This model assumes that both the dividend amount and the stock’s fair value will grow at a constant rate. This model assumes that the dividend paid by the company will grow at a constant percentage.

Constant growth rate model also known as ‘Gordon Growth Model’ has been named after Professor Myron J. Gordon. This model works on the underlying assumption that the company will continue to pay the dividend amount as a fixed multiple of growth in the future, as it is paying now. It is an appropriate model to value companies who increase dividend by fixed rate every year.

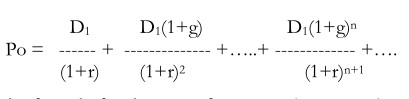

It is one of the most popular dividend discount models assumes that the dividend per share grows at a constant rate (g). The value of a share, under this assumption is

Applying the formula for the sum of a geometric progression, the above expression simplifies to

Illustration:

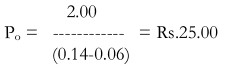

Arvind Engg. Ltd. Is expected to grow at the rate of 6 %per annum. The dividend expected on Arvind’s equity share a year hence is Rs.2.00. What price will you put on it if you’re required rate of return for this share is 14 % ?

The price of Arvind’s equity share would be