Corporate Finance examines all aspects of a company’s financial needs in order for it to succeed. It can be characterized primarily as the optimum utilization of the financial resources of the organization. It is the financial sector that deals with the arrangement of funds for different ventures at the lowest possible expense in order to preserve the company’s capital structure.

Let us dive deeper into the career prospects of Corporate Finance.

What is Corporate Finance?

Corporate finance is the branch of finance that deals with how businesses handle financing, capital structure, and investment decisions. The primary goal of corporate finance is to maximize shareholder value through long and short-term financial planning and the execution of various strategies.

Why should you learn Corporate Finance?

There are many important activities which corporate finance branch deals with in an organization. Some of the reasons to learn about the corporate finance is to specialize in these activities which can help you learn and understand finance in a better way –

Investments & Capital Budgeting

Planning where to position the company’s long-term capital assets in order to achieve the best risk-adjusted returns is part of investing and capital budgeting. This mostly entails determining whether or not to follow a particular investment opportunity, which is achieved by thorough financial analysis.

Capital Financing

This core task entails deciding how to best fund the capital investments (discussed above) using the company’s equity, debt, or a combination of the two. Selling company stock or issuing debt securities in the market through investment banks may provide long-term financing for large capital projects or acquisitions.

Dividends and Return of Capital

This practice necessitates corporate executives deciding whether to keep a company’s surplus profits for potential acquisitions and operations or to allocate them to shareholders in the form of dividends or stock buybacks.

Financial Analyst:

– Capital Budgeting: Estimate sales for the annual budget and compare recent monthly and quarterly results to projections. Examine the differences between the real and estimated statistics and the explanations for the discrepancies. Assess capital proposals and lease vs. purchase decisions – whether to buy or lease a new piece of equipment.

– Different Projects: For instance, conducting a competitive peer review, evaluating component costs to determine if it is easier to produce them in-house or purchase them from outside, valuing a potential acquisition, determining the feasibility of entering a new market, and determining the best price for a new product launch are all examples of tasks.

– Industry Specific: A financial analyst may endorse one or more brands or product lines within a conglomerate, providing financial support for a new product launch or promotion strategy.

Cost Analyst:

– Manufacturing Industry: Job-order costing, activity-based costing, and so on; work in a manufacturing plant to understand product costs and find cost-cutting opportunities, as well as participate in marketing pricing decisions.

– Service Industry: Involved in assessing the cost of delivering any service and assisting in pricing decisions in general.

Treasury Management:

– Investment/ Financing: Evaluate the company’s financing requirements and work with banks to meet those requirements from internal or external capital markets channels (commercial paper, bonds, equity, etc.).

– Cash Management: This is a piggy bank for a company. The function ensures that the organization has enough cash on hand to meet its everyday needs, invests any surplus cash overnight by selecting the best short-term investment options, and negotiates the best rate with banks.

– Risk Management: To protect corporate assets by using insurance plans or currency hedges, as well as to track and control the company’s foreign currency and/or product exposure.

– Pensions Management: Manage the Company’s retirement funding investment scheme – individual payment plan, taking into account the periodicity of pension contributions, and so on.

How can you start your career in Corporate Finance?

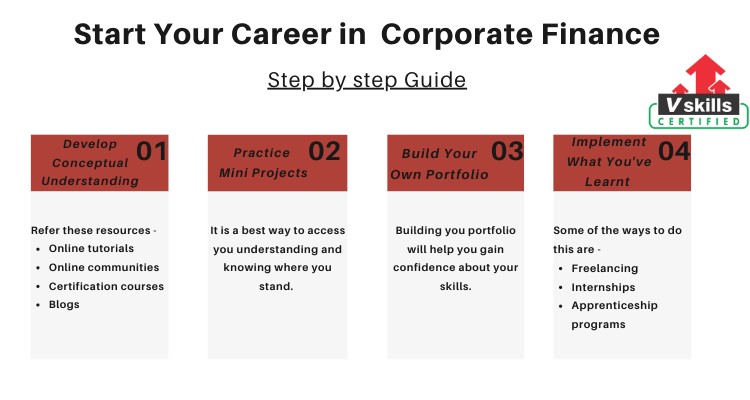

It is very much important to have a decent beginning with proper assets and learning material to be acceptable at something. Therefore, you initial steps towards learning must be apt in order to be pro in this field. Let look at some steps that you can take in order to begin your learning process –

