Contract (or terminal) costing, is one form of application of the principles of job order costing. In contract costing each contract is treated as a cost unit and costs are ascertained separately for each contract. It is suitable for business concerned with building or engineering projects or structural or construction contracts.

Usually, there is a separate account for each contract. Also the number of contracts undertaken at a time, generally, not being very large, the Contract Ledger can very well be operated as part of the financial books. The contract account is debited with all direct and indirect expenditure incurred in relation to the contract. It is credited with the amount of contract price on completion of the contract. The balance represents profit or loss made on the contract and is transferred to the profit and loss account. In case, the contract is not completed at the end of the accounting period, a reasonable amount of profit, out of the total profit made so far on the incomplete contract, may be transferred to profit and loss account.

Distinction between Job and Contract Costing

Contract jobs, while they resemble jobs, have a few distinctive features:

- Under job costing, the cost is first allocated to cost centers and then to individual jobs. In contract costing, most of the expenses are of direct nature, overhead forms only a small percentage of total expenditure and it represents expenses like share of head office expenses, share of central storage cost etc.

- Under job costing pricing is influenced by individual conditions and general policy of the organisation. Under contract costing, pricing is influenced by specific clauses of the contract.

- Unlike job costing, each contract is a cost unit in contract costing.

- Under contract costing, the work is usually carried out at a site other than contractor’s own premises. Job costing is often applied where jobs are carried out at the contractee’s own premises.

Specific Aspects and Recording of Transactions of Contract Costing

The recording procedure of the following items may be noted carefully:

- Material: Materials may be purchased in bulk and kept in store for supply to the contract, as and when required, or these may be purchased and directly supplied to the contract. In the latter case, the cost of material would be debited directly to the contract. If any materials are transferred from one contract to another, their costs would be adjusted on the basis of Material Transfer Note, signed both by the transferor and transferee foreman. In case certain materials charged to contract are returned to stores, the same will be credited to the contract account. Materials stolen or destroyed by fire will be transferred to profit and loss account. Materials in hand at the end of the year will appear on the credit side of the contract account.

- Labour: All labour actually employed on the site is regarded as direct labour irrespective of the nature of the task performed by the labour concerned. If it is desired to ascertain the labour cost for a particular job or work, each person would be provided with a job card upon which he must record the nature of the work performed by him. On the basis of the analysis of the job cards, labour analysis sheets are prepared for ascertaining the actual cost of labour on different operations.

If concurrently numbers of contracts are carried on and workmen are made to divide their time between two or more contracts, it would be necessary to prepare analysis sheets of labour, for charging to each contract, wages appropriate thereto.

- Direct expenses: The expenses which can be directly charged to different contracts will be posted directly to the respective contracts. These include cost of special tools, cost of design, electric charge, insurance etc.

- Plant used in a contract: The value of plant used on a contract may be either debited to the contract and the written down value thereof at the end of the year entered on the credit side for closing the contract account, or only a charge for use of the plant (depreciation) may be debited to the account.

- Overhead expenses: In contract, overhead expenses are few and relate only to works or administration expenses which cannot be directly apportioned to individual contracts. These indirect expenses may be distributed on several contracts as a percentage of cost of materials or wages paid or the prime cost. If, however, the contracts are big, the labour hour method is often adopted for distribution of expenses since it is more efficacious. In making the distribution, the location of the site of the contract is another important factor to be considered, for contracts situated at a distance are not likely to receive the same supervision as compared to those which are close. Where such factors are prominent, some sort of quota basis for distribution of expenses may be followed.

- Extras: Where some additional work not stipulated in the contract is carried out, the expenditure on this additional work should be separately analyzed from that charged to the main contract.

If the additional work is quite substantial, it should be treated as a separate contract and a separate account should be opened for it. If it is not very substantial, expenses incurred up on extra work should appear on the debit side of the contract account as ‘cost of extra work’, and the extra amount which the contractee has agreed to pay should be added to the contract price.

- Sub-contracts: Generally work of a specialised character e.g. the installation of lifts; special flooring etc. is entrusted to other contractors by the main contractor. The cost of such sub-contracts is a direct charge against the contract for which the work has been done.

- Escalation clause: Escalation clause is usually provided in the contract as a safeguard against any likely changes in the price or utilization of material and/labour. This clause provides that in case prices of items of raw materials, labour etc. specified in the contract change during the execution of the contract, beyond a specified limit over the prices prevailing at the time of signing the agreement, the contract price will be suitably adjusted. The terms of the contract specify the procedure for calculating such adjustment in order to avoid all future disputes. Thus this clause safeguards the interest of both the contractor and the contractee in case of fluctuations in the prices of material, labour etc.

- Cost plus contract: Cost plus contract is a contract in which the value of the contract is ascertained by adding a certain percentage of profit over the total cost of the work. This is used in case of those contracts whose exact cost cannot be correctly estimated at the time of undertaking a work. The profit to be paid to the contractor may be a fixed amount or it may be a particular percentage of cost or capital employed. These type of contracts are undertaken for production of special articles not usually manufactured and is generally employed, when Government happens to be a contractee. Generally, in such contract, contractor and contractee have clear agreement about the items of cost to be included, type of material to be used, labour rates for different grades, normal wastages to be permitted and the rate or amount of profit.

