Advance Tax

Advance Tax For Individuals and HUFs for the assessment year 2013-14

- No advance tax is payable if the total tax liability after reducing the tax deducted at source is less than Rs. 10,000/-.

- If Advance Tax is not paid in full for installments falling due on 15th September and 15th December, interest at the rate of 1% on the short amount for 3 months is to be paid.

- If Advance Tax is not paid in full for installments falling due on 15th March, interest at the rate of 1% on the short amount for 1 month is to be paid. If you delay payment of the last instalment in March by even a day, you will have to pay interest on the entire instalment amount.

- Senior citizens who do not have any income from business are exempted from the payment of advance tax w.e.f. 01/04/2012.

- If you do not pay advance tax at all or if the aggregate paid by March 31 is less than 90 per cent of the total tax payable, you will have to pay an interest of 1 per cent per month on the deficit amount from April 1 of the following year till the date you file your return.

- The senior citizens have been exempted from payment of Advance Tax from Assessment Year 2013-14.

- Important :If your are having income from salary / pension and tax is deducted by your employer, the income from salary/pension, tax deducted at source by the employer and deduction(s) taken into account by the employer should be excluded while calculating Advance Tax payable by you i.e. where TDS on salary/pension income is deducted by employer, Advance Tax is payable on income other than salary income less TDS/TCS (other than TDS deducted/to be deducted by the employer) less deductions (other than those already taken into account by the employer).

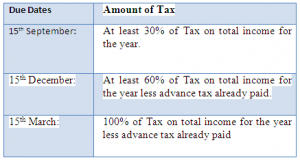

Advance Tax Installments & Due Dates

Test Your Skills By Taking Our Business Accountant Practice Tests On This Link

Apply for Business Accountant Certification Now!!

http://www.vskills.in/certification/Certified-Business-Accountant