in the preparation of cash budgets. The opening balance of cash of a period and the estimated cash receipts are added and from this, the total of estimated cash payments is deducted to find out the closing balance.

Illustration 1

Prepare a cash budget of M/s Novan Television & Co. on the basis of the following information for the first six months of 2012:

- Cost and prices unchanged.

- Cash sales – 25% and credit sales – 75%.

- 60% of credit sales are collected in the month after sales, 30% in the second month and 10% in the third. No bad debts are anticipated.

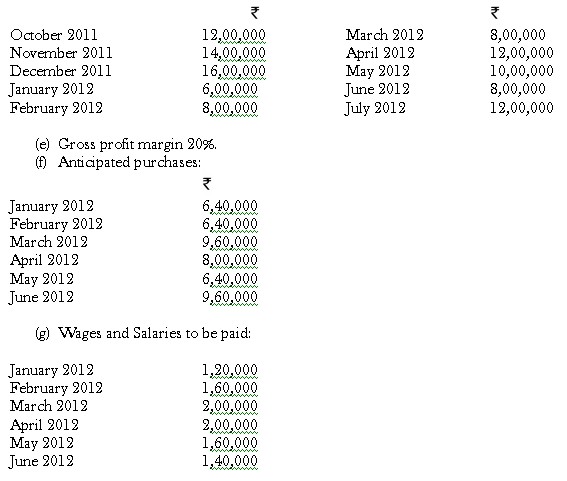

- Sales forecasts are as follows:

- Interest on 10,00,000 @ 12% on debentures is due by the end of March and June.

- Excise deposit due in April 2,00,000.

- Capital expenditure on plant and machinery planned for June 1,20,000.

- Company has a cash balance of 4,00,000 at 31.12.2009.

- Company can borrow on monthly basis.

- Rent is 8,000 per month.

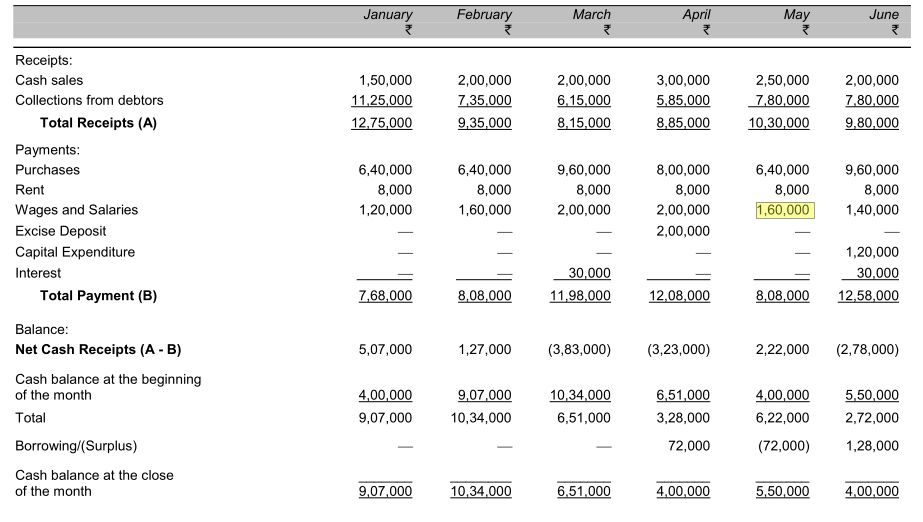

Solution:

M/s Novan Television Company Cash Budget for six months, January to June, 2012

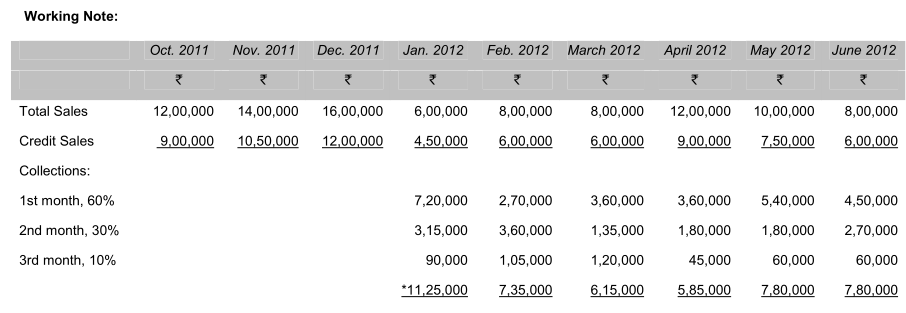

For example:

60% of credit sales in December 2011;

30% of credit sales in November 2011; and

10% of credit sales in October 2011.