Advantage of cost plus contract

- Cost plus contract ensures that a reasonable profit accrues to the contractor even in risky projects.

- It simplifies the work offering tenders and quotations.

- It provides escalation clauses and thus covers the contractor from fluctuations in price and utilization of elements of production.

- The customer is assured of paying only reasonable amount of profit.

- The customer has the right to conduct cost audit so that he can ensure that he is not being cheated by the contractor.

Disadvantages of cost plus contract system

Inspite of the advantages mentioned above cost plus contract system has the following disadvantages:

- Since the contractor is assured of profit margin, he may not take initiative for cost reduction by affecting economies of production and reducing wastages.

- The ultimate price to be paid by the customer cannot be exactly ascertained until the work is completed and this creates delay in preparing purchase budget by the customer.

- The customer has to pay not only the resultant high cost but also the resultant high profit. Thus, customer have to pay substantially for lack of proper attitude (towards cost and efficiency) on the part of contractor.

- Progress payment, Retention money and Architects’ certificate: When a contractor is engaged on a contract for several years, he cannot afford to block a large amount of funds until the completion of the contract. Therefore, in case of large contracts the system of progress payment is adopted. The contractee agrees to pay a part of the contract price from time to time depending upon satisfactory progress of the work. The progress will be judged by the contractee’s architect, surveyor or engineer who will issue a certificate stating the value of work so far done and approved by him. Such work is termed as work certified. The terms of the contract provide that whole of the amount shown by the certificate shall not be paid immediately but a percentage thereof shall be retained by the contractee until sometime after the contract is completed. The sum retained is called retention money. Usually the contractor may be paid 75% or 80% of the work certified depending upon the terms of the contract. The object of this retention is to place the contractee in a favorable position in case the contractor does not fulfill some of the conditions laid down by the contract or in case of faulty work.

It may quite possible that at the end of a period a part of the work done may remain unapproved because it has not reached a stipulated stage. Such work which has not been so far approved by the contractee’s architect or surveyor is termed as work uncertified. The full value of the work certified should be credited to the contract account and debited to the account of the contractee. Whenever any amount is received from the contractee cash account is debited and contractee’s account is credited. Until the contract is completed, amount received from the contractee shows advance payments and is deducted from work in progress in the balance sheet. When the contract is completed, contractee’s account is debited with the contract price and the contract account is credited.

- Profit on incomplete contracts: At the end of an accounting period it may be found that certain contracts which have been completed while others are still in process and will be completed in the coming years. The profit on completed contracts may be safely taken to the credit of the profit and loss account. In the case of incomplete contracts there are unforeseen contingencies which may lead to heavy fluctuations in costs and profit. At the same time it does not also seem desirable to consider the profits only on completed contracts and ignore completely incomplete ones as this may result in heavy fluctuations in the future for profit from year to year. If profit or loss is not shown in the intermittent years for the work in progress, contract will show high figure of profit in the year of completion and reverse may be the case in the year in which a large number of contracts remain incomplete. Therefore, profits on incomplete contracts should be considered, of course, after providing adequate sums for meeting unknown contingencies. There are no hard and fast rule regarding calculation of the figures for profit to be taken to the credit of profit and loss account.

However, the following rules may be followed:

- Profit should be considered in respect of work certified only; work uncertified should always be valued at cost.

- No profit should be taken into consideration if the amount of work certified is less than 1/4th of the contract price because in such a case it is not possible to foresee the future clearly.

- If the amount of work certified is 1/4th or more but less than 1/2 of the contract price, 1/3rd of the profit disclosed as reduced by the percentage of cash received from the contractee, should be taken to the profit and loss account or

Profit =1/3 x Notional Profit x {Cash received / Work certified}

The balance is allowed to remain as a reserve.

If the amount of work certified is 1/2 or more of the contract price, 2/3rd of the profit disclosed, as reduced by the percentage of cash received from the contractee, should be taken to the profit and loss account.

Profit= 2/3 x Notional Profit x {Cash received / Work certified}

The balance should be treated as reserve.

- In case the contract is very much near to completion, if possible the total cost of completing the contract should be estimated. The estimated total profit on the contract then can be calculated by deducting the estimated cost from the contract price. The profit and loss account should be credited with that proportion of total estimated profit on cash basis, which the work certified bears to the total contract price.

Profit=Estimated total profit x {Work certified / Contract price}

- The whole of loss, if any, should be transferred to the profit and loss account.

That part of the profit which is not credited to the profit and loss account is treated as a reserve against contingencies and is deducted from the amount of work-in-progress for balance sheet purpose. It is carried down as a credit balance in the contract account itself, the work-in-progress being represented by the debit balance in the contract account.

