The Certified Futures Trader is a course developed to Evaluate a candidate as per the organization’s requirements and skill accordingly. This certification program will educate a candidate in different areas in future market basics, VaR pricing of futures contracts, investment assets, stochastic interest rates, hedging, short term interest rate futures contracts, t-bills, long term interest rate futures, foreign exchange futures, and stock index features.

Why become a Certified Future Trader

This course is designed for professionals and Graduates who want to gain good roles and positions in their respective niche. An employee who is already working can also attempt this certification exam, it will open the doors of employment opportunities and result in earning potential.

Who should take this certification?

Individuals who are looking for Job in options and future trading departments of different companies. Graduates who wish to improve their skills and make their CV’s stronger this certification will give them more opportunities in their career. Employees looking for a better role, through this certification a candidate can add value to their skills.

Roles and responsibilities of a Certified Futures Trader

The first step is to analyze and take the details about the task that a practitioner undertakes after Getting qualified for the particular examination. Below is the list of duties that a Certified Futures Trader undertakes.

- To collect information on securities, market conditions, government regulations and financial circumstances of customers

- To elucidate data from securities reports, financial periodicals and stock-quotation viewer screens.

- To make proper analysis of financial markets and financial market products.

- To Give information and offer advice on financial market matters and market conditions, as well as the history and prospects of corporations.

- To undertake and execute buying and selling orders in the marketplace on behalf of clients.

- To predict futures prices and market changes, and bidding for commodity futures contracts.

- To keep record and transmit buy and sell orders.

Career as a Futures Trader

As a financial trader, you’ll purchase and sell stocks, bonds, and other assets for individual and institutional clients. You’ll establish pricing and deals in order to maximize assets or reduce financial risk. When it comes to futures trading, there’s more to it than meets the eye. Let us know about Career as a Futures Trader!

Benefits of taking Vskills Certification

Vskills being India’s largest certification provider gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and Shine.com

Exam Details

- Exam Duration: 60 minutes

- Vskills Exam Code: VS-1137

- Number of questions: 50

- Maximum marks: 50

- Passing marks: 25 (50%)

- Exam Mode: Online

- There is NO negative marking in this module.

Course Details

The Certified Futures Trader exam covers the following topics –

Introduction

- Forward Contracts versus Futures Contracts

- Type of Assets Underlying Futures Contracts

- Futures Exchanges

- Types of Assets Underlying Options Contracts

- Options Exchanges

- Hedgers, Speculators, and Arbitrageurs

- The Role of Futures and Options Markets

- Reasons for the Rapid Growth of Derivative Markets

- The Recent Indian Story in Derivatives

- Electronic Exchanges: The State-of-the-Art

Fundamentals of Futures Markets

- Standardization of Futures Contracts

- Margins and Marking to Market: General Principles

- Spot-Futures Convergence at Expiration

- Trading: General Principles

- Value at Risk (VaR)

- VaR in the Context of Futures Trading in India

- Types of Members and the Margining System in India

- Types of Orders

- Liquidating a Futures Position

- Trading Volume versus Open Interest

- Conversion Factors When There are Multiple Deliverable Grades

- Single Stock Futures

Pricing of Futures Contracts

- Notation

- Assumptions

- Forward Contract on a Security That Provides No Income

- Forward Contracts on Assets That Provide a Known Dividend Yield

- Forward Contracts on Commodities

- Investment Assets

- Consumption Assets

- Calendar Spreads and Arbitrage

- Net Carry

- ‘Backwardation’ and ‘Contango’