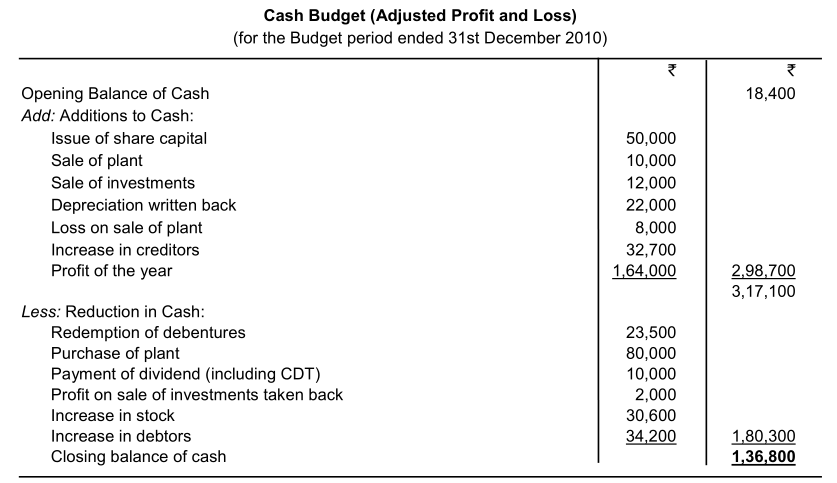

Adjusted Profit and Loss Account Method: In this method the opening balance is adjusted with the anticipated increases or decreases in current assets and liabilities, provision for depreciation, special receipts and the net profit for the year before taxation and appropriations From the aggregate amount of these, the estimated taxation and dividends payable, expenditure on fixed assets and special payments if any are deducted. The resulting balance is the estimated cash in hand at the end of the budget period.

The vital point of difference between receipts and payments method and adjusted profit and loss method is that the former takes into account only cash transactions while the latter considers non-cash items as it reverses all accruals. Further, adjusted profit and loss method gives only a broad idea of the cash position but receipts and payments method furnishes the maximum possible details.

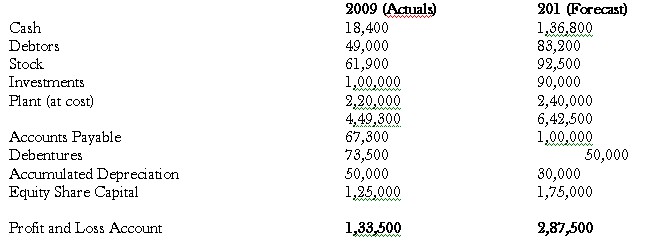

Illustration 2

Following are the Balance Sheets of Metal Engineering Limited one actual as on 31st December, 2009 and other forecast as on 31st December, 2010:

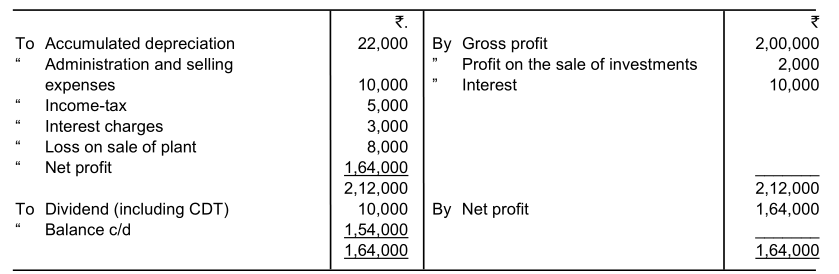

The forecast Profit and Loss Account in a summarized form for the budget year ended 31st December, 2010 is as follows:

Additional information:

- New plant costing 80,000 was purchased during the year.