Note: The treatment of profit on incomplete contract will be computed as per specific instruction of problem. If there is no specific instruction then above rules should be applied.

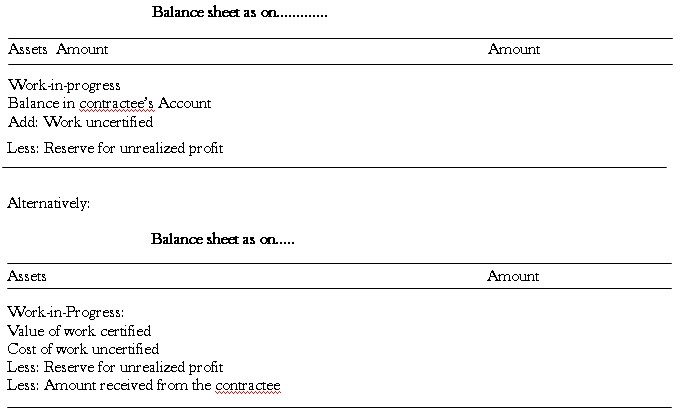

- Work-in-Progress: In contract accounts, the value of work-in-progress includes the amount of work certified and the amount of work uncertified. The work-in-progress account will appear in the assets side of the balance sheet. The amount of cash received from the contractee and reserve for contingencies will be deducted out of this amount.

The work-in-progress account can be presented in balance sheet as follows:

If the expenditure on incomplete contracts includes the value of plant and materials, these items may be shown separately in the balance sheet. Thus, instead of showing the total expenditure under the heading of work-in-progress, expenditure may split up and shown separately in the balance sheet, under the headings of plant at site, material at site, and work-in-progress.

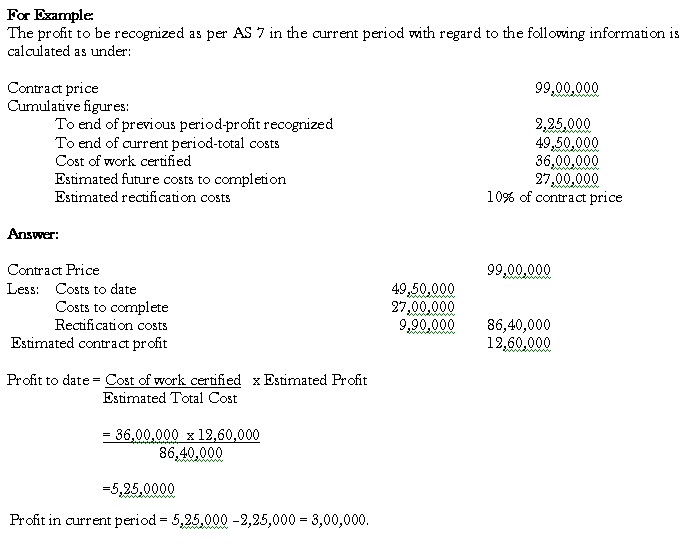

Profits on Incomplete Contracts (Based On As 7 – Revised 2002)

The basic principle of ascertaining profits on incomplete contracts is to give credit to share of profit on the outcome of a contract which can reasonably be foreseen. In calculating the total estimated profit on the contract, it is necessary to take into account the total costs to date and the total estimated further costs to completion and the estimated future costs or rectification and guarantee work, and any other future work to be undertaken. These are then compared to the total contract price.

The profit taken in any year is calculated on a cumulative basis having regard to profit taken in the earlier years. The amount to be reflected in the year’s profit and loss account will be the appropriate proportion of this total profit by reference to the work done to date, less any profit already taken in previous year.

Hence, the profit is calculated as follows:

Total contract value ……..

Less: Costs incurred to date ………

Estimated costs to completion ………

Rectification and guarantee work ……..

Total estimated contract costs ……….

Estimated profit or loss on the contract ……….

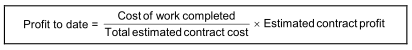

The estimated profit should be adjusted in the following formula:

The amount of profit to be recognized in the current period is calculated on cumulative principles as under:

Profit to date ………

Less: Profit recognized at the end of previous period ………

Profit recognized in current period ………

If a loss is disclosed, then this should be provided in full in the current period.

These general principles have been focused in the Accounting Standard (AS-7) Revised 2002 – ‘Construction Contracts’ issued by the Institute of Chartered Accountants of India. It is stated that when the outcome of a construction contract can be estimated reliably, contract revenue and contract costs associated with the construction contract should be recognized as revenue and expenses respectively by reference to the stage of completion of the contract activity at the reporting date. An expected loss on the construction should be recognized as an expense immediately.

However when the outcome of a construction cannot be estimated reliably then,

- revenue should be recognized only to the extent of contract cost incurred of which recovery is probable; and

- Contract costs should be recognized as an expense in the period in which they are incurred.

An expected loss on the construction contract should be recognized as an expense. When it is probable that total contract cost will exceed total contract revenue the expected loss should be recognized as an expense immediately.