- Delivery Options

- Imperfect Markets

- Synthetic Securities

- Forward Price versus Futures Prices

- Stochastic Interest Rates

- Quasi- Arbitrage

- Risk and Futures Prices

Hedging

- A Selling Hedge

- A Buying Hedge

- Lifting a Hedge Prior to the Expiration of the Futures Contract

- Basis Risk

- Selecting a Futures Contract

- A Rolling Hedge

- The Hedge Ratio

- Estimating the Hedge Ratio

- Tailing a Hedge

- Quantity Uncertainty

- Rationale for Hedging

- Hedging Processing Margins

- Developing Derivative Exchanges Key Issues

Short -Term Interest Rate Futures

- Eurodollars

- T-bills

- Yields

- T-bill Futures

- The No-Arbitrage Pricing Condition

- Risk Management Using T-bill Futures

- Shortening T-bill Maturities

- Lengthening T-bill Maturities

- Risk Management Using Chained Hedge Ratios

- Introduction to Eurodollar Futures

- Calculating Profits and Losses on ED Futures

- Bundles and Packs

- Locking in a Borrowing Rate

- Cash and Carry Arbitrage

- Reverse Cash and Carry Arbitrage

- The No-Arbitrage Pricing Equation

- Hedging Rates for Periods Not Equal to Days

- Creating a Fixed Rate Loan

- Strip versus Stack Hedges

- The TED Spread

Long-Term Interest Rate Futures

- Fundamentals of Bond Valuation

- Duration

- The Cash Market

- The Futures Market

- Conversion Factors

- Calculating the Invoice Price for a T-bond

- The Cheapest to Deliver Bond

- Arbitrage or Risk Arbitrage?

- Seller’s Options

- Hedging

Foreign Exchange Futures

- Purchase and Sale

- The Spot Market

- Arbitrage

- The Forward Market

- Merchant Rates and Exchange Margins

- The No-Arbitrage Forward Price

- One Way Arbitrage

- The Relationship Between Interest Rate Parity and One-Way Arbitrage

- Options Forwards

- Modification of Forward Contracts

- Futures Markets

- Hedging an Export Transaction

- Hedging an Import Transaction

- Creating Synthetic Investments

- Borrowing Funds Abroad

- Creating Synthetic Futures Contracts

- Creating Synthetic Futures Contracts

- Creating Synthetic Short-Term Interest Rate Contracts

- Forward Covered Interest Arbitrage

Stock Index Futures

- Price Weighted Indices

- Value Weighted Indices

- Equally Weighted Indices

- Forming Portfolios to Mimic an Index

- Portfolio Re-Balancing

- Re-balancing an Equally Weighted Portfolio

- Changing the Base Period Capitulation

- Pricing of Index Futures

- Cash and Carry Arbitrage

- Reverse Cash and Carry Arbitrage

- The No-Arbitrage Equation

- Index Arbitrage and Programme Trading

- Hedging with Index Futures

- Market Timing with Index Futures

- Using Index Futures to Change the Beta of a Portfolio

- Stock Picking

- Portfolio Insurance

- Index Futures and Stock Market Volatility

- Index Futures in India

Preparation Guide for Vskills Certified Futures Trader

Study guide improves comprehension and helps a candidate to follow an organized pattern for studying before examination. It also enables a candidate to understand concepts and resources clearly. This preparation guide consists of the resources that will guide you and prepare you to do better for the exam.