- An old plant, costing 60,000 and with accumulated depreciation of 42,000 was sold for 10,000.

- Investments costing 10,000 were sold for 12,000.

Prepare a cash budget for the management of the company by Adjusted Profit and Loss method.

Balance Sheet Method: Under this method of preparing cash budget a forecast balance sheet is prepared as at the end of the budget period with all items of assets and liabilities except cash balance which is arrived at as a balancing figure. The magnitude of the two sides of the balance sheet excluding cash balance would determine whether the bank account would show a debit or credit balance i.e. cash balance at bank or bank overdraft.

Capital Expenditure Budget: Capital expenditure budget is the plan of the proposed outlay on fixed assets and is very closely related to the cash budget. Capital expenditure forecasting is a continuous process and by nature it is a long-term function. Capital forecasts should be made for a number of years. Along with the long-term forecast, there should also be a short-term forecast to cover the general budget period under consideration. It is also essential that the capital expenditure budget be properly co-ordinate with all the operational budgets of the concern so as to form an integral part of the overall plan.

Master Budget

Master budget is a consolidated summary of the various functional budgets. A master budget is the summary budget incorporating its component functional budget and which is finally approved, adopted and employed. It is the culmination of the preparation of all other budgets like the sales budget, production budget, purchase budget etc. It consists in reality of the budgeted profit and loss account, the balance sheet and the budgeted funds flow statement.

The master budget is prepared by the budget committee on the basis of co-ordinate functional budgets and becomes the target of the company during the budget period when it is finally approved. This budget acts as the company’s individualized key to successful financial planning and control. It provides the basis of computing the effect of any changes in any phase of operations, such as sales volume, product mix, prices, labour costs, material costs or change in facilities. It segregates income, costs and profits by areas of responsibility. Master budget presents all this information to the depth appropriate for the top management action.

In the master budget, costs are classified and summarized by types of expenses as well as by departments. This information extends the range of usefulness of master budget. It is considered as the best mode of understanding the company’s micro- economic position relating to the forthcoming budget period. Master Budget is not merely a compendium of theoretical calculations. The figures that it contains are the reflection of the actual intentions of the company relating to different areas for the forthcoming budget period.

Fixed Budgets

A budget may be established either as a fixed budget or a flexible budget. A fixed budget is a budget designed to remain unchanged irrespective of the level of activity actually attained. A fixed budget is one which is designed for a specific planned output level and is not adjusted to the level of activity attained at the time of comparison between the budgeted and actual costs. Obviously, fixed budgets can be established only for a small period of time when the actual output is not anticipated to differ much from the budgeted output. However, a fixed budget is liable to revision if due to business conditions undergoing a basic change or due to other reasons, actual operations differ widely from those planned in the fixed budget. These budgets are most suited for fixed expenses but they have only a limited application and is ineffective as a tool for cost control.

Flexible Budgets

The Chartered Institute of Management Accountants, London defines flexible budget as a budget which by recognizing different cost behavior patterns, is designed to change as volume of output changes. It is a budget prepared in a manner so as to give the budgeted cost for any level of activity. It is a budget which by recognizing the difference between fixed, semi-fixed and variable cost is designed to change in relation to the activity attained. It is designed to furnish budgeted cost at any level of activity attained. Flexible budgeting is desirable in the following cases:

- Where the level of activity during the year varies from period to period, either due to the seasonal nature of the industry or to variation in demand.

- Where the business is a new one and is difficult to foresee the demand.

- Where the undertaking is suffering from shortage of a factor of production such as materials, labour, plant capacity, etc.

