Indian Accounting Standard (abbreviated as Ind-AS) is the Accounting standard reared by companies in India and issued under the supervision of Accounting Standards Board (ASB) having representatives from a government department, academicians, other professional bodies viz. ICAI, representatives from ASSOCHAM, CII, FICCI, etc. For the Vskills Certified IndAS Professional exam, the candidate needs to have knowledge regarding accounting standards, Ins AS basics, Ind AS Assets Recognition and Measurement, their liabilities, etc.

Exam Overview

The Vskills Certified IndAS Professional course is denoted for professionals and graduates aspiring to excel in their chosen areas. It is also well accommodated for those who are previously working and would like to take certification for further career progression. Earning Vskills IndAS Certification can help candidate differentiate in today’s competitive job market, broaden their employment opportunities by displaying their advanced skills, and result in higher earning potential.

Vskills being India’s largest certification provider gives candidates access to top exams as well as provides after exam benefits. This includes:

- Become Government Certified Professional!

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and ‘Vskills Certified’ On Shine Shine.com.

Exam Details

- Exam Duration: 60 minutes

- Vskills Exam Code: VS-1563

- Number of questions: 50

- Maximum marks: 50

- Passing marks: 25 (50%)

- Exam Mode: Online

- There is NO negative marking in this module.

Course Outline

Vskills Certified US GAAP Professional exam covers the following topics –

Introduction to Ind AS

- Accounting Standards

- Global Standardization and IFRS

- Enterprise Classification

- Ind AS Basics

- Ind AS 101 First-time Adoption of Indian Accounting Standards

Ind AS Assets Recognition and Measurement

- Ind AS 2 Inventories

- Ind AS 16 Property, Plant and Equipment

- Ind AS 116 Leases

- Ind AS 20 Accounting for Government Grants and Disclosure of Government Assistance

