Consumer behavior is the study of individuals and organizations and how they select and use products and services. It is mainly concerned with psychology, motivations, and behavior.

The study of consumer behavior includes:

- How consumers think and feel about different alternatives (brands, products, services, and retailers)

- How consumers reason and select between different alternatives

- The behavior of consumers while researching and shopping

- How consumer behavior is influenced by their environment (peers, culture, media)

- How marketing campaigns can be adapted and improved to more effectively influence the consumer

The factors that affect consumer behaviour, are

- Psychological: This is considered to be the most important factor that affects consumer behaviour. Traits like perception, motivation, personality, beliefs and attitude are important to decide why a consumer would buy a product.

- Personal: These are characteristics that are applicable to individuals and may not relate to other people in a group. These factors can include age, occupation, financial situation and lifestyle.

- Social: Social characteristics play an important role in consumer behaviour, and it can include family, communities and social interaction. These factors are difficult to assess while preparing marketing plans.

- Geographical: The location of consumers also plays a role in how they purchase products. For example, a person living in warmer weather would be less likely to purchase winter clothing compared to someone living in temperate climates.

Analysing Consumer Behaviour

Analysing consumer behaviour can be done by answering the following questions

- Who purchases your products and services? You should first carry out a market research to understand who your target audience is.

- Who makes the decision to purchase your products and services? You should ascertain who is actually making the decisions to purchase your products or services. For example, an organisation may purchase furniture for its office, but the decision to purchase that particular furniture could have been made by the hired interior designer.

- Who influences the decision to purchase the products? Children are a great example of influencers. Parents may buy a particular toy or game, but the influencer behind these purchases are usually the children. Hence, you might have noticed toy companies advertising their products on cartoon channels.

- How is the purchase decision made? Using the above example of the toy purchase, children go to their parents and ask for the toy. Thus, in this scenario, the influencer sways the decision maker to purchase a product. It is important that marketers should be aware of this process.

- Why does the consumer buy a product? You should attempt to understand the reasoning behind the consumer’s purchase, which will vary from one person to another. For example, parents can purchase toys as gifts for their children, and an organisation can purchase furniture for its office to make it more modern and comfortable.

- Why does a consumer prefer one brand over another? There are many reasons that can influence a consumer to prefer one brand over another. These factors can include quality, quantity, cost and branding of the product.

- Where do customers purchase the product? In today’s time, consumers can purchase products either online or from shops. The manner in which they shop provides an insight into their purchasing behaviour.

- When do consumers buy a product? There are several occasions in which a consumer might want to purchase a product or service. For example, parents may purchase a toy for their child’s birthday, and an organisation can purchase new furniture when it relocates to new premises.

- What is the consumer’s opinion about the product? Do the consumers view the product as expensive, value for money or cheap? What do they think of the product’s quality? The perception of a product plays a big role in generating positive world-of-mouth reviews.

- What is the role of consumers’ lifestyle in their buying behaviour? People who are fond of adventure would buy hiking shoes or travelling backpacks. On the other hand, people who enjoy reading would buy books or electronic devices for reading.

Benefits of Studying Consumer Behaviour

Consumer behaviour has significant bearing on decisions related to public relations and marketing; and studying it provides you with vital information regarding the thought process of consumers. It can also help you understand several factors:

- Attitudes: Consumer attitudes often affect their beliefs regarding specific products. Understanding customer attitudes using consumer behaviour models helps marketers tune their campaigns to strike a chord with the consumers, resulting in a greater market reach.

- Cultures: Constantly evolving cultures impact the designing of marketing campaigns. Studying consumer psychology can help you understand cultural nuances and determine the target market for your product.

- Perceptions: Studying consumer perceptions about your brand might help you uncover negative opinions, which you can then work on to improve your offering.

- Lifestyle: Comprehending consumer lifestyles would allow you to tune your products to meet their specific requirements.

Collecting Consumer Behavior Data

As the motivations that influence consumer behavior are so wide, a research mix including a variety of data will be the most robust. Some are more cost effective than others.

