Financial management provides a framework for selecting a proper course of action and deciding on a commercial strategy. These kinds of certifications are widely renowned and are used to showcase the candidate’s skills. This is one such certification course which helps you gain an advantage over other members and even increase your job opportunities. However, due to lack of proper study resources and adequate knowledge, people fail to clear these certifications.

Certifications prove that you are committed towards your development and growth and will prove to be an asset for the organization you are working for. Certificates not only help you to showcase your skills but also make you stand out in the crowd. Let us dig deeper into the exam details and then about the preparation resources.

Why to choose this certification?

This Course is one of the best career choices. And it is intended for professionals and graduates wanting to excel in their chosen areas. It is also well suited for those who are already working and would like to take certification for further career progression. Earning Vskills Financial Management Professional Certification can help candidate differentiate in today’s competitive job market, broaden their employment opportunities by displaying their advanced skills, and result in higher earning potential.

Job seekers those who are looking for opportunities in accounts, finance or auditing departments of various companies, students generally wanting to improve their skill set and make their CV stronger and existing employees looking for a better role can prove their employers the value of their skills through this certification.

Who can take this certification?

This certification is intended for professionals and graduates wanting to excel in their chosen areas and is well suited for those who are already working and would like to take certification for further career progression. Hence, any one looking to progress their career into the ambit of financial management can take this certification.

Career Path for a Financial Manager

A financial manager’s job is to provide clients and colleagues with financial advice and support so that they can make informed company decisions. As a financial manager, you’ll need a strong grasp of financial systems and procedures, as well as a solid head for numbers and the ability to deal with complex modelling and analysis. Let us know about Career Path for a Financial Manager!

Benefits of Certification

- Government certification

- Lifelong E-Learning access

- Certification valued and approved by Industry

- Get tagged as ‘Vskills Certified’ On Monsterindia.com

- Get tagged as ‘Vskills Certified’ On

Shine.com

Shine.com

Test Details for Financial Management Certification

- Duration: 60 minutes

- No. of questions: 50

- Maximum marks: 50, Passing marks: 25 (50%).

- There is NO negative marking in this module.

- Online exam.

Certification Process

- Select Certification & Register

- Receive a.) Online e Learning Access (LMS) b.) Hard copy – study material

- Take exam online anywhere, anytime

- Get certified & Increase Employability

Certify and Increase Opportunity.

Be

Govt. Certified Financial Management Professional

Financial Management Certification

Introduction to Financial Management

Finance is defined as the provision of money at the time when it is required. Every enterprise, whether big, medium, small, needs finance to carry on its operations and to achieve its target. In fact, finance is so indispensable today that it is rightly said to be the blood of an enterprise. Without adequate finance, no enterprise can possibly accomplish its objectives.

- Meaning of Financial Management: Financial management refers to that part of the management activity, which is concerned with the planning, & controlling of firm’s financial resources. It deals with finding out various sources for raising funds for the firm. Financial management is practiced by many corporate firms and can be called Corporation finance or Business Finance.

- According to Guttmann and Doug all: “Business finance can be broadly defined as the activity concerned with the planning, raising controlling and administrating the funds used in the business.”

- According to Joseph & Massie: “Financial Management is the operational activity of a business that is responsible for obtaining and effectively utilizing the funds necessary for efficient operations” Financial Management is the application of the general management principles in the area of financial decision-making, namely in the areas of investment of funds, financing various activities, and disposal of profits.

Objectives of the Financial Management

The main objective of a business is to maximize the owner’s economic welfare. Financial management provides a framework for selecting a proper course of action and deciding a commercial strategy.

The objectives can be achieved by:

- Profit maximization

- Wealth maximization

Profit Maximization: Profit earning is the main aim of every economic activity. A business being an economic institution must earn profit to cover its cists and provide funds for growth. No business ca survives without earning profit. Profit is a measure of efficiency of a business enterprise. Profit also serves as a protection against risks which cannot be ensured.

Wealth Maximization: Financial theory asserts that the wealth maximization is the single substitute for a stake holder’s utility. When the firm maximizes the shareholder’s wealth, the individual stakeholders can use this wealth to maximize his individual utility. It means that by maximizing stakeholder’s wealth the firm is operating consistently toward maximizing stakeholder’s utility. A stake solder’s wealth in the firm is the product of the numbers of the shares owned, multiplied within the current stock price per share.