- Ind AS 23 Borrowing Costs

- Ind AS 36 Impairment of Assets

- Ind AS 38 Intangible Assets

- Ind AS 40 Investment Property

- Ind AS 105 Non-Current Assets held for Sale and Discontinued Operations

Ind AS Liabilities Recognition and Measurement

- Ind AS 12 Income Taxes

- Ind AS 19 Employee Benefits

- Ind AS 37 Provisions, Contingent Liabilities and Contingent Assets

- Ind AS 102 Share-based Payments

Ind AS Revenue

- Ind AS 115 Revenue from Contracts with Customers

Ind AS Financial Instruments

- Ind AS 32 Financial Instruments Presentation

- Ind AS 109 Financial Instruments

- Ind AS 107 Financial Instruments Disclosure

Ind AS Business Structures and Consolidations

- Ind AS 27 Separate Financial Statements

- Ind AS 28 Investment in Associates & Joint Ventures

- Ind AS 103 Business Combinations

- Ind AS 110 Consolidated Financial Statements

- Ind AS 111 Joint Arrangements

- Ind AS 112 Disclosure of Interest in Other Entities

Ind AS Disclosures and Measurements

- Ind AS 24 Related Party Disclosure

- Ind AS 108 Operating Segments

- Ind AS 113 Fair Value Measurement

Ind AS Financial Statements and Reporting

- Ind AS 1 Presentation of Financial Statements

- Ind AS 7 Statement of Cash Flows

- Ind AS 8 Accounting Policies, Changes in Accounting Estimates and Errors

- Ind AS 10 Events after Reporting Period

- Ind AS 33 Earnings Per Share

- Ind AS 34 Interim Financial Reporting

Miscellaneous

- Ind AS 21 The effects of changes in Foreign exchange rates

- Ind AS 29 Financial reporting in hyperinflationary economies

- Ind AS 41 Agriculture

- Ind AS 106 Exploration for and Evaluation of Mineral resources

- Ind AS 104 Insurance contracts

- Ind AS 114 Regulatory Deferral Accounts

Updates

- Ind AS Updates

- Superseded Ind AS

Preparation Guide

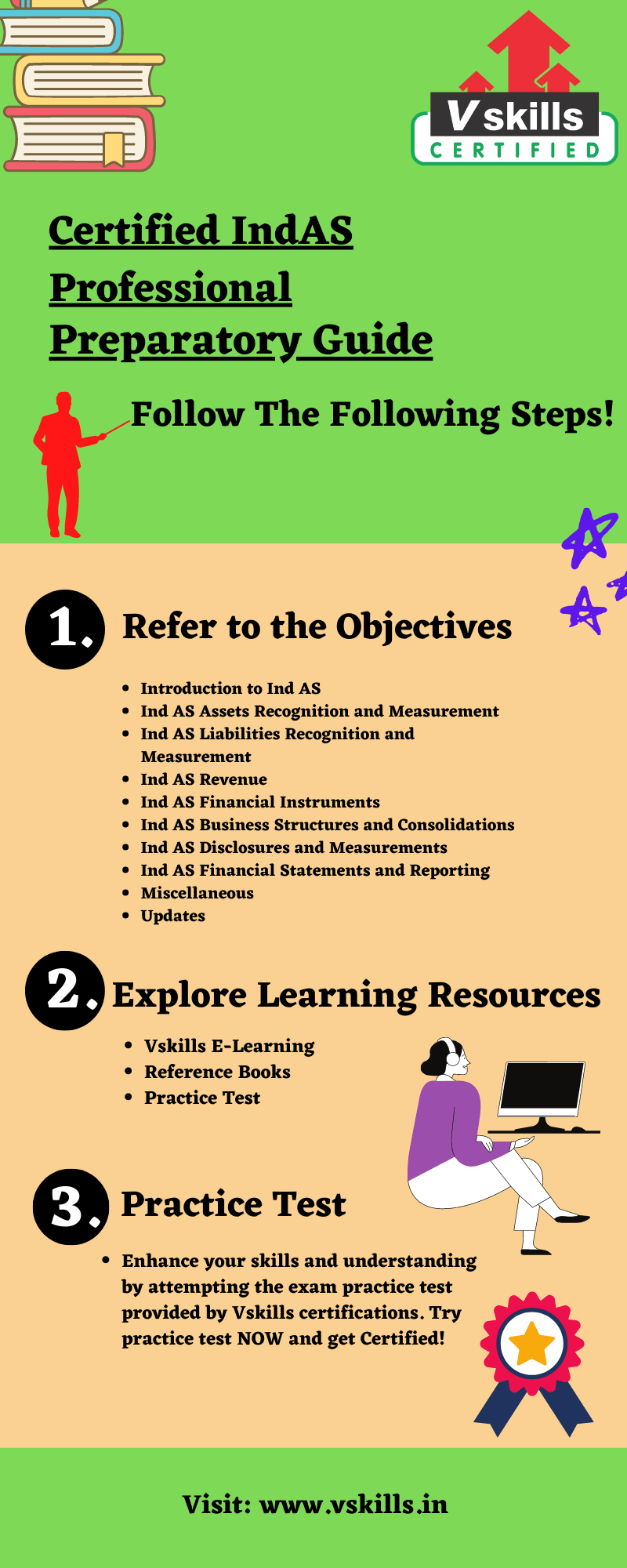

Candidates brewing for the Certified IndAS Professional exam should recognize the importance of exam resources. During the exam preparation, it is important to get all the necessary exam study sources. This will provide the benefit to understand the concepts and meaning more precisely. In the preparation guide, we will review some of the most significant resources to help the candidate prepare well for the exam.

Exam Objectives

For every examination, the first task should be to get all the exam relevant details including the important contents and its topic. With complete exam objectives, the candidate’s exam preparation time is better spent because they already know what to study. For this exam, the topics include:

- Introduction to Ind AS

- Ind AS Assets Recognition and Measurement

- Ind AS Liabilities Recognition and Measurement

- Ind AS Revenue

- Ind AS Financial Instruments

- Ind AS Business Structures and Consolidations

- Ind AS Disclosures and Measurements

- Ind AS Financial Statements and Reporting

- Miscellaneous

- Updates

Vskills Online Learning Material

Vskills provides candidates a way to prepare for the exam using the online learning material for existence. The online material for this is regularly updated. Moreover, e-learning is bundled with hard copy material which encourages candidates to enhance and update the learning curve for superior and better opportunities. The candidate can also download the sample chapter for the Certified IndAS Professional exam.

Vskills Brochure

Vskills also provides a brochure for the Certified IndAS Professional exam. The brochure contains all the necessary related to the exam such as details, sample papers, important information, course outline, etc.

Books for Reference

The next step in the preparatory guide should be books and study guides. The candidate needs to find those books which are enriched with information. Finding a good book may be a difficult task, but in order to gather knowledge and skills, the candidate has to find, read, and understand.

Practice Test

Practice tests are the one who ensures the candidate about their preparation for the exam. The practice test will help the candidates to acknowledge their weak areas so that they can work on them. There are many practice tests available on the internet nowadays, so the candidate can choose which they want. Try the practice test here!