The process of classification of overheads involves:

- The determination of the classes or groups in which the costs are sub-divided; and

The actual process of classification of the various items of expenses into one or another of the groups

The classification of overheads expenditure depends upon the type and size of a business and the nature of the product or service rendered.

Generally overheads are classified on the following basis:

- Functional analysis

- Behavioral analysis

Functional Analysis

Overheads can be divided into the following categories on functional basis:

- Manufacturing or production or factory overheads: Manufacturing overheads includes all indirect costs (indirect material, indirect labour and indirect expenses) incurred for operation of manufacturing or production division in a factory. It is also known as, factory overheads, works overheads, factory cost or works cost etc.

- Administration overheads: It is the sum of those costs of general management, secretarial, accounting and administrative services, which cannot be directly related to the production, marketing, research or development functions of the enterprise. Administration overheads include the cost of formulating the policy, directing the organisation and controlling the operations of an undertaking which is not related directly to production, selling, distribution, research or development activity or function.

- Selling and distribution overheads: Selling overheads is the cost of seeking to create and stimulate demand and of securing orders. It comprises the cost to products of distributors for soliciting and recurring orders for the articles or commodities dealt in and of efforts to find and retain customers. Distribution overhead is the expenditure incurred in the process which begins with making the packed product available for dispatch and ends with the making the reconditioned returned empty package, if any, available for re-use. It includes expenditure incurred in transporting articles to central or local storage. It also comprises expenditure incurred in moving articles to and from prospective customer as in the case of goods on sale or return basis. In case of gas, electricity and water industries distribution means pipes, mains and services which may be regarded as equivalent to packing and transportation.

- Research and development overheads: Research overhead is incurred for the new product, new process of manufacturing any product. The development overhead is incurred for putting research result on commercial basis.

Behavioural Classification

Based on the behavioral patterns, overheads can be classified into the following categories:

- Fixed overheads

- Variable overheads

- Semi-variable overheads.

Fixed Overheads: Fixed overheads expenses are those which remain fixed in total amount with increases or decreases in volume of output or productive activity for a particular period of time, e.g. managerial remuneration, rent of building, insurance of building, plant etc. Fixed overhead costs remain the same from one period to another except when they are deliberately changed, e.g. increments granted to staff. The incidence of fixed overhead on unit cost decreases as production increases and vice versa.

Fixed overheads are stated to be uncontrollable in the sense that they are not influenced by managerial action. However, it should be noted that expenditure is fixed within specified limit relating to time or activity. In a hypothetical organization no expenditure remains unchanged for all time. Therefore, it is true to state that “fixed overhead is fixed within specified limit relating to time and activity”.

Variable Overheads: Variable overhead costs are those costs which vary in total in direct proportion to the volume of output. For instance, if the output increases by 5%, the variable expenses also increase by 5%. Correspondingly, on a decline of the output it will also decline proportionately. Examples are indirect material and indirect labour. Variable overhead changes in total but its incidence on unit cost remains constant.

Semi-variable Overheads/ Step Cost: These overhead costs are partly fixed and partly variable. They are known as semi-variable overheads because they contain both fixed and variable element. Semi-variable overheads do not fluctuate in direct proportion to volume. They are also called Step Costs It may remain fixed within a certain activity level, but once that level is exceeded, they vary without having direct relationship with volume changes. Examples are depreciation, telephone charges, repair and maintenance of buildings, machines and equipment etc.

Semi-variable expenses usually have two parts—one fixed and other variable. For instance depreciation usually depends on two factors—one time (fixed) and other wear and tear (variable). The two together make depreciation (as a whole) semi-variable. An analytical study thus can make it possible for all semi-variable expenses to be split up into two parts. Fundamentally, therefore, there are only two types of expenses—fixed and variable.

Advantages of classification of overheads into fixed and variable

- Effective cost control: The classification of expenses into fixed and variable helps in controlling expenses. Fixed expenses are incurred by management decisions and are incurred irrespective of the output; hence it is more or less uncontrollable. Variable expenses vary with the volume of activity and the responsibility for incurring this expenditure is determined in relation to output.

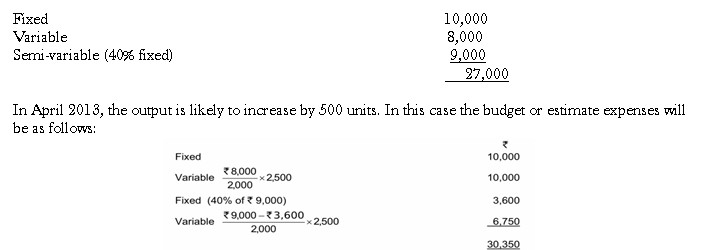

- Preparation of budget estimates: Unless a distinction between fixed and variable expenses is made, it would not possible to prepare a flexible budget in a given period on the basis of different levels of activity. For instance in March 2013, the output of the factory is 2,000 units and the expenses are as follows:

Ascertaining Marginal Cost: Decision Making: A number of decisions of management depend upon a comparison of (a) the extra amount that would have to be spent if an additional activity is undertaken or an alternative course is adopted, and (b) measurement of the benefits resulting thereof. The extra amount that will have to be spent will only be the variable costs (including materials, labour and variable expenses) and not fixed expenses. Therefore, a distinction between fixed and variable expenses is essential. Marginal costs (or variable costs) afford a number of advantages, in fixing prices in a special market, for a special customer and during a slump or a period of depression, decision on make or buy, shut down or continue etc. The main principle is that if the price available is above the variable or marginal cost, profits would increase or losses would decrease because of additional units sold. This is because fixed expenses would not increase.

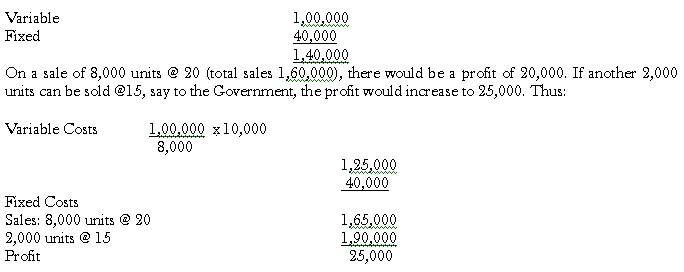

Suppose, a factory having a capacity of 10,000 units per month produces and sells 8,000 units @ 20 each, the total costs being:

Profit maximization is possible only if marginal and fixed costs are distinguished. The advantages of marginal costs will be discussed in a later study.