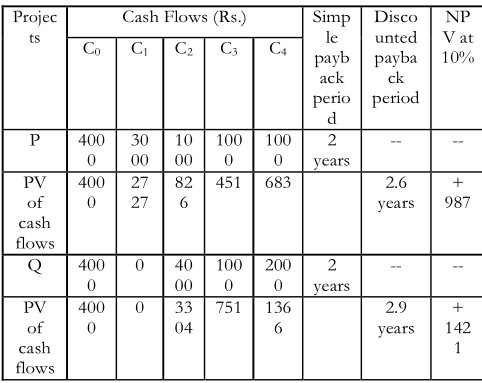

One of the serious objections to the payback method is that it does not discount the cash flows for calculating the payback period. Some people, therefore, discount cash flows and calculate the discounted payback period. The number of periods taken in recovering the investment outlay on the present value basis is called the discounted payback period. The discounted payback period still fails to consider the cash flows occurring after the payback period. Let us consider an example. Projects P and Q involve the same outlay of Rs 4,000 each. The opportunity cost of capital may be assumed 10 per cent. The cash flows of the projects and their discounted payback periods are shown in the following table:

The projects are indicated of same desirability by the simple payback period. When cash flows are discounted to calculate the discounted payback period, Project P recovers the investment outlay faster, and therefore, would be preferred over Project Q, which takes more time to recover the investment outlay. Discounted payback role is better as it does discount the cash flows until the outlay is recovered. But it does not help much. It does not take into consideration the entire series of cash flows. It can be seen in our example that if we use the NPV rule, Project Q is better.