- Customer Reviews – Reading customer reviews can highlight common problems or wishes.

- Q&A sites – These sites can give you an idea of the questions and concerns that people have in relation to your brand, service or product.

- Surveys – Online surveys can be easily set up with sites like Survey Monkey and allow you to ask specific questions.

- Focus groups – Bring a group of consumers together and ask them questions directly.

- Keyword research – A mainstay of SEO, keyword research can tell you what consumers are interested in and the relative level of interest. It also helps to reveal the language they are using.

- Google Analytics – Analytics can be used to tell you where your traffic is coming from. The Audience tab shows geography, interests, and a range of demographics.

- Competitor analysis – This can provide useful information about consumers that are shopping in your vertical but don’t buy from your brand.

- Blog comments – Comments on your blog can be a good way of discovering any questions your audience might have.

- Twitter Insiders – Twitter recently launched Insiders, a 12,000 strong focus group of US & UK Twitter users.

- Google trends – Google Trends can help you to understand if a topic is becoming more or less popular.

- Government data – Government data is available for free and can help you understand a group, and several other sources can also be accessed without charge.

- Social media – Millions of people reflect their lives on social media, so information that can enrich several strands of consumer behavior can be uncovered with the right tools.

Conduct a Customer Behavior Analysis

Step 1 – Segment your audience

The first step in conducting a customer behavior analysis is to categorize your customer base. When doing so, it’s important to use a wide range of characteristics. Consider demographic traits such as gender, age, and location, but also be sure to include engagement tendencies like web activity, preferred media channels, and online shopping habits.

You’ll want to identify the characteristics of customers who are the most valuable to your business. One way to do this is to perform a RFM analysis which outlines how recent and frequent a customer buys from you. Another way to do this to calculate customer lifetime value. Customer lifetime value considers metrics such as customer lifespan, purchase value, and frequency rate, then determines how much revenue the company can expect from that customer. This information gives you a quantitative picture of how much impact loyal customers have on your business.

Step 2 – Identify the key benefit for each group.

Each customer persona will have its own unique reason for choosing your business, and it’s imperative to identify it. Look beyond just the product or service, and consider the external factors that influence the customer’s buying decision. For example, was the purchase made out of convenience? Or did the customer make a conscious decision to seek out your brand? How urgent is the purchase, and how much does the customer want to spend? Thinking about the context of the customer’s needs is a great way to determine where you can improve the customer experience.

Step 3 – Allocate quantitative data.

The first two steps help us extract qualitative data, but the next step is to obtain quantifiable information about your customers. While some resources may be more accessible than others, it’s important to derive information from both internal and external sources. This ensures you get a complete picture of both micro and macro customer trends.

From within the company, you can pull stats such as blog subscription data, social media insights, and product usage reports. Secondary outlets can offer things like consumer reviews and competitor analytics. Third party data isn’t specific to one company, but rather provides general statistics across an entire industry. Through the combination of the three, you’ll have a broad scope information to work with when analyzing customer behaviors.

Step 4 – Compare your quantitative and qualitative data

After you’ve collected your data, the next step is to compare the qualitative data against the quantitative. To do this, go through your customer journey map using the data sets as a reference. Look at which persona bought what product, when they bought it, and where. Did they return for another visit? By comparing the two sets of data against the customer experience, you can develop a detailed understanding of your customers’ journey.

Once you compare the data to the customer journey, you should be able to pick out some recurring trends. Look for common roadblocks that seem to pop up at different lifecycle stages, and note any unique behaviors specific to a customer type. Circle back to your high-value customers, and be sure to acknowledge anything that stands out with their buying behaviors.

Step 5 – Apply your analysis to a campaign

Now that you understand your customers’ behaviors, it’s time to capitalize on it. As we discussed earlier, you can use your findings to optimize your content delivery. Pick the best delivery channel for each persona, and take advantage of opportunities where you can personalize the customer experience. Nurture customers throughout the entire customer journey by responding to roadblocks in a timely manner. The insights you’ve gained from conducting your customer behavior analysis should give you a good idea of where you can make updates to your marketing campaigns.

