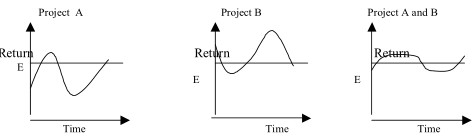

The important principle to consider that in an efficient capital market, investors should not hold all their eggs in one basket; they should hold a well-diversified portfolio. In order to diversify risk for the creation of an efficient portfolio (one that allows the firm to achieve the maximum return for a given level of risk or to minimize risk for a given level of return), the concept of correlation must be understood. Correlation is a statistical measure that indicates the relationship, if any, between series of numbers representing anything from cash flows to test data. If the two-series move together, they are positively correlated; if the series move in opposite directions, they are negatively correlated. The existence of perfectly correlated, especially negatively correlated – projects is quite rare. In order to diversify project risk and thereby reduce the firm’s overall risk, the projects that are best combined or added to the existing portfolio of projects are those that have a negative (or low positive) correlation with existing projects. By combining negatively correlated projects, the overall variability of returns or risk can be reduced. The figure below illustrates the result of diversifying to reduce risk.

It shows that a portfolio contains the negatively corrected projects A and B, both having the same expected return, E, also has the return E, but less risk (i.e., less variability of return) than either of the projects taken separately. This type of risk is sometimes described as diversifiable or alpha risk. The creation of a portfolio by combining two perfectly correlated projects cannot reduce the portfolio’s overall risk below the risk of the least risky project, while the creation of a portfolio combining two projects that are perfectly negatively correlated can reduce the portfolio’s total risk to a level below that of either of the component projects, which in certain situations may be zero. Combining projects with correlations falling between perfect positive correlation (i.e., a correlation coefficient of + 1) and perfect negative correlation (i.e., a correlation coefficient of – 1), can therefore reduce the overall risk of a portfolio.

Benefits of Diversification

The gains in risk reduction from portfolio diversification depend inversely upon the extent to which the returns on securities in a portfolio are positively correlated. Ideally the securities should display negative correlation. This implies that if a pair of securities has a negative correlation of returns, then in circumstances where one of the securities is performing badly the other is likely to be doing well, and vice versa in reverse circumstances. Therefore the ‘average’ return on holding the two securities is likely to be much safer than investing in one of them alone.