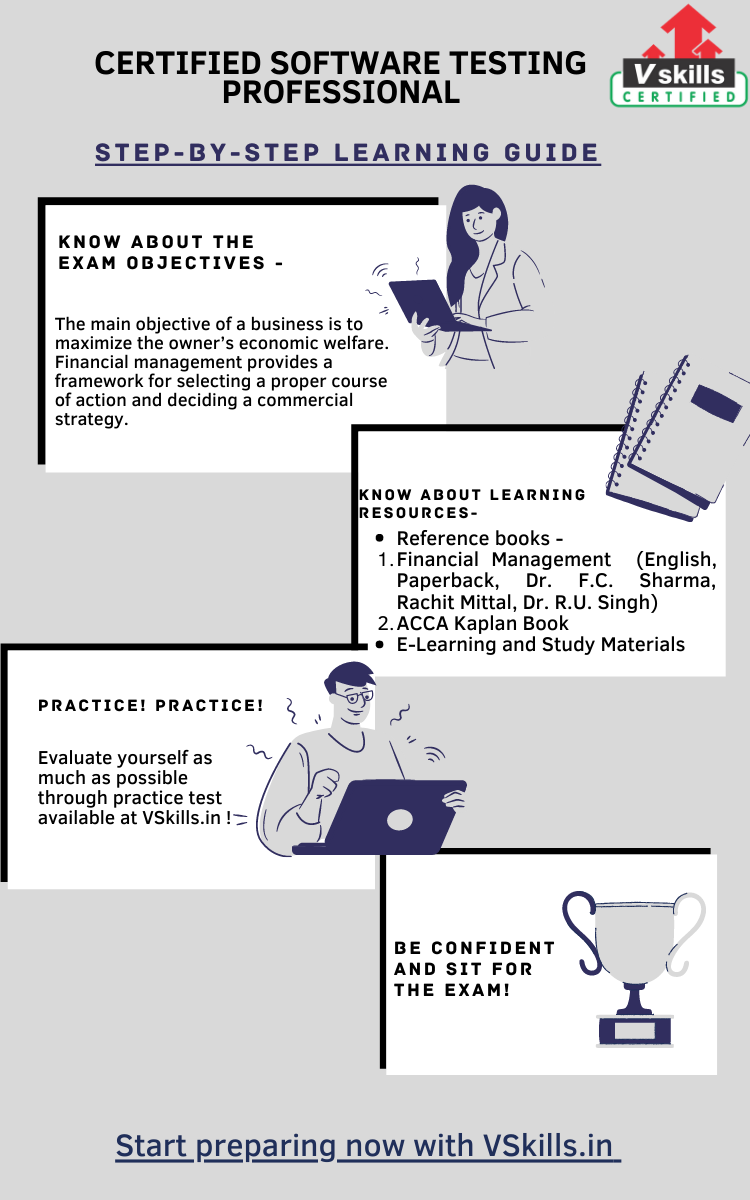

Preparatory Guide for Certified Financial Management Professional

Always remember that the resources that you will choose will make the difference. Clearing the exam will be easier if you choose the right set of resources. There are unlimited resources available for preparation which are available for the prescribed syllabus. Let us have a look at handful of them-

Step 1 – Review the exam objectives

The first and foremost thing before you start preparing is to get well versed with the objectives of the exam. This is the most important step before preparing for the exam. Knowing in detail about the exam objectives will let you understand the way through which you will prepare for the exam and then help to pass that with the flying colors. The main objective of a business is to maximize the owner’s economic welfare. Financial management provides a framework for selecting a proper course of action and deciding a commercial strategy.

Overview

- Introduction to Financial Management

- Financial Instruments: Equity Shares, Preference Shares, Right Issue

- Debts: Debentures, Types of Debentures

- Indian Financial System

- Time Value of Money

- Valuation of Bonds and Shares

Financial Statements

- Comparative Statement

- Common Size Statement

- Trend Analysis

- Ratio Analysis

Cash Flow

- Fund Flow Statement

- Cash Flow Statement

Fixed Capital Analysis

- Capital Budgeting

- Evaluations Techniques of Projects

Capital Structure and Dividend Policy

- Leverage Analysis

- Capital Structure

- Cost of Capital

- Dividend Policy

Working Capital Analysis

Working Capital

Receivables Management

Inventory Management

- Introduction to Inventory Management

- Tools and Techniques of Inventory Management

Cash Management Analysis

- Cash Management

- Cash Management Models

Foreign Exchange Orientation

- International Finance

- Managing of Foreign Exchange Risk

- Raising Foreign Currency Finance

Commodity Exchange

- Commodities Exchange Basics

- History

- Commodity Market in India

- Commodity Exchange Structure

- Regulatory Framework

Financial Risk Management

- Financial Risk Basics

- Financial Risk Types

- Components of Risk

- Financial Risk Management

- Financial Risk Identification

- Statistical Tools

- Capital Asset Pricing Model (CAPM)

Step 2 – Refer to the books

Books are the best resources and always the first way that comes in our mind while preparing. The books can be chosen as per your ease and level of understanding. There are many books that are available that can be used to clear your concepts and can provide you with insightful other topics too. This can be used to deal with the tricky part of the paper too. Some books that can be referred are –

- Financial Management (English, Paperback, Dr. F.C. Sharma, Rachit Mittal, Dr. R.U. Singh)

- ACCA Kaplan Book

Step 3 – E-Learning and Study Materials

Learning for the exam can be fun if you have right set of resources matching your way of studying. Vskills offers you its E-Learning Study Material to supplement your learning experience and exam preparation. This online learning material is available for lifetime and is updated regularly. You can also get the hardcopy for this material, so, you can prefer either way in which you are comfortable.

Step 4 – Evaluate yourself with practice tests

Practices makes a man perfect. Practice papers and test series help you in identifying the loopholes in the preparation for Financial Management Certification. Practicing as much as you can will help in identifying various parts of the syllabus that need more attention and that are fully prepared. You can also find the problems you are facing in your strategy. We all are quite well versed with this saying and also with the truth in this. This is the best way to know your level of preparation. Start practicing now!

Financial Management Interview Questions

Checkout these latest online interview questions on Financial Management to prepare for any job interview. The questions are created by domain experts, to help you to overcome the job interview obstacle.