Before rolling out your new initiatives, use your analysis to determine what your customers will think about these changes. Customers are habitual creatures, and some will push back on change even if it’s for the better. These customers tend to be more loyal to your brand, so it’s imperative you don’t lose them as a result. Consider different ways you can introduce change to these customers, and remember to be receptive of their feedback.

Step 6 – Analyze the results

Once you’ve given ample time for testing, you’ll probably want to know if your changes worked. Use metrics like conversion rate, acquisition cost, and customer lifetime value to determine the effect of your updated campaigns. It’s important to continuously analyze your results as new tech, politics, and events constantly influence customer needs. Revisiting your analysis frequently ensures you’re capturing new trends appearing in the customer’s journey.

RFM Model

RFM is a method used for analyzing customer value. It is commonly used in database marketing and direct marketing and has received particular attention in retail and professional services industries.

RFM stands for the three dimensions:

- Recency – How recently did the customer purchase?

- Frequency – How often do they purchase?

- Monetary Value – How much do they spend?

Customer purchases may be represented by a table with columns for the customer name, date of purchase and purchase value. One approach to RFM is to assign a score for each dimension on a scale from 1 to 10. The maximum score represents the preferred behavior and a formula could be used to calculate the three scores for each customer. For example, a service-based business could use these calculations:

- Recency = the maximum of “10 – the number of months that have passed since the customer last purchased” and 1

- Frequency = the maximum of “the number of purchases by the customer in the last 12 months (with a limit of 10)” and 1

- Monetary = the highest value of all purchases by the customer expressed as a multiple of some benchmark value

Alternatively, categories can be defined for each attribute. For instance, Recency might be broken into three categories: customers with purchases within the last 90 days; between 91 and 365 days; and longer than 365 days. Such categories may be derived from business rules or using data mining techniques to find meaningful breaks.

Once each of the attributes has appropriate categories defined, segments are created from the intersection of the values. If there were three categories for each attribute, then the resulting matrix would have twenty-seven possible combinations (one well-known commercial approach uses five bins per attributes, which yields 125 segments). Companies may also decide to collapse certain sub segments, if the gradations appear too small to be useful. The resulting segments can be ordered from most valuable (highest recency, frequency, and value) to least valuable (lowest recency, frequency, and value). Identifying the most valuable RFM segments can capitalize on chance relationships in the data used for this analysis. For this reason, it is highly recommended that another set of data be used to validate the results of the RFM segmentation process. Advocates of this technique point out that it has the virtue of simplicity: no specialized statistical software is required, and the results are readily understood by business people. In the absence of other targeting techniques, it can provide a lift in response rates for promotions.

Variations

- RFD – Recency, Frequency, Duration is a modified version of RFM analysis that can be used to analyze consumer behavior of viewership/readership/surfing oriented business products. (For example, amount of time spent by surfers on Wikipedia)

- RFE – Recency, Frequency, Engagement is a broader version of the RFD analysis, where Engagement can be defined to include visit duration, pages per visit or other such metrics.

- RFM-I – Recency, Frequency, Monetary Value – Interactions is a version of RFM framework modified to account for recency and frequency of marketing interactions with the client (e.g. to control for possible deterring effects of very frequent advertising engagements).

- RFMTC – Recency, Frequency, Monetary Value, Time, Churn rate an augmented RFM model proposed by I-Cheng et al. (2009). The model utilizes Bernoulli sequence in probability theory and creates formulas that calculate the probability of a customer buying at the next promotional or marketing campaign.

Life Time Value or LTV Model

Customer lifetime value (CLV or often CLTV), lifetime customer value (LCV), or life-time value (LTV) is a prediction of the net profit attributed to the entire future relationship with a customer. The prediction model can have varying levels of sophistication and accuracy, ranging from a crude heuristic to the use of complex predictive analytics techniques.

Customer lifetime value can also be defined as the monetary value of a customer relationship, based on the present value of the projected future cash flows from the customer relationship. Customer lifetime value is an important concept in that it encourages firms to shift their focus from quarterly profits to the long-term health of their customer relationships. Customer lifetime value is an important metric because it represents an upper limit on spending to acquire new customers. For this reason it is an important element in calculating payback of advertising spent in marketing mix modeling.