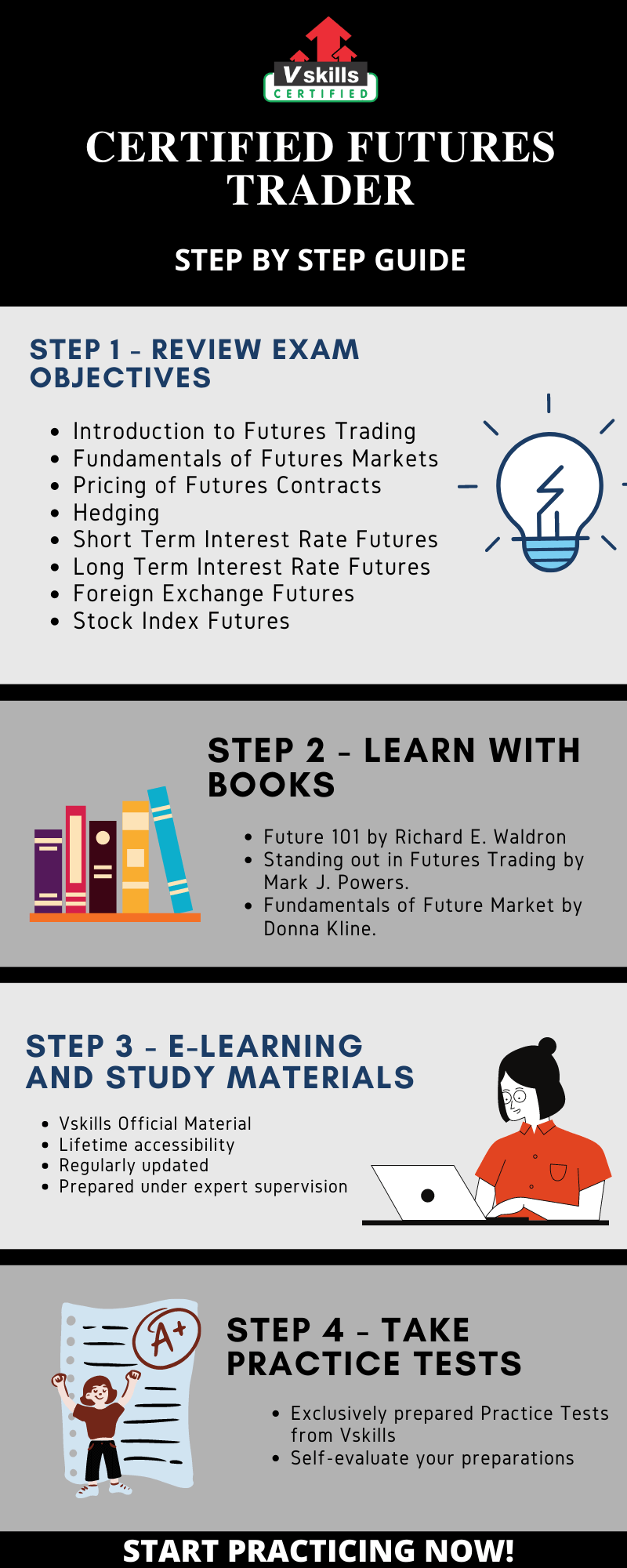

Step 1 – Review Exam Objectives

Exam objectives/ syllabus are a significant resource under the preparation guide. It is the first step in the preparation and it is to analyze the syllabus and topics that a candidate will study during this certification program.

- Introduction to Futures Trading

- Fundamentals of Futures Markets

- Pricing of Futures Contracts

- Hedging

- Short Term Interest Rate Futures

- Long Term Interest Rate Futures

- Foreign Exchange Futures

- Stock Index Futures

Refer: Certified Futures Trader Brochure

Step 2 – Learning with Books

Books are our main source of guidance during any preparation for any examination. It is the prime source of knowledge that consists of all important concepts for beginners in an intelligible manner. All topics are explained in detail and a book is an easy to access source. The top 3 for this certification exam is given below.

- Future 101 by Richard E. Waldron. This book is known for its not so technical future trading concepts mentioned in it. The book is just completely designed for beginners in future trading.

- Standing out in Futures Trading by Mark J. Powers. The standing out in future trading is the sixth edition. It is written by a serious spectator of the domain. This book will highlight key points like brokers and how to choose nuances of placing different order types and the importance of stock indices.

- Fundamentals of Future Market by Donna Kline. The writer of this book is a reporter and she has given some important knowledge and details of Fundamentals of the Futures market and fundamental aspects of the futures markets.

Step 3 – E-learning and Study material

Online learning is all about flexibility and self-paced learning. If a candidate wants to gain more knowledge through different online learning platforms to explore more content, e-learning gives you the best knowledge and updated one as well. It makes the information comprehensible and easy to access. Study materials are the new form of notes, which are already created by the masters of the particular niche so that the candidates get quality notes to refer to. Vskills offers you its E-Learning Study Material and its hard copy as well, to supplement your learning experience and exam preparation. Moreover, this online learning material is available for a lifetime and is updated regularly.

Refer: Certified Futures Trader Sample Chapter

Step 4 – Check your Progress with Practice Tests

Practice Tests are essential to create your own exam taking endurance. The more a candidate practices, the easier it gets for you to attempt the real examination as you get the experience through the practice tests. Attempting practice tests will help you attain the questions swiftly and learn the quirks of the exam. The practice tests will help you realize what you know and what you don’t from the syllabus and how much are you ready for the exam.