The main characteristic of flexible budget is that it shows the expenditure appropriate to various levels of output. If the volume changes the expenditure appropriate to it can be established from the flexible budget for comparison with actual expenditure as a means of control. It provides a logical comparison of budget allowances with actual cost. When flexible budget is prepared, actual cost at actual activity is compared with budgeted cost at actual activity i.e. two things to a like base. For preparation of flexible budget, items of cost have to be analyzed individually to determine how different items of cost behave to change in volume. Therefore, in-depth cost analysis and cost identification is required for preparation of flexible budget. Following are the striking features of flexible budgets:

- They are prepared for a range of activity instead of a single level.

- They provide a very dynamic basis for comparison because they are automatically geared to changes in volume.

- They provide a tailor-made budget for a particular volume.

- These are based upon adequate knowledge of cost behavior pattern.

Flexible budgets may be prepared in the following method:

- Tabular method or multi-activity method

- Formula method or ratio method and

- Graphic method.

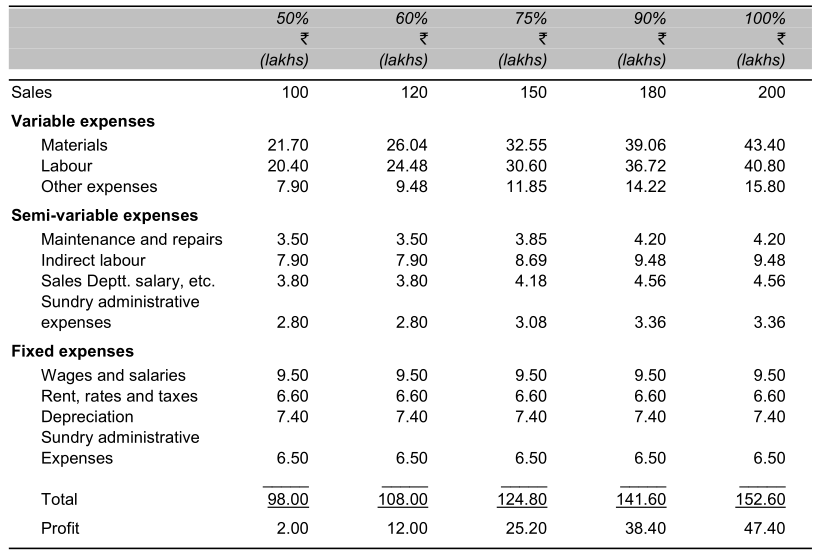

Illustration 3

Following information is available from the records of Jay Ltd. for the year end 31st March 2013.

Fixed Expenses

Wages and salaries 9.5

Rent, rates and taxes 6.6

Depreciation 7.4

Sundry administrative expenses 6.5

Semi-Variable Expenses (at 50% of capacity)

Maintenance and repairs 3.5

Indirect labour 7.9

Sales department salaries 3.8

Sundry administrative expenses 2.8

Variable Expenses (at 50% of capacity)

Materials 21.7

Labour 20.4

Other expenses 7.9

98.0

Assuming that the fixed expenses remain constant for all levels of production, semi-variable expenses remain constant between 45% and 65% of capacity increasing by 10% between 65% and 80% and by 20% between 80% and 100%.

Sales at various levels are:

50% capacity Rs. (lakhs)

60% “ 100

75% “ 120

90% “ 150

100% “ 200

Prepare a flexible budget for the year and forecast the profits at 60%, 75%, 90% and 100% of capacity.

Solution:

Flexible Budget Period…………………..