The purpose of the customer lifetime value metric is to assess the financial value of each customer. Don Peppers and Martha Rogers are quoted as saying, “some customers are more equal than others.” Customer lifetime value differs from customer profitability or CP (the difference between the revenues and the costs associated with the customer relationship during a specified period) in that CP measures the past and CLV looks forward. As such, CLV can be more useful in shaping managers’ decisions but is much more difficult to quantify. While quantifying CP is a matter of carefully reporting and summarizing the results of past activity, quantifying CLV involves forecasting future activity.

CLV applies the concept of present value to cash flows attributed to the customer relationship. Because the present value of any stream of future cash flows is designed to measure the single lump sum value today of the future stream of cash flows, CLV will represent the single lump sum value today of the customer relationship. Even more simply, CLV is the monetary value of the customer relationship to the firm. It is an upper limit on what the firm would be willing to pay to acquire the customer relationship as well as an upper limit on the amount the firm would be willing to pay to avoid losing the customer relationship. If we view a customer relationship as an asset of the firm, CLV would present the monetary value of that asset.

One of the major uses of CLV is customer segmentation, which starts with the understanding that not all customers are equally important. CLV-based segmentation model allows the company to predict the most profitable group of customers, understand those customers’ common characteristics, and focus more on them rather than on less profitable customers. CLV-based segmentation can be combined with a Share of Wallet (SOW) model to identify “high CLV but low SOW” customers with the assumption that the company’s profit could be maximized by investing marketing resources in those customers.

Customer Lifetime Value metrics are used mainly in relationship-focused businesses, especially those with customer contracts. Examples include banking and insurance services, telecommunications and most of the business-to-business sector. However, the CLV principles may be extended to transactions-focused categories such as consumer packaged goods by incorporating stochastic purchase models of individual or aggregate behavior. In either case, retention has a decisive impact on CLV, since low retention rates result in Customer Lifetime Value barely increasing over time.

Developing the Model

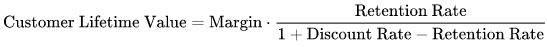

When margins and retention rates are constant, the following formula can be used to calculate the lifetime value of a customer relationship:

The model for customer cash flows treats the firm’s customer relationships as something of a leaky bucket. Each period, a fraction (1 less the retention rate) of the firm’s customers leave and are lost for good.

The CLV model has only three parameters: (1) constant margin (contribution after deducting variable costs including retention spending) per period, (2) constant retention probability per period, and (3) discount rate. Furthermore, the model assumes that in the event that the customer is not retained, they are lost for good. Finally, the model assumes that the first margin will be received (with probability equal to the retention rate) at the end of the first period.

The one other assumption of the model is that the firm uses an infinite horizon when it calculates the present value of future cash flows. Although no firm actually has an infinite horizon, the consequences of assuming one are discussed in the following.

Under the assumptions of the model, CLV is a multiple of the margin. The multiplicative factor represents the present value of the expected length (number of periods) of the customer relationship. When retention equals 0, the customer will never be retained, and the multiplicative factor is zero. When retention equals 1, the customer is always retained, and the firm receives the margin in perpetuity. The present value of the margin in perpetuity turns out to be the Margin divided by the Discount Rate. For retention values in between, the CLV formula tells us the appropriate multiplier.

Example

(Avg Monthly Revenue per Customer * Gross Margin per Customer) ÷ Monthly Churn Rate

The numerator represents the average monthly profit per customer, and dividing by the churn rate sums the geometric series representing the chance the customer will still be around in future months.

For example: $100 avg monthly spend * 25% margin ÷ 5% monthly churn = $500 LTV

CLV (customer lifetime value) calculation process consists of four steps:

- forecasting of remaining customer lifetime (most often in years)

- forecasting of future revenues (most often year-by-year), based on estimation about future products purchased and price paid

- estimation of costs for delivering those products

- calculation of the net present value of these future amounts