Step 1 – Learn about the basics and Develop Conceptual understanding

Before becoming an expert in some field, it is very much essential that you have a strong base. An appropriate applied information is required even before you get your hands on to the practical portion. Everyone starts somewhere. You need to take baby steps if you want to build a successful career in this field. You can take the help of following resources for getting complete knowledge and having a complete conceptual understanding –

- Firstly, Online Tutorials for Corporate finance

- Also, Certification Courses from verified sources such as Vskills, Coursera, Udemy and so on.

- In addition, Online communities

- Moreover, Blogs and study material from experts in this field and many more.

Vskills also provide Online tutorials, certification courses and free practice tests for the same. You can check them out on our official site.

Step 2 – Practice Mini Projects

Practicing is crucial if you want to land in a good place. Also, it is a best way to access you understanding and knowing where you stand in terms of implementing the knowledge you have gained. When it comes to the practical aspects like implementing Core concepts related to corporate finance in projects, having some experience can help you outshine others. You can supplement your learning with the help of reading the blogs and tutorials by various sites which will help you to grasp a better understanding of the practical aspect.

Step 3 – Build Your Portfolio

Building you portfolio will help you gain confidence about your skills and will also get you a platform to implement your learnings. Your portfolio shows your abilities to carry out and plan various codes or how impeccably you execute your abilities in Corporate finance. These tasks ought to incorporate a few diverse datasets and should leave readers with intriguing bits of knowledge that you’ve gathered. Your portfolio needn’t bother with a specific subject; find subjects that interest you, at that point think of an approach to assemble them.

Step 4 – Implement your skills in Real world

Implementation of the skill you have gained is very much important because that is why you have been learning for – To be able to implement the skill perfectly! It is also important to keep updating yourself with new technological advancements and keep working and developing on your own skills. You can also enroll in some of the advance learning courses which will also serve as proof that you are well aware of advanced skills. Some of the ways through which you can implement your skills are –

- Freelancing

- Internships

- Apprenticeship programs

Above mentioned steps will help you to get started in this domain. However, there is a long way to go. You can take up an advanced course to take your skills to a new level.

Market Demand

If you want to get paid the most as a corporate finance analyst, being employed by a company such as Google or Yahoo would be a smart choice, as they are the highest paying companies in this field. Additionally, companies like General Motors and Western Digital also report highly competitive salaries for corporate finance analysts. Candidates will find employment in Top MNC’s and organizations like PwC, Anand Rathi, Deloitte, KPMG, JP Morgan Chase.

Average Salary

In the United States, corporate finance analysts earn an average of $66,877 a year, or $32.15 per hour. In terms of pay, an entry-level corporate finance analyst earns around $46,000 a year, while the top 10% earn around $96,000. Finance and manufacturing firms aim to attract the most jobs in this sector if you like following the crowd. However, if you’re looking for a high-paying job, look for companies in manufacturing, banking, or health care, since these industries have the highest wages. As with most items, location is important. The highest corporate finance analyst salaries are found in Connecticut, New York, New Jersey, Michigan, and California.

Skillset for Careers in Corporate finance

The corporate finance environment necessitates an analytical mind, the ability to think on one’s feet, and the ability to make decisions based on careful study and research. The following skills are needed for a corporate finance career:

- Problem-solving ability

- Leadership skills

- Communication skills and persuasion ability

- Interpersonal and Intrapersonal skills

- Team cohesion and management

- Commercial Awareness

- Research-based thinking

- Understands what is Financial modeling

- Networking ability

- Comfortable with ambiguities and constantly changing scenarios

Conclusion

Corporate finance practitioners do not have deadlines to meet like their marketing peers, but their work is much more exciting and demanding because they must make choices that favor the company in the long run rather than achieving short-term objectives. Corporate finance positions are, without a doubt, the most sought after and coveted in the entire financial sector.

Get started and discover the career opportunities in the field of Corporate Finance. Hurry up and try free practice tests now offered by Vskills.in!