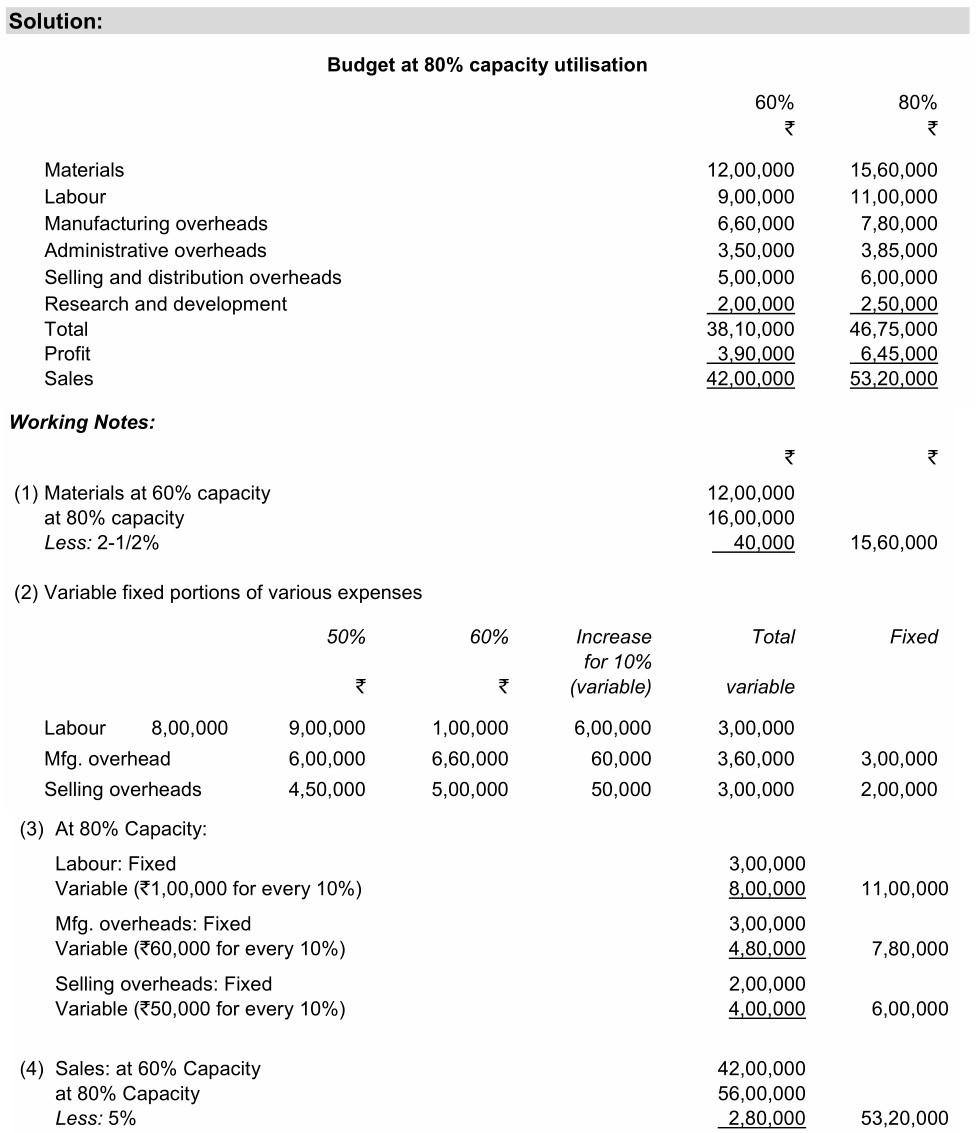

Illustration 4

A firm at present operates at 60% of its capacity. At this level and at the level of 50% utilization of capacity, the figures relating to its operations could be summarized as stated below:

Draw up the budget at 80% utilization of capacity assuming that –

- sales at this level can be maintained only by a flat 5% reduction in the selling price;

- economy in purchase of material will equal to 2-1/2% of the current amounts;

- the research and development expenditure will be pegged at 2,50,000 per annum; and

- Administrative overheads will require 10% increase.

- Basic Budgets: Basic budget has been defined as a budget which is prepared for use unaltered over a long period of time. This does not take into consideration current conditions and can be attainable under standard conditions.

- Current Budgets: A current budget can be defined as a budget which is related to the current conditions and is prepared for use over a short period of time. This budget is more useful than basic budget, as the target it lays down will be corrected to current conditions.

- Long-Term Budgets: A long-term budget can be defined as a budget which is prepared for periods longer than a year’. These budgets help in business forecasting and forward planning. Capital expenditure budgets and research developments budgets are just examples of long-term budgets.

- Short-Term Budgets: This budget is defined as a budget which is prepared for a period less than a year and is very useful to lower levels of management for control purposes. In an ideal situation a short-term budget should perfectly fit into a long-term budget.